Get the free farm income and expense worksheet

Show details

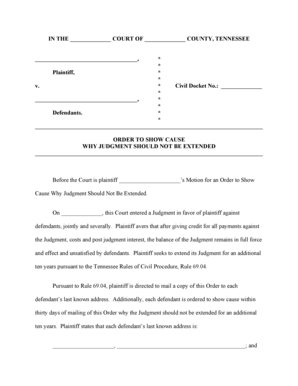

2010 FARM INCOME & EXPENSE WORKSHEET NAME SS # / FEDERAL ID # FA R M IN C O ME SALE OF NON-BREEDING LIVESTOCK and OTHER ITEMS BOUGHT FOR RESALE (Include animals used for dairy, draft or breeding below)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm income and expense

Edit your farm income and expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm income and expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing farm income and expense online

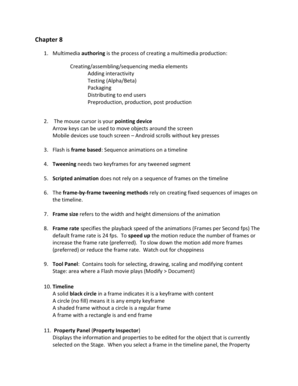

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit farm income and expense. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm income and expense

How to fill out farm income and expense:

01

Begin by gathering all relevant financial documents and records related to farm income and expenses. This may include sales receipts, invoices, bank statements, crop records, livestock records, and any other financial records.

02

Organize these documents in a systematic manner, either in physical files or digital folders, to easily access and refer to them when needed.

03

Next, categorize the farm income and expenses into different categories, such as crop sales, livestock sales, equipment expenses, feed expenses, labor costs, utilities, etc. This step will help in analyzing the financial situation of the farm.

04

Ensure accuracy in recording the exact amounts of income and expenses. Double-check calculations and reconcile any discrepancies.

05

Enter the income and expenses into a farm income and expense statement or a farm financial management software program specifically designed for this purpose. This will provide a comprehensive overview of the farm's financial performance.

06

Regularly update the income and expense statement throughout the year, adding any new income or expenses as they occur.

07

Use the farm income and expense statement as a tool for decision-making, financial planning, and evaluating farm profitability.

08

Additionally, consult with agricultural accountants or financial advisors if needed for professional guidance on farm income and expense management.

Who needs farm income and expense:

01

Farmers and ranchers who want to effectively manage their farm finances and understand their farm's profitability.

02

Agricultural lenders or financial institutions that require farm income and expense statements as part of loan applications or ongoing financial monitoring.

03

Farm consultants or advisors who assist farmers in making informed decisions regarding their businesses.

04

Tax professionals who need accurate records of farm income and expenses for tax filing purposes.

05

Researchers or policymakers who analyze agricultural trends, evaluate farm programs, or study the economic impact of farming activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get farm income and expense?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the farm income and expense in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute farm income and expense online?

pdfFiller has made filling out and eSigning farm income and expense easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit farm income and expense online?

With pdfFiller, it's easy to make changes. Open your farm income and expense in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is farm income and expense?

Farm income and expense refers to the financial records of income generated from agricultural activities and the costs associated with operating a farm. This includes revenues from selling crops and livestock, as well as expenses related to seeds, equipment, labor, and maintenance.

Who is required to file farm income and expense?

Farmers, ranchers, and individuals who earn income from farming activities are typically required to file farm income and expense. This includes sole proprietors, partnerships, and corporations engaged in agricultural practices for profit.

How to fill out farm income and expense?

To fill out farm income and expense, gather all financial records for the tax year, including income statements and receipts for expenses. Complete the relevant tax forms, such as Schedule F for U.S. federal taxes, by reporting total income, deductible expenses, and net profit or loss from farming.

What is the purpose of farm income and expense?

The purpose of farm income and expense is to accurately report financial performance and taxable income from farming activities. This information is important for tax compliance, financial planning, and assessing the overall profitability of the farming operation.

What information must be reported on farm income and expense?

Information that must be reported on farm income and expense includes gross sales of agricultural products, other income sources, cost of goods sold, operating expenses (such as utilities, wages, and materials), depreciation, and any losses incurred during the tax period.

Fill out your farm income and expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Income And Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.