Get the free Acquisition Opportunity Leading Private Label and Branded Pet ...

Show details

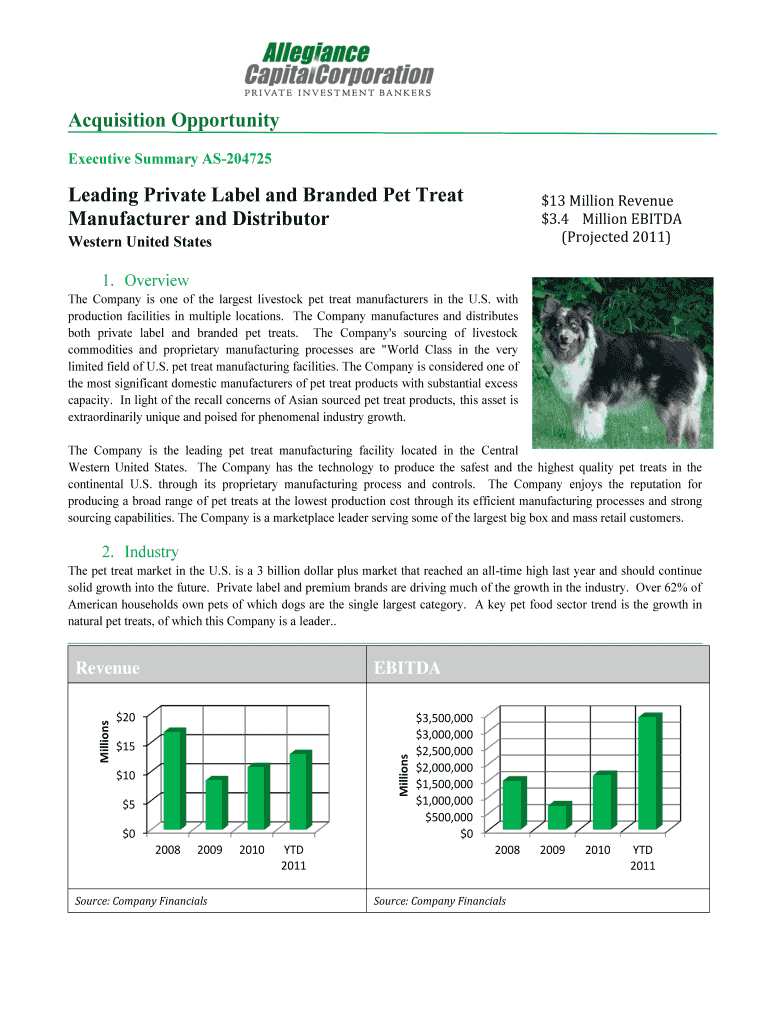

Acquisition Opportunity Executive Summary AS204725 Leading Private Label and Branded Pet Treat Manufacturer and Distributor $ $13 Million Revenue 1 ×3.4 Million EBITDA 2 (Projected 2011) + Western

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign acquisition opportunity leading private

Edit your acquisition opportunity leading private form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your acquisition opportunity leading private form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing acquisition opportunity leading private online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit acquisition opportunity leading private. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out acquisition opportunity leading private

How to fill out acquisition opportunity leading private:

01

Start by conducting thorough research on the target company or business you are interested in acquiring. Gather information about their financial health, market position, and potential growth prospects.

02

Evaluate your own resources and capabilities to determine if you have the necessary means to successfully pursue the acquisition opportunity. Consider factors such as funding availability, management expertise, and strategic fit with your existing business.

03

Develop a clear acquisition strategy outlining your objectives, target criteria, and expected synergies. This will help you stay focused and make informed decisions throughout the process.

04

Reach out to the target company's leadership to express your interest in the acquisition opportunity. This can be done through a formal letter of intent or initial discussion.

05

Conduct due diligence to thoroughly assess the target company's financial statements, legal contracts, operational processes, and any potential risks or liabilities. Seek assistance from legal, financial, and industry experts to ensure a comprehensive evaluation.

06

If the due diligence process yields satisfactory results and you are confident about moving forward with the acquisition, start negotiating the terms of the deal. This includes determining the purchase price, deal structure, and any contingencies or conditions.

07

Once the acquisition agreement has been reached, work with your legal team to draft and finalize the necessary legal documents, such as the purchase agreement, shareholders' agreement, and any regulatory filings.

08

Seek necessary regulatory approvals, if applicable, and ensure compliance with any legal or antitrust requirements.

09

Secure the necessary funding to execute the acquisition, whether through internal resources, external financing, or a combination of both.

10

Close the deal by transferring ownership of the target company to your organization. This may involve finalizing the financial transaction, addressing any transitional issues, and integrating the acquired business into your existing operations.

Who needs acquisition opportunity leading private?

01

Entrepreneurs or business owners looking to expand their market presence or diversify their business portfolio.

02

Private equity firms seeking to invest in promising companies or industries for potential high returns.

03

Strategic buyers aiming to gain a competitive advantage, access new technologies, or enter new markets.

04

Investors or venture capitalists interested in supporting and growing innovative startups or early-stage companies.

05

Existing companies seeking opportunities for growth, market consolidation, or synergistic partnerships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out acquisition opportunity leading private using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign acquisition opportunity leading private and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit acquisition opportunity leading private on an iOS device?

You certainly can. You can quickly edit, distribute, and sign acquisition opportunity leading private on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out acquisition opportunity leading private on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your acquisition opportunity leading private. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is acquisition opportunity leading private?

Acquisition opportunity leading private refers to the potential opportunity for a private individual or entity to acquire another private company.

Who is required to file acquisition opportunity leading private?

In general, any private individual or entity looking to acquire another private company may be required to file an acquisition opportunity leading private.

How to fill out acquisition opportunity leading private?

To fill out an acquisition opportunity leading private, the individual or entity must provide detailed information about the potential acquisition, including financial details and the reasons for the acquisition.

What is the purpose of acquisition opportunity leading private?

The purpose of acquisition opportunity leading private is to inform regulatory authorities and stakeholders about a potential acquisition and ensure transparency in the process.

What information must be reported on acquisition opportunity leading private?

Information such as the parties involved, the financial terms of the acquisition, the expected timeline, and any potential impact on stakeholders must be reported on acquisition opportunity leading private.

Fill out your acquisition opportunity leading private online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Acquisition Opportunity Leading Private is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.