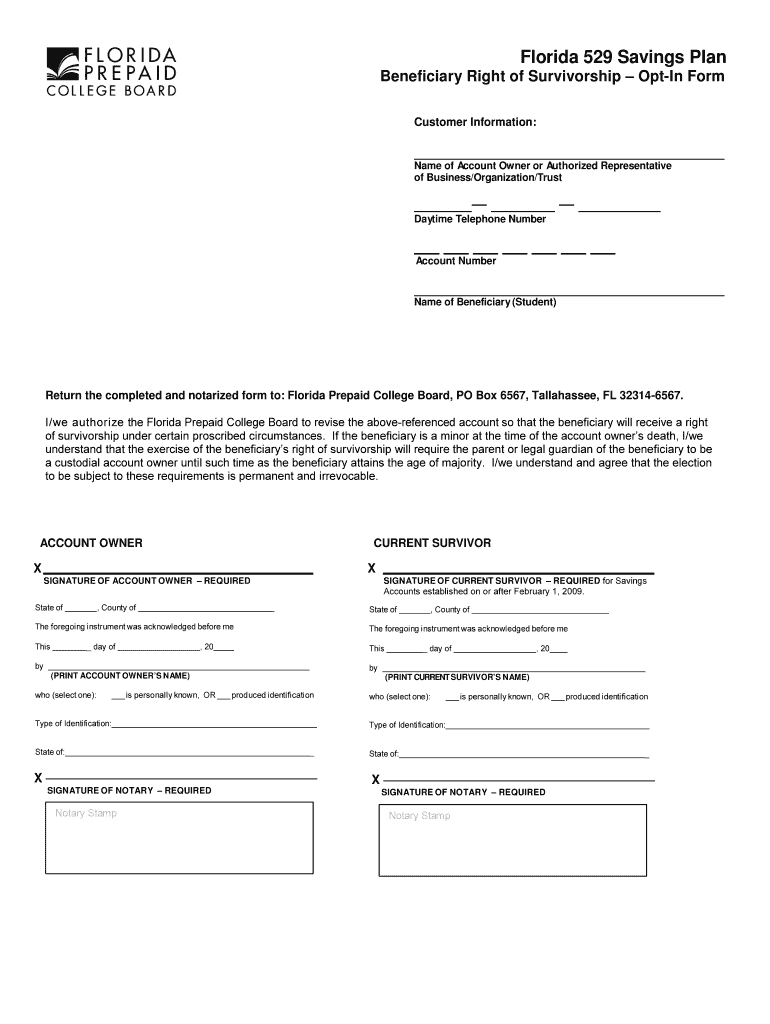

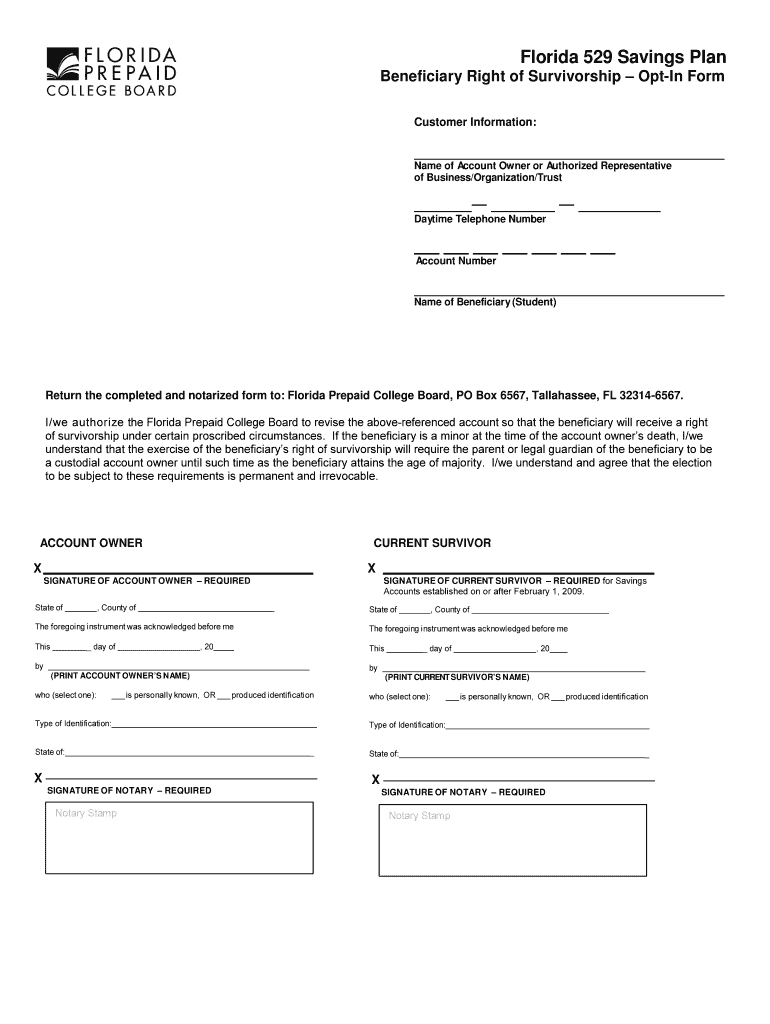

Get the free Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form

Show details

This form is used to grant a right of survivorship to the beneficiary of Florida 529 Savings Plan accounts established prior to May 29, 2013. It requires notarized signatures from the account owner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign florida 529 savings plan

Edit your florida 529 savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida 529 savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit florida 529 savings plan online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit florida 529 savings plan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out florida 529 savings plan

How to fill out Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form

01

Obtain the Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form from the official website or your account manager.

02

Fill out the account holder's information in the designated fields, including name, address, and account number.

03

Provide the beneficiary's details, including their name, address, and social security number.

04

Carefully read through the terms and conditions of the Right of Survivorship.

05

Indicate your decision to opt-in by checking the appropriate box on the form.

06

Sign and date the form to authenticate your intent.

07

Submit the completed form to the Florida 529 Plan by mail or through any specified digital submission method.

Who needs Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

01

Account holders of a Florida 529 Savings Plan who wish to establish a right of survivorship for their beneficiaries to ensure that the account passes directly to the designated beneficiary upon the account holder's death.

Fill

form

: Try Risk Free

People Also Ask about

What is a Florida 529 savings plan?

529 savings plans 529 plans are flexible, tax-advantaged accounts designed specifically for education savings. Funds can be used for qualified education expenses at schools nationwide. Before you start you will need to know the child's date of birth, social security number and what investment choices you want.

How do I know if I'm a qualified beneficiary under the terms of the Florida prepaid college program?

Exceptions and Qualifications Qualified beneficiaries under the terms of the Florida Prepaid College Program. Persons married to legal Florida residents and who intend to make Florida their permanent home, and who relinquish their legal ties to any other state.

What is the biggest downside to a 529 plan?

Drawbacks of a 529 Plan Potential overfunding. Impact on financial aid. Market risk. Penalties for non-qualified withdrawals. Limited investment options. State-specific restrictions. Fees and expenses.

What is the minimum contribution to a 529 plan in Florida?

No. There is no minimum contribution to get started. You contribute as much and as often as you like. The aggregate maximum account balance for all plans for the same student is $418,000.

What happens to Florida prepaid if your kid doesn't go to college?

What Happens To Your Florida Prepaid Plan If Your Child Doesn't Go To College? What happens to your Florida Prepaid College Plan if your child decides not to attend college? Your Florida Prepaid Plan is still guaranteed. Starting Is Believing

What can most 529 be used for?

The money in your account may be used at any eligible educational institution in the United States and abroad that qualifies under federal guidelines, including qualified apprenticeship programs. The money can also be used for tuition at K–12 public, private, and religious schools.

What happens to Florida prepaid if my kid doesn't go to college?

What Happens To Your Florida Prepaid Plan If Your Child Doesn't Go To College? What happens to your Florida Prepaid College Plan if your child decides not to attend college? Your Florida Prepaid Plan is still guaranteed. Starting Is Believing

What is a survivor on Florida prepaid?

Survivor: Takes over the account should the Account Owner become deceased. Authorized Agent: Designated by the Account Owner to co-manage the plan with equal rights. Joint Approver: Designated by the Account Owner or legal authority to approve certain major account and plan changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

The Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form is a document that allows account holders to designate a beneficiary on their 529 savings account, ensuring that in the event of the account holder's death, the funds will pass directly to the designated beneficiary.

Who is required to file Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

Account holders of the Florida 529 Savings Plan who wish to establish a right of survivorship for their designated beneficiary are required to file the Opt-In Form.

How to fill out Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

To fill out the Opt-In Form, account holders must provide the necessary personal information, including their name, account number, and the beneficiary's details, and then sign the form to indicate consent.

What is the purpose of Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

The purpose of the form is to allow account holders to ensure that the funds in their 529 savings plan are automatically transferred to their chosen beneficiary upon their death, streamlining the transfer process.

What information must be reported on Florida 529 Savings Plan Beneficiary Right of Survivorship – Opt-In Form?

The form must report the account holder's name, the 529 account number, the designated beneficiary's name, and any additional required details, including signatures and dates.

Fill out your florida 529 savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida 529 Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.