Get the free Registration Form for Estate & Family Farm Business Transfer Planning - agecon purdue

Show details

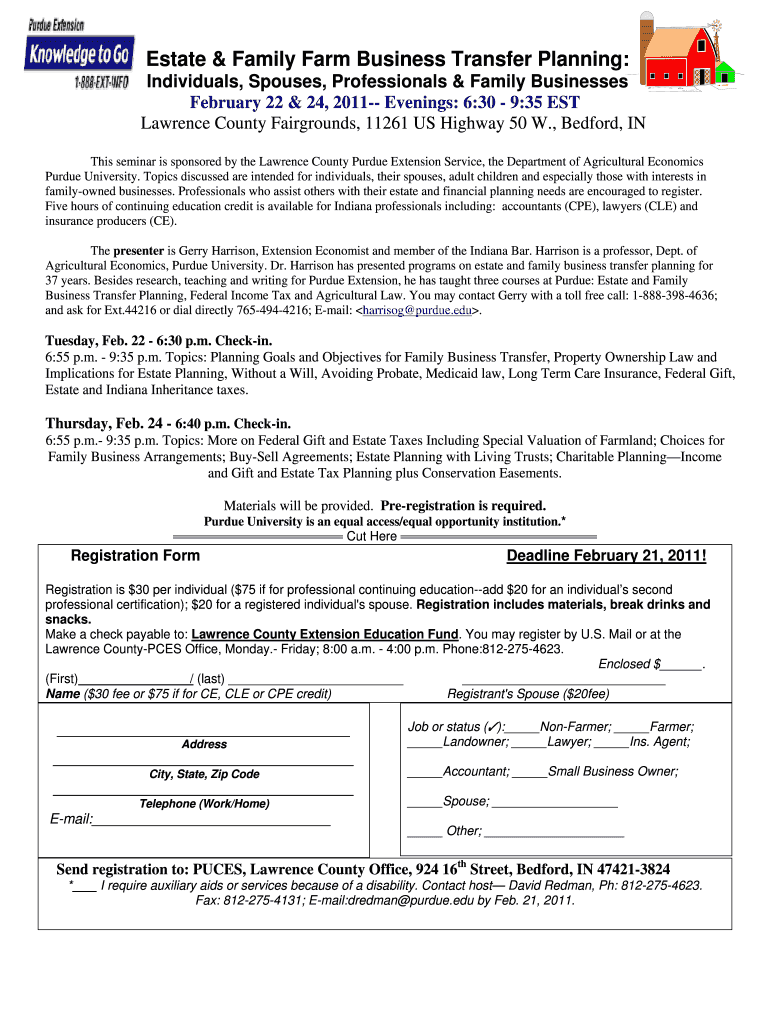

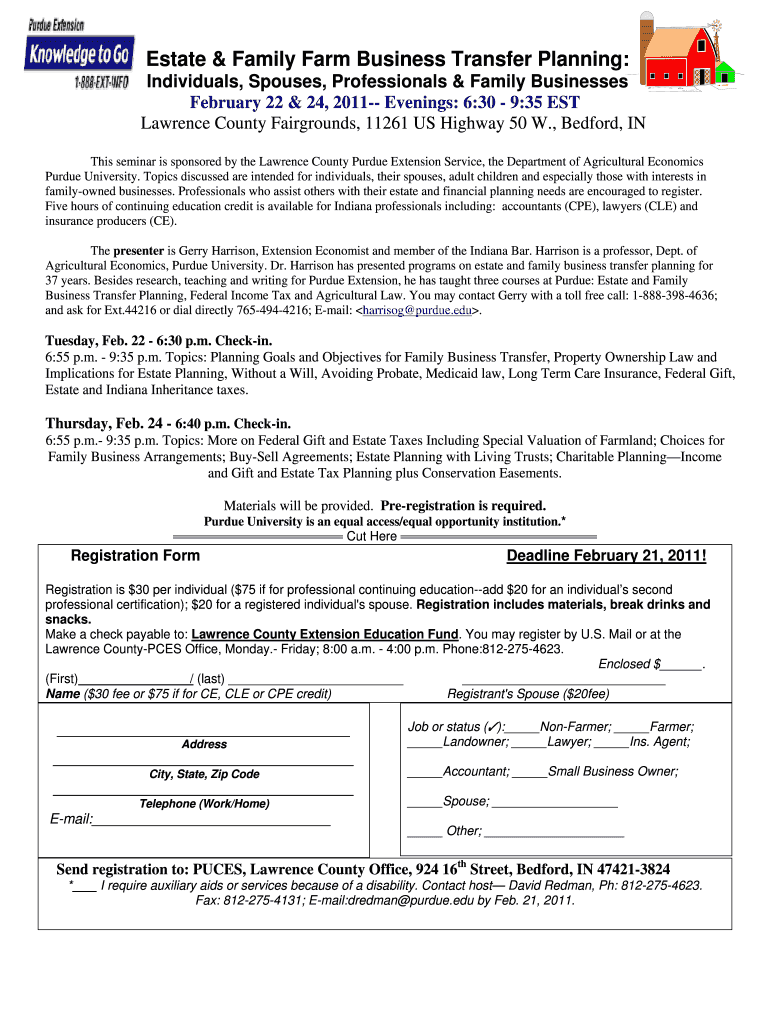

This document serves as a registration form for a seminar focused on estate and family business transfer planning, offering continuing education credits for professionals in Indiana.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration form for estate

Edit your registration form for estate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration form for estate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration form for estate online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit registration form for estate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

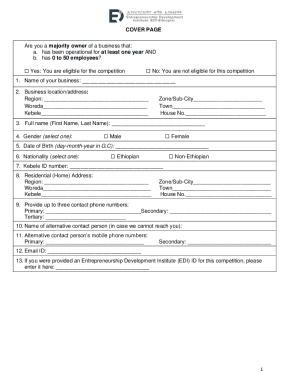

How to fill out registration form for estate

How to fill out Registration Form for Estate & Family Farm Business Transfer Planning

01

Obtain a copy of the Registration Form for Estate & Family Farm Business Transfer Planning.

02

Start with the contact information section by providing your name, address, and phone number.

03

Fill in details about the estate, including the location and description of the property.

04

List the family members or beneficiaries involved in the estate transfer.

05

Specify the type of business and provide any relevant business registration numbers.

06

Detail the current ownership structure and any partnerships involved.

07

Provide information on debts and liabilities related to the estate and business.

08

Include any special considerations or instructions for the transfer.

09

Review the completed form for accuracy and completeness.

10

Submit the form through the designated channel or return it to the relevant authority.

Who needs Registration Form for Estate & Family Farm Business Transfer Planning?

01

Farm owners looking to transfer their estate and business to family members.

02

Beneficiaries of family farms who need to formalize their inheritance process.

03

Estate planners and advisors managing family farm estates.

04

Individuals or families planning for succession in their agricultural operations.

Fill

form

: Try Risk Free

People Also Ask about

How to avoid Irish capital gains tax?

The main exemptions from CGT include: Your home (Principal Private Residence Relief) Assets you get from your spouse. A site you get from your parent. Business or farm assets if you are 55 or older. Assets passed on when you die.

Is there capital gains tax on agricultural land in Ireland?

When selling land, Capital Gains Tax (CGT) is chargeable in Ireland at a rate of 33%. However, farmers may be able to reduce this bill if they qualify for certain reliefs. Farm Consolidation Relief refers to the stamp duty charged on the purchase of land. The standard rate of stamp duty on land is 7.5%.

What is the capital gains tax on farms in Ireland?

When selling land, Capital Gains Tax (CGT) is chargeable in Ireland at a rate of 33%. However, farmers may be able to reduce this bill if they qualify for certain reliefs. Farm Consolidation Relief refers to the stamp duty charged on the purchase of land. The standard rate of stamp duty on land is 7.5%.

What is the 7 year rule for capital gains tax in Ireland?

7-Year Capital Gains Tax Exemption If you dispose of land or buildings bought between 7 December 2011 and 31 December 2014, and held them for at least 4 years, you may be eligible for partial or full relief: Held for more than 7 years: No CGT for the first 7 years of ownership.

What is the farm tax relief in Ireland?

Agricultural Relief If you inherit a farm, there are certain taxes you will have to pay. However, you may qualify for Agricultural Relief. This reduces the taxable value of agricultural property and land by 90%. You must meet certain conditions to qualify for this relief, including passing the 'Active Farmer Test'.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Registration Form for Estate & Family Farm Business Transfer Planning?

The Registration Form for Estate & Family Farm Business Transfer Planning is a document that facilitates the lawful transfer of ownership and management of family farm businesses and estates, ensuring smooth transitions upon the owner's retirement, death, or transfer of assets.

Who is required to file Registration Form for Estate & Family Farm Business Transfer Planning?

The individuals or entities involved in the transfer of ownership of a family farm business or estate, such as current owners, heirs, or potential buyers, are required to file the Registration Form.

How to fill out Registration Form for Estate & Family Farm Business Transfer Planning?

To fill out the Registration Form, individuals must provide relevant personal information, details related to the family farm or estate, and specify the intended transfer arrangements. Each section of the form must be completed accurately, and additional documentation may be required.

What is the purpose of Registration Form for Estate & Family Farm Business Transfer Planning?

The purpose of the Registration Form is to officially document the intentions of the current owner regarding the transfer of their family farm business or estate, ensuring clarity, legal compliance, and facilitating smooth transitions to the new owners.

What information must be reported on Registration Form for Estate & Family Farm Business Transfer Planning?

The information that must be reported includes the names and contact details of the current owner and transferees, a description of the family farm business or estate, the date of transfer, and any specific arrangements or conditions related to the transfer.

Fill out your registration form for estate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration Form For Estate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.