PR 480.30(II) 2016 free printable template

Show details

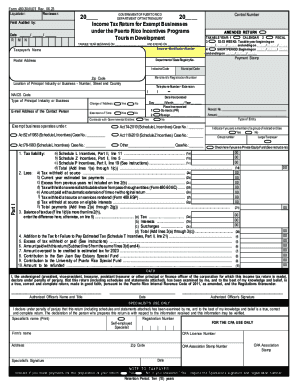

5 480. 6A 480. 6B. 6a b Withholding Statement Form 499R-2/W-2PR. 6b 7. If the gross income of the entity or controlled group exceeds 3 000 000 did you submit financial statements audited by a CPA licensed in Puerto Rico. Form 480. 30 II DT Rev. 04. 16 Liquidator Reviewer Field Audited by COMMONWEALTH OF PUERTO RICO DEPARTMENT OF THE TREASURY 20 Serial Number Income Tax Return for Exempt Businesses under the Puerto Rico Incentives Programs Tourism Development Date / / R M N AMENDED RETURN...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PR 48030II

Edit your PR 48030II form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PR 48030II form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PR 48030II online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit PR 48030II. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PR 480.30(II) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PR 48030II

How to fill out PR 480.30(II)

01

Start by obtaining the PR 480.30(II) form from the relevant authority or website.

02

Fill in your personal information, including name, address, and contact information.

03

Provide details of the specific services or benefits you are applying for.

04

If necessary, attach supporting documentation as specified in the form instructions.

05

Review all information for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form as instructed, either by mail or electronically.

Who needs PR 480.30(II)?

01

Individuals applying for specific government services or benefits that require this particular form.

02

Organizations submitting on behalf of individuals when required by the overseeing agency.

03

Anyone seeking eligibility determination or assistance related to specified programs.

Fill

form

: Try Risk Free

People Also Ask about

What is a 480.6 SP form?

What is IRS Form 480.6A? Form 480.6A is issued by the government of Puerto Rico for the filing of informative returns on income not subject to withholding.

What should I do with form 480.6 C?

Do I need to file it? Yes, you will need to report this Puerto Rican Bank interest as income on your income tax returns. You can include this PR interest under the 1099-INT section as if you received a 1099-INT.

What is a 480 form?

Series 480.6A reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. This form will also report any interest paid out in your cash account.

What is the withholding for Puerto Rico services?

Corporations not engaged in a trade or business in Puerto Rico are subject to a 29% WHT at source on certain gross income items (considered fixed or determinable, annual or periodical [FDAP]) from Puerto Rico sources.

What is form 480 Puerto Rico?

What is a 480 form? Form 480 is a document that summarizes payments that have not been subject to withholding, payments generated to a supplier for services, distributions, among others, to declare statements before the Department of the Treasury of Puerto Rico.

What is form 480.6 C Puerto Rico withholding?

480.6C - Form 480.6C is intended for non-residents of Puerto Rico. It covers investment income that has been subject to Puerto Rico source withholding. 480.6D - Form 480.6D is intended for residents of Puerto Rico. It covers exempt income and income subject to the Puerto Rico Alternate Basic Tax (ABT).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PR 48030II from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your PR 48030II into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send PR 48030II to be eSigned by others?

When your PR 48030II is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the PR 48030II in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your PR 48030II right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is PR 480.30(II)?

PR 480.30(II) is a specific tax form used for reporting certain financial information in compliance with regulatory requirements.

Who is required to file PR 480.30(II)?

Individuals and businesses that meet specific criteria outlined by tax authorities, such as having certain income levels or engaging in specific financial activities, are required to file PR 480.30(II).

How to fill out PR 480.30(II)?

To fill out PR 480.30(II), gather all required financial documents, follow the guidelines provided in the instructions accompanying the form, and accurately enter all relevant information into the designated fields.

What is the purpose of PR 480.30(II)?

The purpose of PR 480.30(II) is to ensure that individuals and businesses report their financial activities accurately for tax compliance and regulatory purposes.

What information must be reported on PR 480.30(II)?

The information that must be reported on PR 480.30(II) includes income details, expense declarations, and any other financial transactions as stipulated by the tax authority's guidelines.

Fill out your PR 48030II online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PR 48030ii is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.