Get the free broward county tax sale - broward k12 fl

Show details

Instructions for completing the Capital Assets Activity Form 3290a Surplus Declaration / Transfer Check SURPLUS or TRANSFER if items are to be removed from a location o Surplus When removing obsolete unusable assets. Transfer When transferring items from one location to another School Board of Broward County location. from the Supply Management Material Logistics B-stock Department 754-321-2850. The School Board of Broward County Florida Capital Assets Activity form Surplus Declaration...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign broward county tax sale

Edit your broward county tax sale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your broward county tax sale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

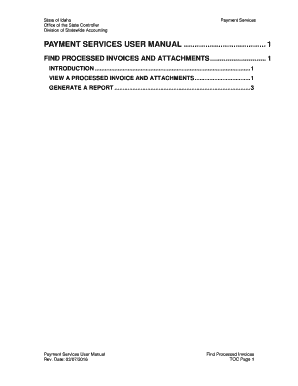

Editing broward county tax sale online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit broward county tax sale. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

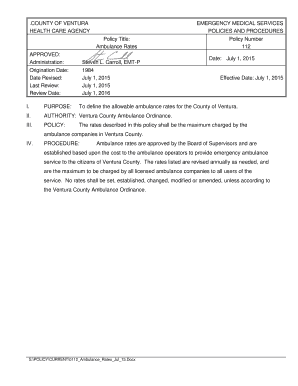

How to fill out broward county tax sale

How to fill out Broward County tax sale:

01

Obtain the necessary forms: Start by acquiring the required forms for the Broward County tax sale. These forms can typically be obtained from the Broward County Tax Collector's office or their website.

02

Review the instructions: Carefully read through the instructions provided with the forms. These instructions will guide you through the process of filling out the necessary information accurately.

03

Gather the required information: Collect all the necessary information that will be needed to complete the forms. This may include property details, tax identification numbers, and contact information.

04

Provide accurate property details: Fill out the forms with accurate property details, such as the address, property identification number, and any relevant legal descriptions. Double-check the information to ensure accuracy.

05

Include necessary documentation: Depending on the requirements, you may need to include additional documentation with your forms. This could include copies of deeds, liens, or any supporting documentation to verify your eligibility for the tax sale.

06

Complete payment: Along with the forms, you will often need to provide payment for the tax sale. This could be in the form of certified funds or cashier's checks. Ensure that you provide the correct amount and follow the instructions for payment submission.

07

Submit the forms: Once you have completed all the necessary information and included the required documentation, submit your forms to the designated location. Follow the instructions provided to ensure a smooth submission process.

Who needs Broward County tax sale?

01

Property owners in Broward County: Individuals or businesses who own properties in Broward County may need to participate in the tax sale if they have any delinquent property taxes.

02

Investors and buyers: Investors or buyers who are interested in purchasing properties through the tax sale process in Broward County may need to participate in order to acquire properties at a potentially discounted rate.

03

Developers and real estate professionals: Developers and real estate professionals who are looking for investment opportunities or potential development projects may participate in the Broward County tax sale to explore property options.

Overall, anyone who owns properties in Broward County or is interested in acquiring properties through the tax sale process can benefit from participating in Broward County tax sale.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

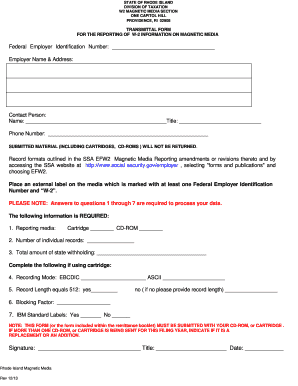

How can I manage my broward county tax sale directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your broward county tax sale and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify broward county tax sale without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your broward county tax sale into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit broward county tax sale on an iOS device?

Create, modify, and share broward county tax sale using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

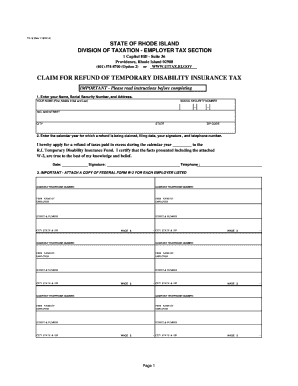

What is broward county tax sale?

Broward County tax sale is a public auction where properties with unpaid taxes are sold to the highest bidder in order to collect the outstanding tax debts.

Who is required to file broward county tax sale?

Only the Broward County government is responsible for conducting and managing the tax sale.

How to fill out broward county tax sale?

As an individual, you cannot directly fill out a broward county tax sale. Instead, you can participate in the auction as a bidder.

What is the purpose of broward county tax sale?

The purpose of broward county tax sale is to collect unpaid property taxes and provide an opportunity for the public to purchase properties at a discounted price.

What information must be reported on broward county tax sale?

The information reported on broward county tax sale includes the properties available for auction, the amount of taxes owed on each property, and any other relevant details such as liens or encumbrances.

Fill out your broward county tax sale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Broward County Tax Sale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.