Get the free Nonprofit Corporation Annual Report

Show details

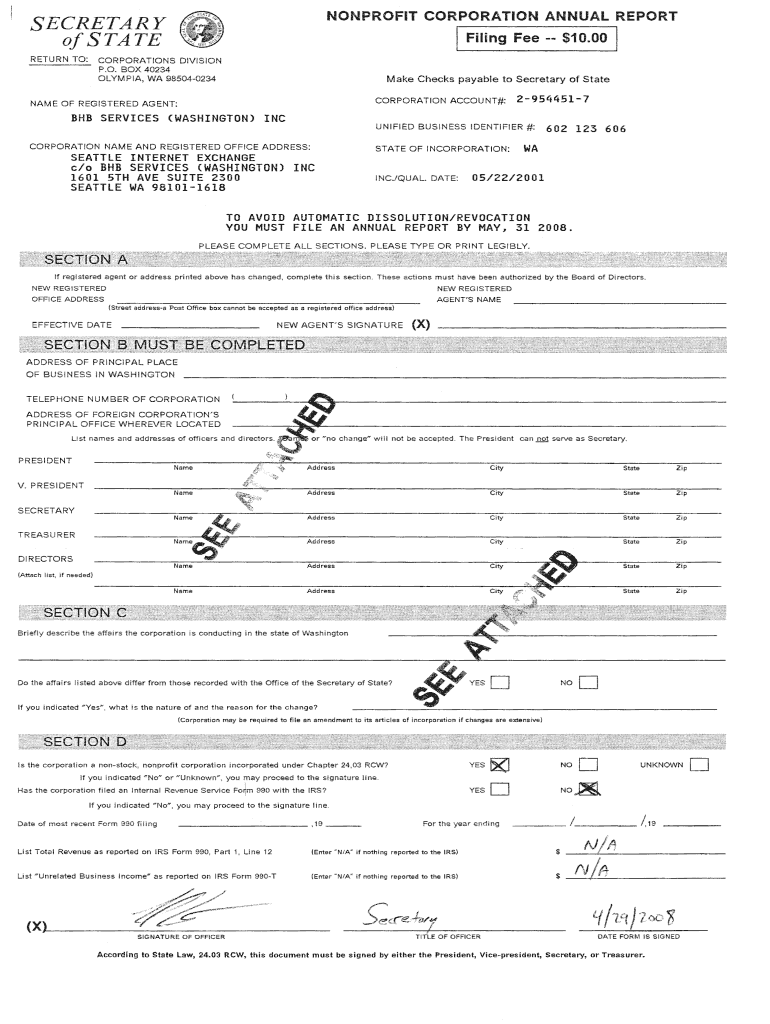

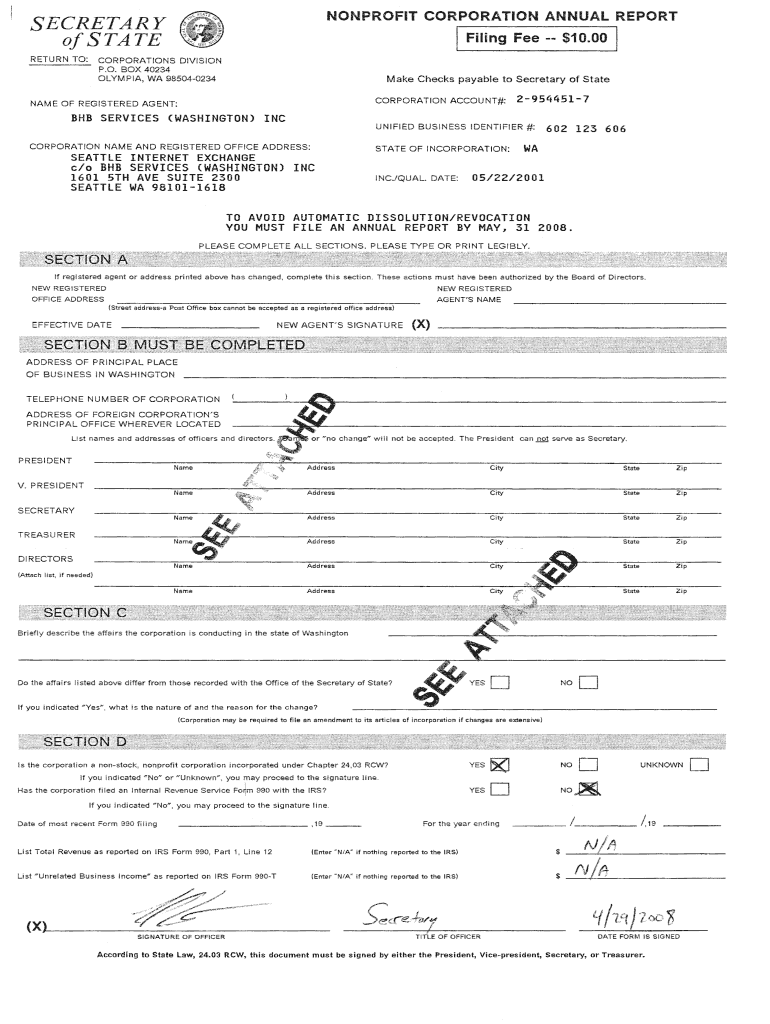

This document is an annual report that needs to be filed by nonprofit corporations in Washington State to avoid automatic dissolution or revocation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit corporation annual report

Edit your nonprofit corporation annual report form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit corporation annual report form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprofit corporation annual report online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nonprofit corporation annual report. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit corporation annual report

How to fill out Nonprofit Corporation Annual Report

01

Obtain the Nonprofit Corporation Annual Report form from your state’s Secretary of State website.

02

Fill in the organization's name and registration number as provided during the initial incorporation.

03

Provide the current address of the nonprofit organization.

04

List the names and addresses of the current board members and officers.

05

State the purpose of the organization as it appears in the original articles of incorporation.

06

Include financial information if required, such as income and expenses for the past year.

07

Sign and date the report, typically by an authorized officer of the organization.

08

Submit the completed report to the appropriate state agency by the specified deadline, usually with any applicable fees.

Who needs Nonprofit Corporation Annual Report?

01

All registered nonprofit organizations are required to file an Annual Report.

02

Nonprofit organizations seeking to maintain good standing with the state.

03

Organizations that wish to update their information or changes in leadership.

04

Entities that are applying for grants or funding, as they may need to show compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do non-profits have an annual report?

Almost all charitable nonprofits that are recognized as tax-exempt by the IRS are required to file an annual report with the IRS, known as the “Form 990.” The IRS Form 990 is a public document that is available on GuideStar, and also from the charitable nonprofit, upon request, in accordance with IRS “public disclosure

What is the 33% rule for nonprofits?

If your organization receives more than 10 percent but less than 33-1/3 percent of its support from the general public or a governmental unit, it can qualify as a public charity if it can establish that, under all the facts and circumstances, it normally receives a substantial part of its support from governmental

How to write a nonprofit annual report?

As shown in the template, your annual report should include the following elements: Your organization's mission statement. Feature your mission statement at the very beginning of the document. Financial information. Projects from the year. Appreciation for your contributors.

What are two to three things you should look at on a nonprofit's financial statements to determine its financial viability?

To monitor nonprofit financial health, stakeholders will want to understand an organization's funding model/revenue, cash flow/sustainability, expenses/efficiency, and debt management.

What is the format for writing an annual report?

Your annual report should include four main components: the chairman's letter, a profile of your business, an analysis of your management strategies, and your financial statements.

What is an annual report for NGOs?

Nonprofit annual reports provide a thorough account of what you've accomplished in one year, with the support of donors, partners, sponsors, and the wider community. These reports typically include visuals that bring data, stories, and milestones to life in an appealing and digestible way.

How to write an annual report of NGO?

What should an NGO annual report include to make it impactful and funder-friendly? A standard NGO annual report includes your mission and vision statements, major project highlights, financial statements, donor acknowledgments, future goals, and key impact numbers.

How to write an annual report for a nonprofit organization?

How to Write a Nonprofit Annual Report Gather Information. First, gather the salient details of your nonprofit. Define the Report's Structure and Content. Once all your data is available, draft the report's structure. Craft a Compelling Narrative. Turn your data into a story. Incorporate Visuals and Data. Review and Edit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nonprofit Corporation Annual Report?

A Nonprofit Corporation Annual Report is a document that nonprofit organizations must file annually to provide updated information about their operations, finances, and governance to the state or other regulatory bodies.

Who is required to file Nonprofit Corporation Annual Report?

Nonprofit corporations that are registered and operating within a state are generally required to file an Annual Report to maintain their status and comply with state regulations.

How to fill out Nonprofit Corporation Annual Report?

To fill out a Nonprofit Corporation Annual Report, organizations typically need to provide information such as the organization's name, address, board of directors, financial statements, and other details as required by the state.

What is the purpose of Nonprofit Corporation Annual Report?

The purpose of the Nonprofit Corporation Annual Report is to ensure transparency and accountability in nonprofit organizations by allowing regulators and the public to assess their activities and financial conditions.

What information must be reported on Nonprofit Corporation Annual Report?

Information that must be reported generally includes the organization's legal name, principal office address, names and addresses of directors and officers, financial statements, mission statement, and any significant changes or updates from the previous year.

Fill out your nonprofit corporation annual report online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Corporation Annual Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.