Get the free Farm Law and Taxes Registration Form - agecon purdue

Show details

This form is for registration to the Farm Law and Taxes seminar, detailing topics covered, registration fees, and other pertinent information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign farm law and taxes

Edit your farm law and taxes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your farm law and taxes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit farm law and taxes online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit farm law and taxes. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out farm law and taxes

How to fill out Farm Law and Taxes Registration Form

01

Obtain the Farm Law and Taxes Registration Form from your local agricultural office or their website.

02

Fill in the personal information section, including your name, address, and contact information.

03

Provide details about your farming operation, such as the type of farm, size, and location.

04

List any employees you may have and their roles in the farming operation.

05

Include information about the crops or livestock you produce.

06

Indicate your business structure (e.g., sole proprietorship, partnership, corporation).

07

Complete any additional sections related to state or federal tax requirements.

08

Review the form for accuracy and completeness.

09

Submit the filled-out form to the appropriate authority along with any required fees.

Who needs Farm Law and Taxes Registration Form?

01

Farmers operating any type of agricultural business.

02

Individuals or entities seeking tax deductions related to farming.

03

New farmers establishing their operations for compliance with regulations.

04

Existing farms that need to update their registration due to changes in business structure or operation.

Fill

form

: Try Risk Free

People Also Ask about

How to register a farm in New Brunswick?

1-506-444-2848 or registraroffarms@gnb.ca A registration package consists of a completed registration form (sections 1, 3, 5 and 6 of the form are mandatory), the associated registration fee and a completed Farmer Purchaser's Permit Annual Report. All incomplete registration packages should expect delays.

How do you prove you are a farmer?

A copy of the Pattadar Passbook/ Deed/1B Extract/ Registered sale deeds of the Lands. Self-declaration made by the farmer.

What is the minimum acreage for a farm?

Crop Farms: Growing strawberries, blueberries, or seasonal vegetables typically requires at least 5 to 20 acres, especially if irrigation systems or dedicated row planting are part of the plan. Livestock Operations: A small cattle operation will need approximately one to two acres of pasture per cow.

How much is 1 acre of land worth in New Brunswick?

Related table(s) with other frequencies: GeographyFarm land and buildings2021 Newfoundland and Labrador (map) Value per acre 7,497 Prince Edward Island (map) Value per acre 4,664 Nova Scotia (map) Value per acre 3,313 New Brunswick (map) Value per acre 3,43210 more rows

What qualifies as a farm in Canada?

For the Farm Census completed by Statistics Canada, a census farm is defined as an agricultural operation that produces at least one of the following products intended for sale: crops (hay, field crops, tree fruits or nuts, berries or grapes, vegetables, seed); livestock (cattle, pigs, sheep, horses, game animals,

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

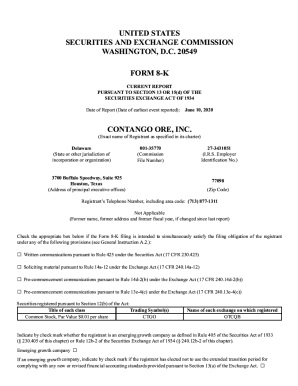

What is Farm Law and Taxes Registration Form?

The Farm Law and Taxes Registration Form is a legal document that farmers and agricultural producers must complete to register their farming activities with the appropriate government authorities, allowing them to comply with taxation laws and regulations specific to the agriculture sector.

Who is required to file Farm Law and Taxes Registration Form?

Farmers, agricultural producers, and entities involved in farming operations that generate income are required to file the Farm Law and Taxes Registration Form, depending on their local regulations and tax requirements.

How to fill out Farm Law and Taxes Registration Form?

To fill out the Farm Law and Taxes Registration Form, individuals should collect relevant information such as business details, income sources, types of farming activities, and any applicable tax identification numbers. They then complete the form following the provided instructions, ensuring accuracy and compliance with regulations.

What is the purpose of Farm Law and Taxes Registration Form?

The purpose of the Farm Law and Taxes Registration Form is to facilitate the legal registration of farming operations, ensure compliance with tax obligations, and help government agencies track agricultural income and related economic activities.

What information must be reported on Farm Law and Taxes Registration Form?

The information that must be reported on the Farm Law and Taxes Registration Form typically includes the farmer's name, business structure, farming activities, income details, tax identification numbers, and any other relevant financial information required by local tax authorities.

Fill out your farm law and taxes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Farm Law And Taxes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.