Get the free ACH DEBIT-RECURRING - swacu

Show details

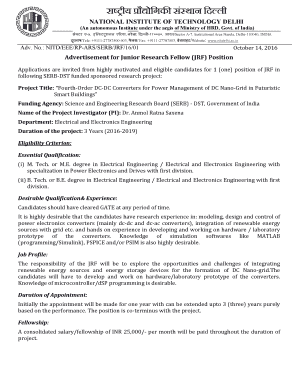

This document serves as an authorization form for recurring ACH debit transactions from a member's account at Southwest Airlines Federal Credit Union.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ach debit-recurring - swacu

Edit your ach debit-recurring - swacu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ach debit-recurring - swacu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ach debit-recurring - swacu online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ach debit-recurring - swacu. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ach debit-recurring - swacu

How to fill out ACH DEBIT-RECURRING

01

Obtain an ACH DEBIT-RECURRING form from your bank or financial institution.

02

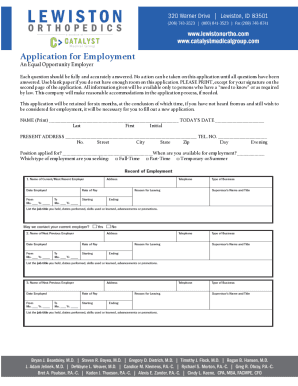

Fill in the name of the account holder on the form.

03

Provide the account number from which funds will be withdrawn.

04

Enter the bank routing number associated with the account.

05

Specify the amount to be debited on a recurring basis.

06

Indicate the frequency of the debit (e.g., weekly, monthly).

07

Set the start date for the recurring debits.

08

Review all information for accuracy.

09

Sign and date the form to authorize the recurring transactions.

10

Submit the completed form to your bank or designated recipient.

Who needs ACH DEBIT-RECURRING?

01

Individuals who wish to automate regular payments, such as monthly subscriptions, bills, or loan payments.

02

Businesses that need to collect recurring payments from customers.

03

Self-employed persons who provide services requiring regular payments.

Fill

form

: Try Risk Free

People Also Ask about

Is ACH the same as automatic payment?

An ACH payment is a payment sent via the ACH (Automated Clearing House) network, an electronic network used to send paperless payments between bank accounts in the United States. If you think of payments as the money taken out of your account when you have your monthly bills on autopay - that's typically done via ACH.

What is a recurring ACH payment?

Recurring ACH payments involve electronically moving money from one bank account to another on a scheduled, automated basis. This system is widely used for arrangements where regular financial transactions are made, such as paying mortgage or utility bills, subscriptions, or membership fees.

What is an ACH auto debit?

An ACH debit transaction is a debit directly from a personal savings, personal checking, or business checking account. In some instances, business checking accounts may not permit ACH transactions.

What is an ACH and how does it work?

An ACH transaction is an electronic money transfer made between banks and credit unions across a network called the Automated Clearing House (ACH). ACH is used for all kinds of money transfers, including direct deposit of paychecks and monthly debits for routine payments.

What is an ACH debit payment?

The ACH debit payment option is a one-time electronic bank payment where you submit your checking account and routing numbers to electronically withdraw funds from your checking account on a date of your choosing.

What is an ACH debit subscription?

Key takeaways. ACH debits are electronic payments initiated by the payee to withdraw funds from the payer's bank account. ACH debits are ideal for recurring payments like utility bills, mortgages, and subscriptions, ensuring timely payments.

Is ACH only in the US?

Can ACH be used globally? Though the ACH network was built for US financial institutions, it can support international transactions — but only where bilateral agreements exist between originating and receiving institutions.

What is ACH recurring payment?

ACH (Automated Clearing House) payments are an electronic money transfer method that sends money from one bank account to another. Recurring ones are like a payment plan that goes through an automated system, transferring a certain amount of money to the same place on a regular schedule.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ACH DEBIT-RECURRING?

ACH DEBIT-RECURRING refers to a system that allows for automated recurring payments from a bank account using the Automated Clearing House (ACH) network. It is commonly used for regular payments such as subscriptions or loan installments.

Who is required to file ACH DEBIT-RECURRING?

Businesses and organizations that wish to collect recurring payments from customers via ACH must file the necessary documentation to initiate ACH DEBIT-RECURRING transactions. This typically includes a completed authorization form from the customer.

How to fill out ACH DEBIT-RECURRING?

To fill out ACH DEBIT-RECURRING, you need to provide the customer's bank account information, specify the amount to be debited, the frequency of the debits, and obtain the customer's authorization for recurring withdrawals. Additionally, you must include your banking details for the transactions.

What is the purpose of ACH DEBIT-RECURRING?

The purpose of ACH DEBIT-RECURRING is to facilitate automated and consistent payments for services or products over a specified period, ensuring timely collection while providing convenience for customers.

What information must be reported on ACH DEBIT-RECURRING?

Information that must be reported on ACH DEBIT-RECURRING includes the transaction date, the amount to be debited, the customer's bank account and routing number, the reason for the debit, the frequency of the debits, and the customer's authorization confirmation.

Fill out your ach debit-recurring - swacu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ach Debit-Recurring - Swacu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.