Get the free Individual Characteristics Form - shrm

Show details

This form is used to determine eligibility for the Work Opportunity Tax Credit (WOTC) and/or Welfare-to-Work Tax Credit programs. It collects individual characteristics and employs specific eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign individual characteristics form

Edit your individual characteristics form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your individual characteristics form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing individual characteristics form online

To use the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit individual characteristics form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out individual characteristics form

How to fill out Individual Characteristics Form

01

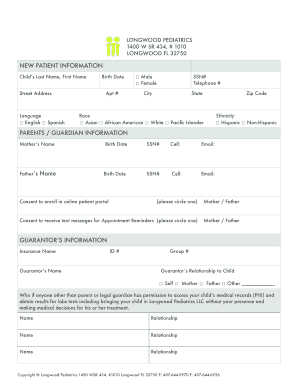

Begin with personal information: Fill in your full name, date of birth, and contact information.

02

Provide demographic details: Indicate your gender, ethnicity, and any other relevant demographic information.

03

List your skills: Document any languages spoken, technical skills, or certifications you hold.

04

Describe your educational background: Include your degrees, institutions attended, and dates of attendance.

05

Enter work experience: Outline your employment history, including job titles, employers, and duration of employment.

06

Complete sections on interests and hobbies: Provide information about your interests that may be relevant.

07

Review your information: Double-check all entries for accuracy and completeness.

08

Submit the form according to the provided instructions.

Who needs Individual Characteristics Form?

01

Individuals who are applying for a job or educational program.

02

Employers looking to understand the personal and professional characteristics of their potential candidates.

03

Educational institutions requiring student demographic information for enrollment or funding purposes.

04

Organizations collecting data for diversity and inclusion initiatives.

Fill

form

: Try Risk Free

People Also Ask about

What is the individual characteristic form?

INSTRUCTIONS FOR COMPLETING THE INDIVIDUAL CHARACTERISTICS FORM (ICF), ETA 9061. This form is used together with IRS Form 8850 to help state workforce agencies (SWAs) determine eligibility for the Work Opportunity Tax Credit (WOTC) Program.

What is the form for WOTC tax credit screening?

Determining Eligibility If the applicant is willing to provide the required information, have them complete the Pre-Screening Notice and Certification Request for the Work Opportunity Credit, IRS Form 8850. The IRS Form 8850 must be completed on or before the day the applicant is offered employment.

What is form 9198?

ETA Form 9198 Employer Representative Declaration. Part I. Authorized Representative(s) Note: Form 9198 will not be honored for any purpose other than declaring Employer Representative(s) with the State Workforce Agency (SWA) for employer WOTC certification requests.

What is the difference between form 9061 and 9062?

The first, ETA Form 9061, or the Individual Characteristics Form (ICF), provides specific information about how an applicant answered the WOTC questionnaire. The second, ETA Form 9062, is the Conditional Certification Form for applicants who have been pre-screened for WOTC by an SWA.

Does WOTC mean I got the job if I?

Does WOTC mean I got the job? Not necessarily. Being eligible for WOTC or being asked to fill out the questionnaire doesn't guarantee you'll get the job.

What is a 9061 form?

The ETA Form 9061 is used by eligible applicants to apply for employment and training services under the Workforce Innovation and Opportunity Act (WIOA).

Should I fill out the work opportunity tax credit questionnaire?

Should I fill out the WOTC questionnaire? If you are a job applicant who may be eligible, you can fill out the questionnaire to determine your eligibility. This will help your employer determine if they can claim the credit for hiring you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Individual Characteristics Form?

The Individual Characteristics Form is a document used to collect personal information about individuals for various purposes, often related to demographic data, eligibility assessments, or compliance with regulations.

Who is required to file Individual Characteristics Form?

Individuals who are seeking participation in certain programs, services, or research studies, especially those requiring demographic or personal data, are typically required to file the Individual Characteristics Form.

How to fill out Individual Characteristics Form?

To fill out the Individual Characteristics Form, individuals should provide accurate and complete information as requested on the form, including personal details, demographic information, and any relevant identifiers.

What is the purpose of Individual Characteristics Form?

The purpose of the Individual Characteristics Form is to gather necessary information to assess eligibility, monitor demographic diversity, and ensure compliance with specific regulatory or programmatic requirements.

What information must be reported on Individual Characteristics Form?

The form typically requires reporting information such as name, address, date of birth, gender, ethnicity, and other relevant personal details that are essential for the intended purpose of the document.

Fill out your individual characteristics form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Individual Characteristics Form is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.