Get the free Paid Sick Days – State, District and County Statutes

Show details

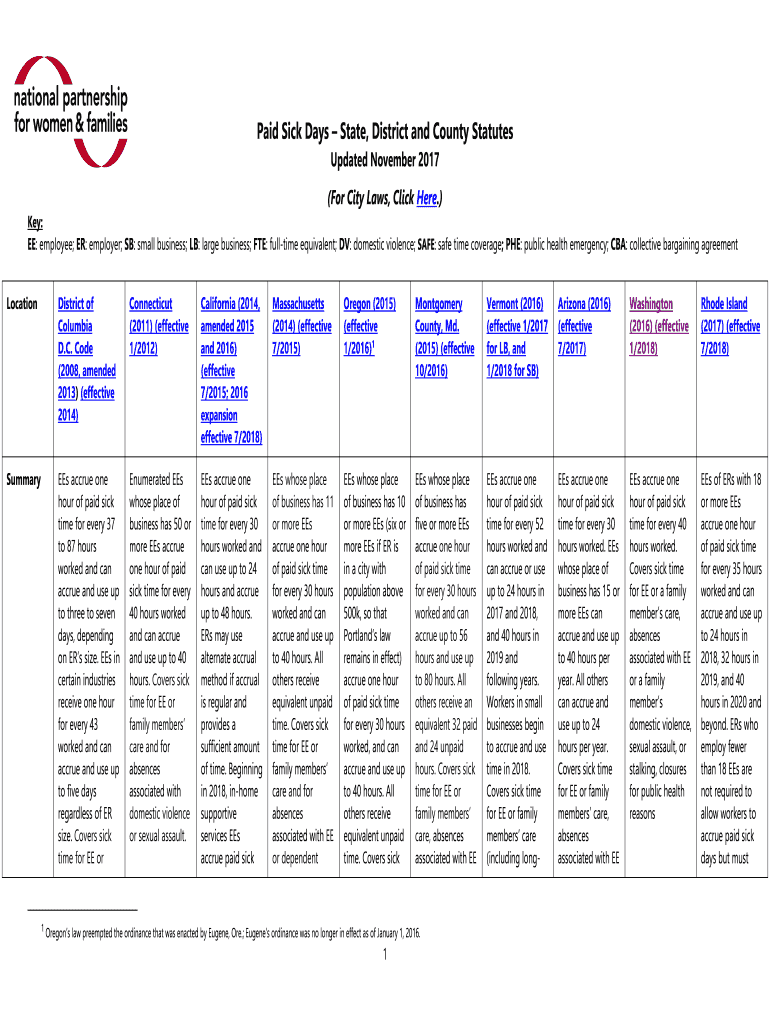

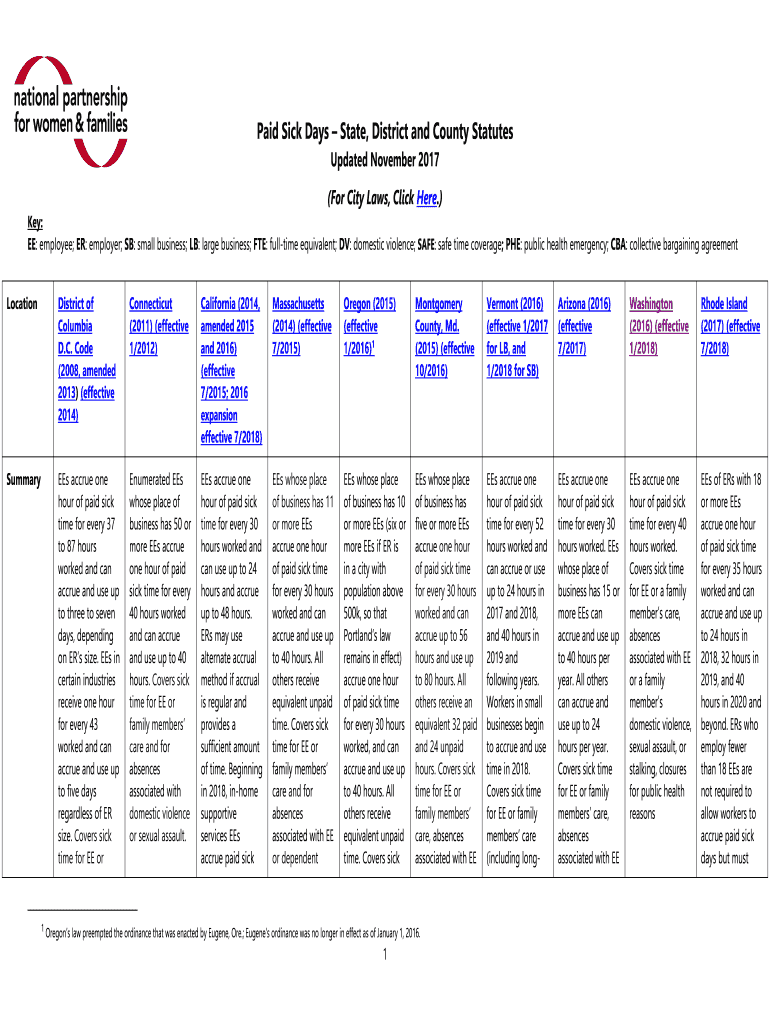

This document outlines various statutes regarding paid sick days across different states, counties, and cities in the United States, including regulations, accrual rates, exemptions, impacts, and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign paid sick days state

Edit your paid sick days state form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paid sick days state form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit paid sick days state online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit paid sick days state. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out paid sick days state

How to fill out Paid Sick Days – State, District and County Statutes

01

Review your state's laws regarding Paid Sick Days.

02

Determine your eligibility based on employment type and hours worked.

03

Log in to your employer's HR portal or use the provided forms to apply.

04

Fill out the necessary forms with accurate information regarding your sick days.

05

Submit the application to your employer or HR department as per their guidelines.

06

Keep a copy of your submission for your records.

Who needs Paid Sick Days – State, District and County Statutes?

01

Employees who are full-time or part-time workers.

02

Individuals who work in industries covered by state, district, or county statutes.

03

Workers who are ill or need to take care of a sick family member.

04

Employees seeking job security while managing health or family obligations.

Fill

form

: Try Risk Free

People Also Ask about

How many paid sick days are there in the USA?

Most commonly, employees earn one hour of sick time for every 30 hours worked. Paid sick time laws generally allow employers to limit the amount of sick time that employees can earn or use in a year, typically to around 40 hours per year.

Are you entitled to paid sick leave?

If you work for an employer, you can usually get SSP if you: have started work with your employer. are sick for 4 full days or more in a row, including your non-working days.

What are the rules around sick days?

SSP is paid when the employee is sick for more than 3 days in a row (including non-working days). You cannot count a day as a sick day if an employee has worked for a minute or more before they go home sick.

Which states have a paid sick leave law?

Paid Sick Leave Laws by State 2025 StateEmployer EligibilityEmployee Eligibility California Any that has at least one employee who works more than 30 days in a year within the state Any who works at least 30 days in the state Colorado All All Connecticut All with one or more employees (tiered implementation until 1/1/2027) All19 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Paid Sick Days – State, District and County Statutes?

Paid Sick Days are provisions established by state, district, and county laws that grant employees a certain amount of paid time off when they are ill or need to care for a sick family member.

Who is required to file Paid Sick Days – State, District and County Statutes?

Employers are typically required to file Paid Sick Days statutes, which may include businesses of a certain size or type as specified by local regulations.

How to fill out Paid Sick Days – State, District and County Statutes?

To fill out Paid Sick Days forms, employees should provide their personal information, the reason for sick leave, and the dates for which they are requesting paid sick days, following any specific guidelines provided by their employer.

What is the purpose of Paid Sick Days – State, District and County Statutes?

The purpose of Paid Sick Days statutes is to promote public health by allowing employees to take necessary time off for illness without suffering a loss of income, thereby reducing the spread of contagious diseases.

What information must be reported on Paid Sick Days – State, District and County Statutes?

Employers are typically required to report the total amount of paid sick leave accrued, the amount used by each employee, and the general compliance with the paid sick leave laws to local or state authorities.

Fill out your paid sick days state online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Paid Sick Days State is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.