Get the free MY PLANNED GIFT TO WASHINGTON UNIVERSITY I have provided support for Washington Univ...

Show details

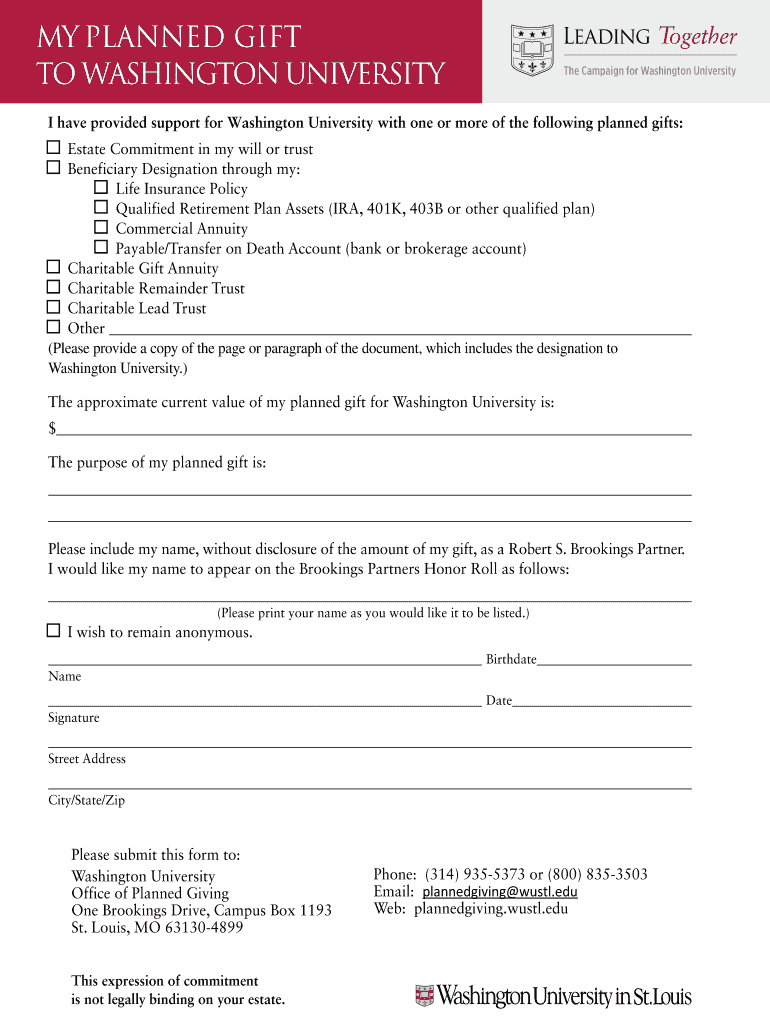

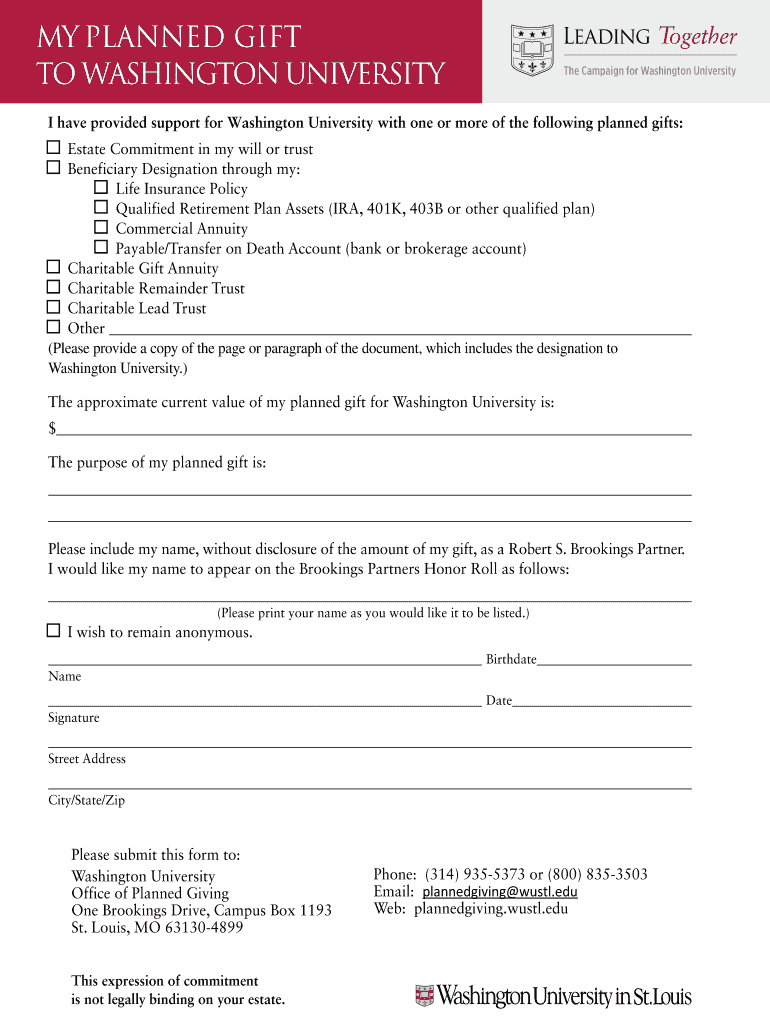

MY PLANNED GIFT TO WASHINGTON UNIVERSITY I have provided support for Washington University with one or more of the following planned gifts: q Estate Commitment in my will or trust q Beneficiary Designation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign my planned gift to

Edit your my planned gift to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your my planned gift to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit my planned gift to online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit my planned gift to. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out my planned gift to

How to fill out my planned gift to:

01

Identify the organization: Start by deciding which organization or cause you want to support with your planned gift. It could be a charity, non-profit organization, educational institution, or any other cause that aligns with your values and interests.

02

Contact the organization: Get in touch with the organization to let them know about your intention to make a planned gift. They can provide you with the necessary information and guidance on how to proceed. Find out who the appropriate contact person is and reach out to them via phone or email.

03

Research gift options: There are various ways to make a planned gift, such as including the organization in your will, setting up a charitable trust, donating stocks or other assets, or naming the organization as a beneficiary of your life insurance policy or retirement account. Research these options to determine which one best suits your financial situation and philanthropic goals.

04

Seek professional advice: To ensure that your planned gift is structured properly and aligned with your financial and estate planning goals, it is advisable to consult with a qualified attorney or financial advisor. They can provide you with expert advice and help you navigate the legal and tax implications associated with making a planned gift.

05

Complete the necessary paperwork: Once you have decided on the type of planned gift and sought the necessary advice, you will need to complete the required paperwork. This may include updating your will, drafting a trust agreement, or filling out beneficiary designation forms for your retirement accounts or life insurance policies. Work closely with your attorney or financial advisor to ensure all the necessary legal documents are properly prepared.

Who needs my planned gift to:

01

Non-profit organizations: Many non-profit organizations rely on planned gifts to support their ongoing operations, fund research, provide scholarships, and deliver programs and services to communities in need. Your planned gift can make a significant impact on the organization's ability to continue their vital work and achieve their mission.

02

Educational institutions: Colleges, universities, and schools often rely on planned gifts to support student scholarships, facility upgrades, educational programs, and other initiatives. By designating your planned gift to an educational institution, you can contribute to providing quality education and creating opportunities for deserving students.

03

Charitable causes: Planned gifts can also be directed towards specific charitable causes such as healthcare, environmental conservation, animal welfare, social justice, and more. By supporting these causes through your planned gift, you can contribute to creating positive change and making a lasting impact in areas that matter to you.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my my planned gift to directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your my planned gift to and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an electronic signature for signing my my planned gift to in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your my planned gift to right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I fill out the my planned gift to form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign my planned gift to and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is my planned gift to?

Your planned gift is to support a charitable cause or organization.

Who is required to file my planned gift to?

The executor of your estate or a designated representative is required to file your planned gift.

How to fill out my planned gift to?

You can fill out your planned gift by following the instructions provided by the charity or organization receiving the gift.

What is the purpose of my planned gift to?

The purpose of your planned gift is to provide financial support to a cause or organization that aligns with your values and beliefs.

What information must be reported on my planned gift to?

The information that must be reported on your planned gift includes the details of the gift, its value, and any conditions or restrictions attached.

Fill out your my planned gift to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

My Planned Gift To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.