Get the free FOR CHARITABLE GIFT ANNUITY AGREEMENTS - University of ... - giveto pitt

Show details

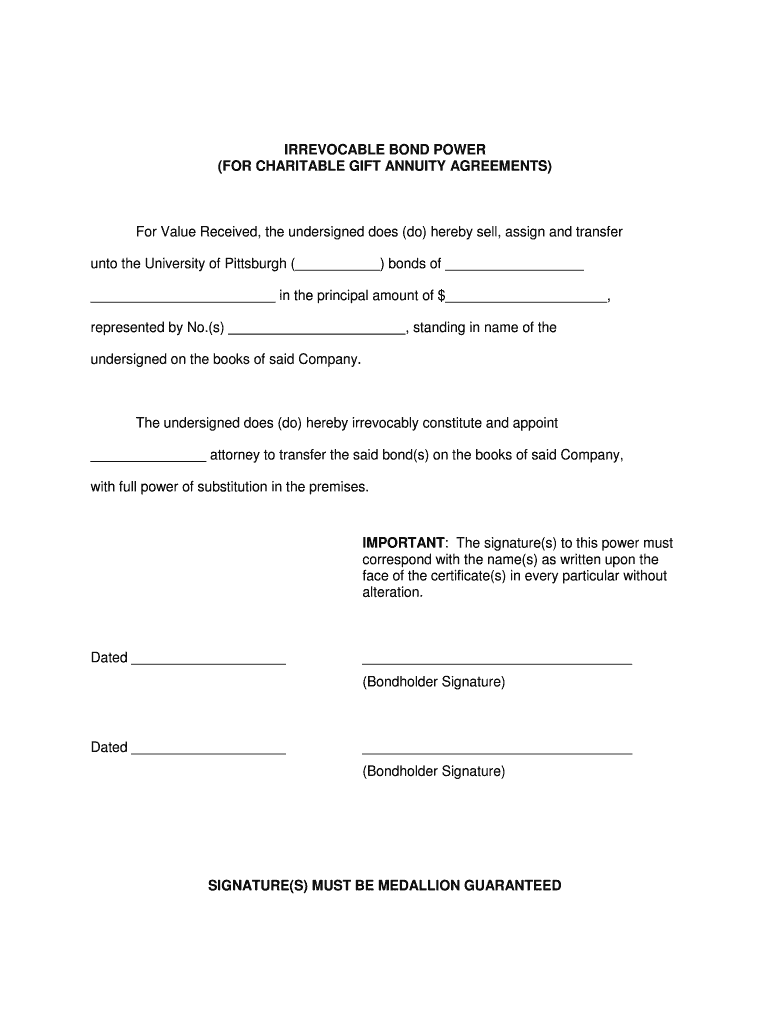

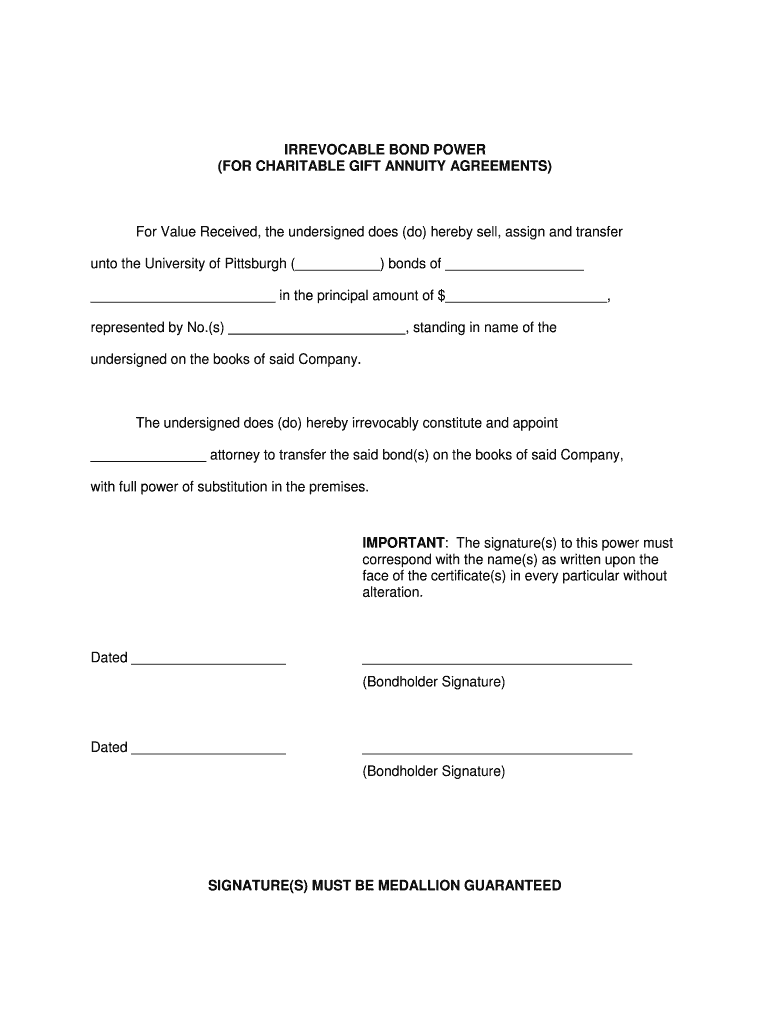

IRREVOCABLE BOND POWER (FOR CHARITABLE GIFT ANNUITY AGREEMENTS) For Value Received, the undersigned does (do) hereby sell, assign and transfer unto the University of Pittsburgh () bonds of in the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign for charitable gift annuity

Edit your for charitable gift annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your for charitable gift annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit for charitable gift annuity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit for charitable gift annuity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out for charitable gift annuity

To fill out a charitable gift annuity, follow these steps:

01

Gather the necessary information: Before filling out the form, collect all the required details such as your personal information, contact information, social security number, and the charity's information.

02

Obtain the charitable gift annuity form: You can usually find the form on the website of the charity or organization that offers gift annuities. Alternatively, you can request a copy of the form directly from the charity.

03

Provide your personal information: Begin by entering your full name, address, phone number, and email address on the form. Make sure to double-check your contact information for accuracy.

04

Enter the details of the charitable gift: Specify the amount or value of the gift you wish to donate. This can be in the form of cash, securities, or other eligible assets. Indicate whether you want the annuity to benefit a specific program or area of interest.

05

Choose the payment arrangement: Decide how you want the annuity payments to be made. You may have options such as a fixed payment amount or a variable payment based on an agreed-upon formula. The frequency of payments (e.g., monthly, quarterly, annually) should also be determined.

06

Determine the tax implications: Consult with a financial advisor or tax professional to understand the potential tax benefits and consequences of your charitable gift annuity. Certain deductions or tax advantages may apply, so it's essential to be informed.

07

Review and sign the form: Carefully review all the information you have provided on the form to ensure accuracy. Read the terms and conditions of the charitable gift annuity agreement thoroughly. Once satisfied, sign and date the form.

Who needs a charitable gift annuity?

Charitable gift annuities are suitable for individuals who:

01

Want to make a generous gift to a charitable organization while also ensuring a lifetime income stream for themselves or a beneficiary.

02

Seek to simplify their charitable giving by combining both philanthropy and financial planning into one arrangement.

03

Desire potential tax benefits that come with making a charitable contribution.

It's important to note that eligibility and specific rules may vary depending on the charity and the jurisdiction. Consulting with professionals knowledgeable in tax and financial matters can assist in determining if a charitable gift annuity is the right option for your individual circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send for charitable gift annuity for eSignature?

Once your for charitable gift annuity is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit for charitable gift annuity online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your for charitable gift annuity to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I fill out for charitable gift annuity using my mobile device?

Use the pdfFiller mobile app to fill out and sign for charitable gift annuity. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is for charitable gift annuity?

A charitable gift annuity is a contract between a donor and a charity where the donor transfers assets to the charity in exchange for a fixed stream of income for the rest of their life.

Who is required to file for charitable gift annuity?

Charities and donors involved in the charitable gift annuity transaction are required to file relevant tax forms with the IRS.

How to fill out for charitable gift annuity?

To fill out a charitable gift annuity, both the donor and the charity should consult with tax professionals and legal advisors to ensure compliance with applicable laws and regulations.

What is the purpose of for charitable gift annuity?

The purpose of a charitable gift annuity is to provide donors with a way to support charitable causes while also receiving a fixed income stream for their lifetime.

What information must be reported on for charitable gift annuity?

Information such as the amount of the gift, the age of the donor, the payout rate, and the frequency of payments must be reported on a charitable gift annuity.

Fill out your for charitable gift annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

For Charitable Gift Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.