Get the free Homeowners Insurance - UAW Ford Retirement

Show details

Homeowners Insurance Co-insurance: Most states require that a dwelling be insured to at least 80% of its constructed replacement cost to get replacement value on partial losses. It is critical to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign homeowners insurance - uaw

Edit your homeowners insurance - uaw form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your homeowners insurance - uaw form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit homeowners insurance - uaw online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit homeowners insurance - uaw. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out homeowners insurance - uaw

Point by point, here's how to fill out homeowners insurance - uaw:

01

Start by gathering all the necessary information about your property, including its address, value, and any details about its construction, such as the type of roof or the materials used.

02

Assess the risks associated with your property, such as its proximity to a flood zone, earthquake-prone areas, or areas prone to wildfires. This information will help determine the coverage you need.

03

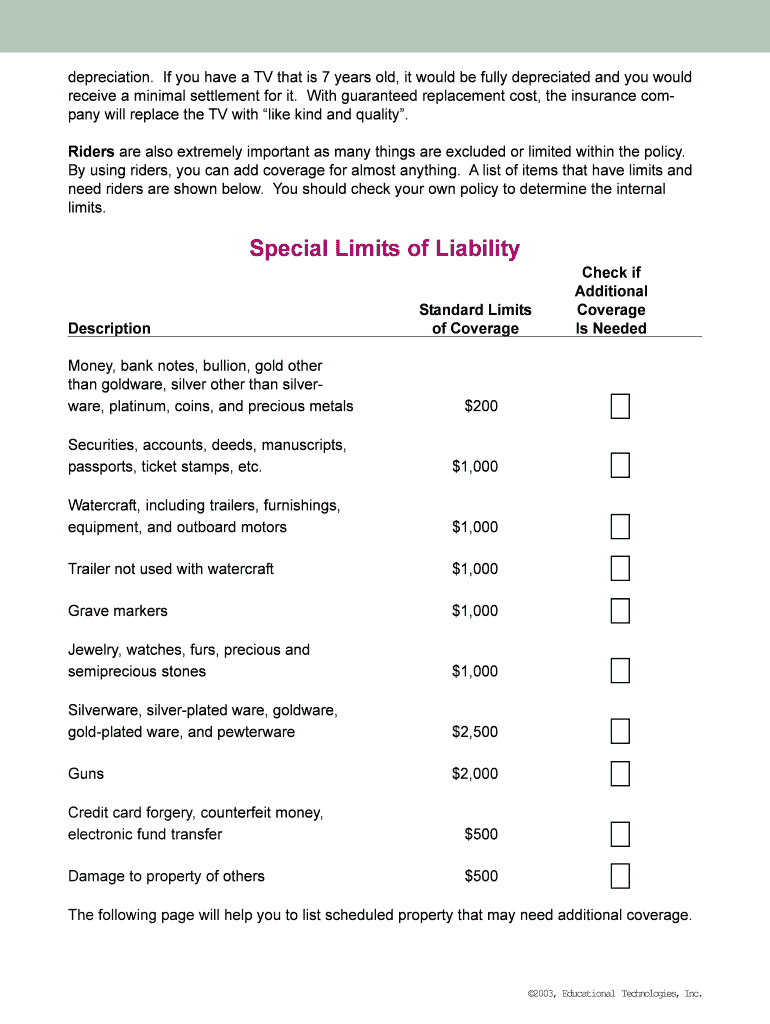

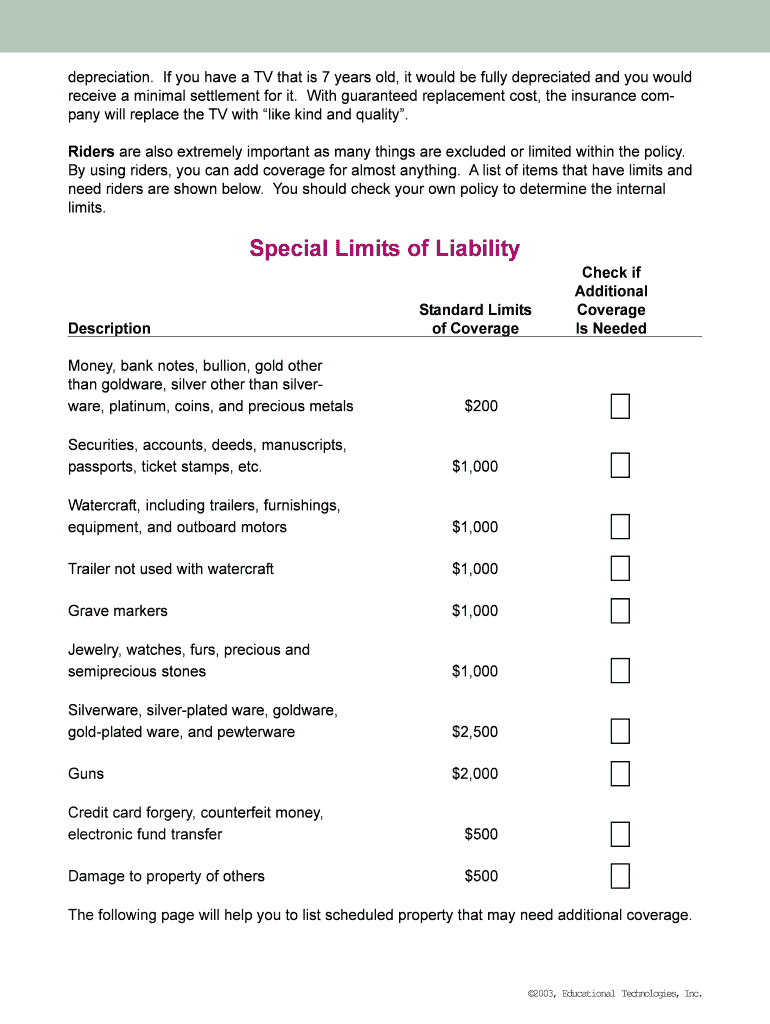

Evaluate the value of your personal belongings and determine how much coverage you need to protect them adequately. Create a detailed inventory of your possessions, including any expensive items like jewelry or artwork.

04

Consider liability coverage to protect yourself if someone gets injured on your property and decides to sue you. Determine the level of coverage you need based on your assets and potential risks.

05

Decide on any additional coverage options you might need, such as protection for valuable items beyond the standard coverage limits or coverage for home-based businesses.

06

Compare quotes from different insurance providers to find the best policy for your needs. Consider factors like coverage limits, deductibles, and the reputation of the insurance company.

07

Once you've selected an insurance provider, carefully review the terms and conditions of the policy before signing on the dotted line. Ensure you understand any exclusions or limitations in coverage.

08

Fill out the necessary paperwork provided by the insurance company accurately and thoroughly. Double-check all the information you provide to avoid any potential issues with your policy.

09

Pay the required premium to activate your homeowners insurance policy. Set up a payment schedule that works for you and ensure you make timely payments to maintain coverage.

Now, let's address who needs homeowners insurance - uaw:

01

Homeowners: If you own a house, whether it's your primary residence or a vacation home, you should strongly consider getting homeowners insurance. It provides protection for your property and belongings against various risks.

02

Condo Owners: While condo associations typically have insurance coverage for the building itself, it may not extend to your individual unit or your personal belongings. Having homeowners insurance can bridge this gap.

03

Renters: Even if you don't own the property you're living in, your personal belongings can still be at risk. Renters insurance, which is similar to homeowners insurance, can protect your belongings and provide liability coverage.

04

Landlords: If you own rental properties, homeowners insurance - uaw can provide coverage for the building itself and protect you from liability claims related to the property.

05

Home-Based Business Owners: If you run a business from your home, standard homeowners insurance may not provide adequate coverage for your business assets. Consider additional coverage options tailored to protect your business in such cases.

Remember, homeowners insurance - uaw is not limited to these groups only. It is essential for anyone who wants to protect their property, belongings, and financial well-being in the face of unexpected events.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send homeowners insurance - uaw for eSignature?

Once you are ready to share your homeowners insurance - uaw, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit homeowners insurance - uaw online?

With pdfFiller, the editing process is straightforward. Open your homeowners insurance - uaw in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in homeowners insurance - uaw without leaving Chrome?

homeowners insurance - uaw can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is homeowners insurance - uaw?

Homeowners insurance - uaw is a type of insurance policy that provides coverage for damage to a home and its contents, as well as liability for accidents that may occur on the property.

Who is required to file homeowners insurance - uaw?

Homeowners are typically required to purchase and maintain homeowners insurance - uaw by their mortgage lender.

How to fill out homeowners insurance - uaw?

To fill out homeowners insurance - uaw, homeowners must contact an insurance company or agent, provide information about their property, and select coverage options.

What is the purpose of homeowners insurance - uaw?

The purpose of homeowners insurance - uaw is to protect homeowners from financial loss due to damage, theft, or accidents on their property.

What information must be reported on homeowners insurance - uaw?

Information that must be reported on homeowners insurance - uaw typically includes the address of the property, details about the home's construction and features, and the value of personal belongings.

Fill out your homeowners insurance - uaw online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Homeowners Insurance - Uaw is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.