Get the free Thrift Savings Plan

Show details

This document provides important information regarding updates to the Thrift Savings Plan (TSP), including changes to account access security, new annual participant statements, and instructions for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign thrift savings plan

Edit your thrift savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your thrift savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit thrift savings plan online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit thrift savings plan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out thrift savings plan

How to fill out Thrift Savings Plan

01

Visit the official Thrift Savings Plan (TSP) website.

02

Create an account or log in if you already have one.

03

Review the eligibility requirements for participation.

04

Choose your contribution type (traditional, Roth, or both).

05

Decide on the percentage of your pay to contribute.

06

Select your investment allocation based on your risk tolerance.

07

Fill out the necessary forms online or download them for manual submission.

08

Review your information and submit the application.

Who needs Thrift Savings Plan?

01

Federal employees

02

Members of the uniformed services

03

Civilian employees who wish to save for retirement

Fill

form

: Try Risk Free

People Also Ask about

How does the Thrift Savings Plan work?

The TSP is a defined contribution plan, meaning that the retirement income you receive from your TSP account will depend on how much money you put into your account during your working years and the earnings accumulated over time (and, if you're eligible, agency or service contributions and their earnings).

Is it worth keeping money in TSP?

Many participants choose to keep their money in the TSP because of the TSP's low-cost funds. And you can always move money into your TSP account by making rollovers from eligible employer plans and from traditional IRAs. You always control how your money in the TSP is invested, even if you aren't making contributions.

What are the downsides of a TSP loan?

One big downside of a TSP loan is that it can significantly hinder the growth of your account. The interest rate for a TSP loan is locked in for the life of your loan and is based on the G Fund interest rate for the month before you request the loan.

Does TSP keep growing after retirement?

Comments Section As long as your TSP is invested in the stock market, then yes - it will keep growing. It will also grow if invested in the G Fund, avg of 2% a year. Not a lot. But it's growth. Doesn't have to just be invested in stocks. If it's not a ton of money just leave it in and see what happens over the years.

What is better, TSP or 401k?

The TSP is better for federal employees and military personnel because of its low fees and consistent employer matching up to 5%. However, a 401(k) offers more investment options and is better suited for private-sector workers. The best plan depends on your employment and retirement goals.

Is the TSP better than a 401k?

The TSP is better for federal employees and military personnel because of its low fees and consistent employer matching up to 5%. However, a 401(k) offers more investment options and is better suited for private-sector workers. The best plan depends on your employment and retirement goals.

What are the cons of the TSP?

Here are some of the cons of TSP plans: In order to receive the maximum employer match, employees need to allocate at least 5% of their salary to their TSP. Some employees may not be aware they are contributing to a retirement account through automatic enrollment, which could lead to misunderstandings about their pay.

What does Dave Ramsey say about TSP?

Dave Ramsey's advice is to save 5% into the TSP to get the full match, then max out a Roth IRA, and then put more into the TSP if you are able to save more after that.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Thrift Savings Plan?

The Thrift Savings Plan (TSP) is a retirement savings and investment plan for federal employees and members of the uniformed services, designed to help them save for their retirement.

Who is required to file Thrift Savings Plan?

All federal employees and members of the uniformed services who wish to participate in the TSP are required to file the necessary enrollment forms to contribute to the plan.

How to fill out Thrift Savings Plan?

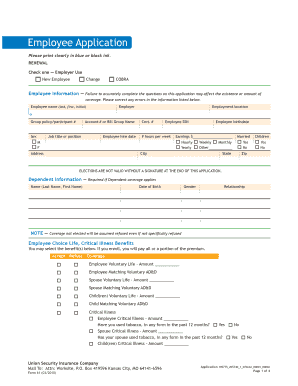

To fill out the Thrift Savings Plan, individuals must complete the TSP enrollment form (TSP-1) and submit it to their agency or service provider, specifying the amount they wish to contribute and selecting any available investment options.

What is the purpose of Thrift Savings Plan?

The purpose of the Thrift Savings Plan is to provide federal employees and service members a means to save and invest for retirement, promoting financial security in their later years.

What information must be reported on Thrift Savings Plan?

Individuals must report their contribution elections, personal information, investment choices, and any changes in employment status or beneficiaries on the Thrift Savings Plan.

Fill out your thrift savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Thrift Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.