Get the free IRS Form 8872 - ftp resource

Show details

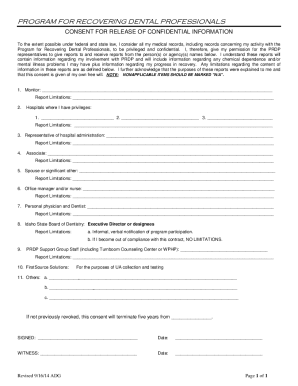

This document serves as a report of contributions and expenditures for the HCA Texas Good Government Fund for the specified periods, detailing both reported contributions and itemized expenditures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 8872

Edit your irs form 8872 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8872 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 8872 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit irs form 8872. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 8872

How to fill out IRS Form 8872

01

Download IRS Form 8872 from the IRS website.

02

Enter your organization's name and address in the designated fields.

03

Provide your Employer Identification Number (EIN) if applicable.

04

Specify the reporting period for the contributions and expenditures.

05

Fill in the contributions received during that period, including the names and addresses of contributors.

06

Record the expenditures made during the period, including details of the recipients.

07

Sign and date the form, certifying that the information is correct to the best of your knowledge.

08

Submit the completed Form 8872 to the IRS either electronically or by mail, depending on your organization's requirements.

Who needs IRS Form 8872?

01

Organizations that are required to report contributions and expenditures under section 527 of the Internal Revenue Code.

02

Political organizations that intend to engage in political activities and receive contributions must file this form.

Fill

form

: Try Risk Free

People Also Ask about

Who files 8872?

Form 8872 - When to file Charitable organizations. Churches and religious organizations. Private foundations. Political organizations. FEC filing required for some 527 organizations. Filing requirements. Political organization filing and disclosure. Solicitation notice. Employment taxes for exempt organizations. Other nonprofits.

Who files a form 5472?

There are three types of entities required to file Form 5472: US corporations with 25% or more direct or indirect foreign ownership. Foreign corporations engaged in a US trade or business. Foreign-owned US disregarded entities (such as an LLC)

What is the IRS form to cancel all debt?

Lenders or creditors are required to issue Form 1099-C, Cancellation of Debt, if they cancel a debt owed to them of $600 or more. Generally, an individual taxpayer must include all canceled amounts (even if less than $600) on the "Other Income" line of Form 1040.

What is form 8871, 8872, or 990?

Registration with the Internal Revenue Service (IRS) as a Section 527 organization (Form 8871) Periodic reporting as a Section 527 organization (Form 8872) Disclosure of certain taxable income (Form 1120-POL) Tax returns for an organization exempt from income taxes (Form 990)

How to get form 8872?

Obtain the form 8872 from the IRS website or through authorized providers. Begin by entering your organization's name and address at the top of the form. Fill out the fiscal year for which contributions and expenditures are reported.

Who has to file form 8871?

Political organizations electronically file this form to notify the IRS: that they are to be treated as a section 527 organization, and. of any material change in the information reported on a previously filed form.

Who is required to file form 8872?

Any organization required to report to the Federal Election Commission as a political committee. Committees of state or local candidates, State or local committees of a political party. Any organization reasonably anticipating that it will always have less than $25,000 for any taxable year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Form 8872?

IRS Form 8872 is a form used by political organizations to report contributions and expenditures for the purpose of complying with federal campaign finance laws.

Who is required to file IRS Form 8872?

Political organizations that expect to receive contributions or make expenditures in excess of $25,000 must file IRS Form 8872.

How to fill out IRS Form 8872?

To fill out IRS Form 8872, organizations must provide information about their contributions and expenditures, including the names and addresses of contributors and the purposes of expenditures, and submit it to the IRS by the required deadlines.

What is the purpose of IRS Form 8872?

The purpose of IRS Form 8872 is to ensure transparency and accountability in political financing by providing the IRS and the public with information about the financial activities of political organizations.

What information must be reported on IRS Form 8872?

IRS Form 8872 requires reporting information such as the total amount of contributions received, the total amount of expenditures made, the names and addresses of contributors who gave more than a specified amount, and details about the purposes of the expenditures.

Fill out your irs form 8872 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 8872 is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.