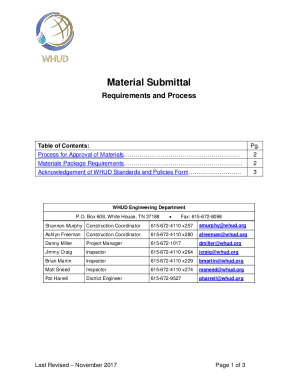

Get the free BANK GUARANTEE FORM - Miedema Auctioneering

Show details

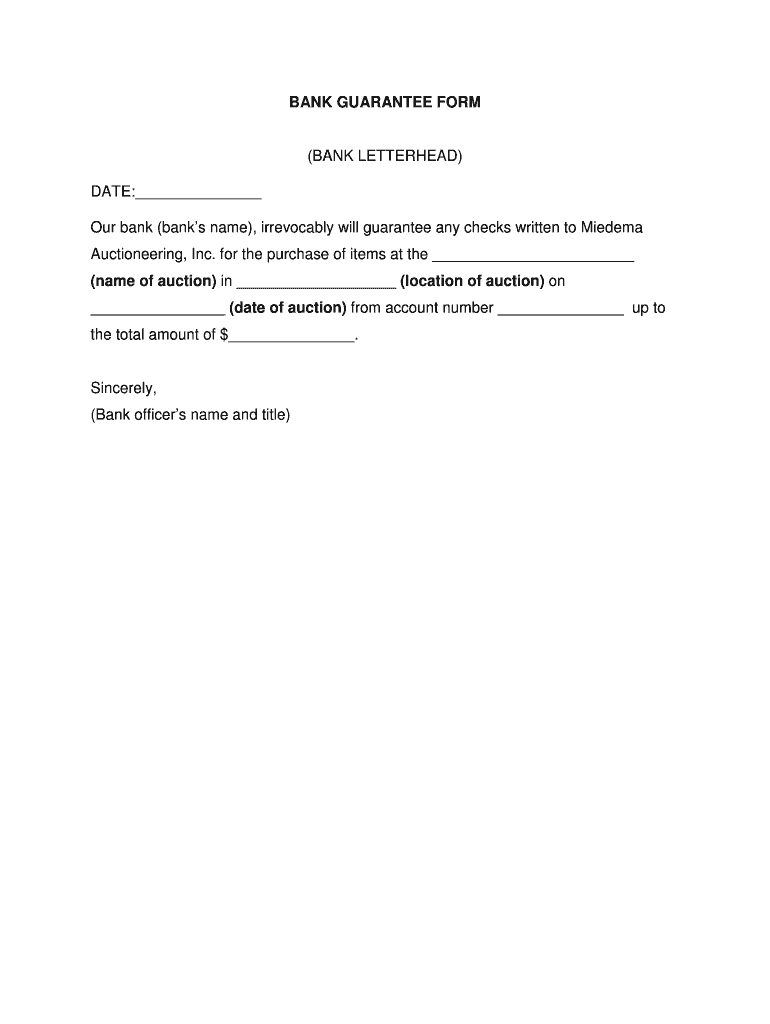

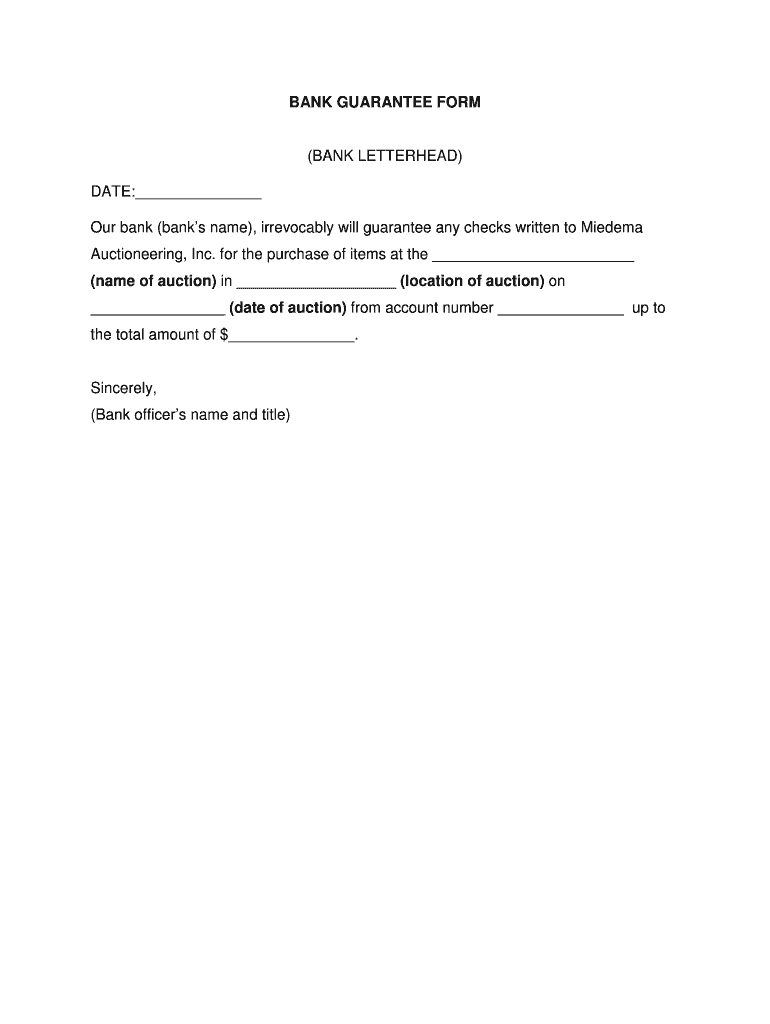

BANK GUARANTEE FORM (BANK LETTERHEAD) DATE: Our bank (banks name), irrevocably will guarantee any checks written to Mi edema Auctioneer, Inc. for the purchase of items at the (name of auction) in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank guarantee form

Edit your bank guarantee form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank guarantee form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bank guarantee form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank guarantee form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank guarantee form

How to fill out a bank guarantee form:

01

Begin by entering your personal information, including your name, address, and contact details. Make sure to provide accurate and up-to-date information.

02

Next, specify the details of the beneficiary, such as their name, address, and any other relevant contact information.

03

Indicate the specific amount of the bank guarantee and the currency in which it will be issued. Be sure to enter the correct figures to avoid any discrepancies.

04

Provide a brief description or purpose of the guarantee. This can include details about the transaction or contract for which the guarantee is being issued.

05

Specify the duration or expiration date of the bank guarantee. Make sure to enter the start and end dates accurately to prevent any confusion.

06

Include any additional terms or conditions that are applicable to the bank guarantee. This can include specifics regarding the enforcement or release of funds, as well as any relevant fees or charges.

07

Review all the information entered on the form to ensure accuracy and completeness. Make any necessary corrections before submitting the form to the bank.

08

Once the form is filled out, sign and date it to indicate your agreement and acceptance of the terms and conditions.

09

Submit the completed bank guarantee form to the relevant bank or financial institution for processing and approval.

Who needs a bank guarantee form?

01

Individuals or businesses involved in international trade often require a bank guarantee form. This includes importers, exporters, and suppliers.

02

Contractors or service providers may also need a bank guarantee form when bidding for or executing projects. This provides assurance to the client that they have the financial capability to fulfill their obligations.

03

Landlords or property owners may request a bank guarantee form from tenants as a security deposit or to guarantee the timely payment of rent.

04

Public and private organizations may also require a bank guarantee form when participating in tenders or contractual agreements. This ensures that the winning bidder or contractor can fulfill their obligations.

Overall, anyone involved in commercial or financial transactions that require a guarantee of payment or performance may need to fill out a bank guarantee form. The specific requirements may vary depending on the nature of the transaction and the parties involved.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the bank guarantee form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your bank guarantee form in minutes.

Can I create an eSignature for the bank guarantee form in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your bank guarantee form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I edit bank guarantee form on an iOS device?

Create, modify, and share bank guarantee form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is bank guarantee form?

Bank guarantee form is a document issued by a bank that guarantees payment to a beneficiary in case the applicant fails to fulfill their obligations.

Who is required to file bank guarantee form?

Any party entering into a contractual agreement may be required to file a bank guarantee form as a means of providing financial assurance.

How to fill out bank guarantee form?

To fill out a bank guarantee form, applicants must provide relevant information such as their name, contact details, amount of guarantee, beneficiary details, and terms of the guarantee.

What is the purpose of bank guarantee form?

The purpose of a bank guarantee form is to ensure that the beneficiary will receive payment in the event that the applicant fails to fulfill their obligations.

What information must be reported on bank guarantee form?

Information such as applicant details, beneficiary details, amount of guarantee, validity period, terms and conditions of the guarantee must be reported on the bank guarantee form.

Fill out your bank guarantee form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Guarantee Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.