Get the free Domestic Return Plan

Show details

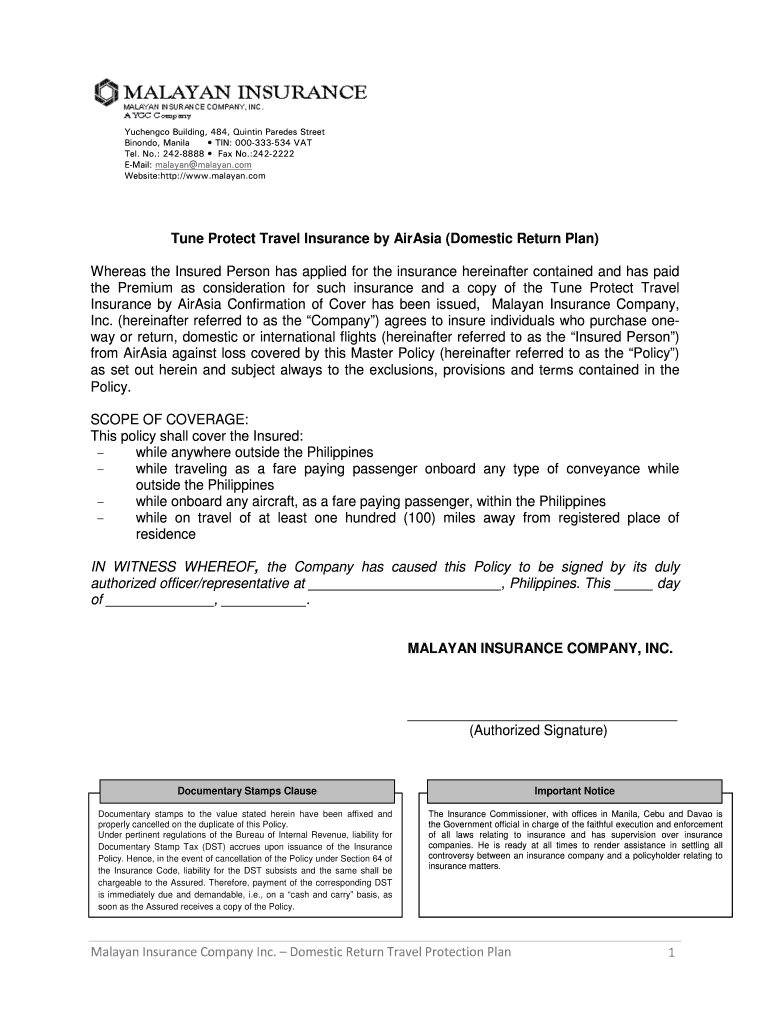

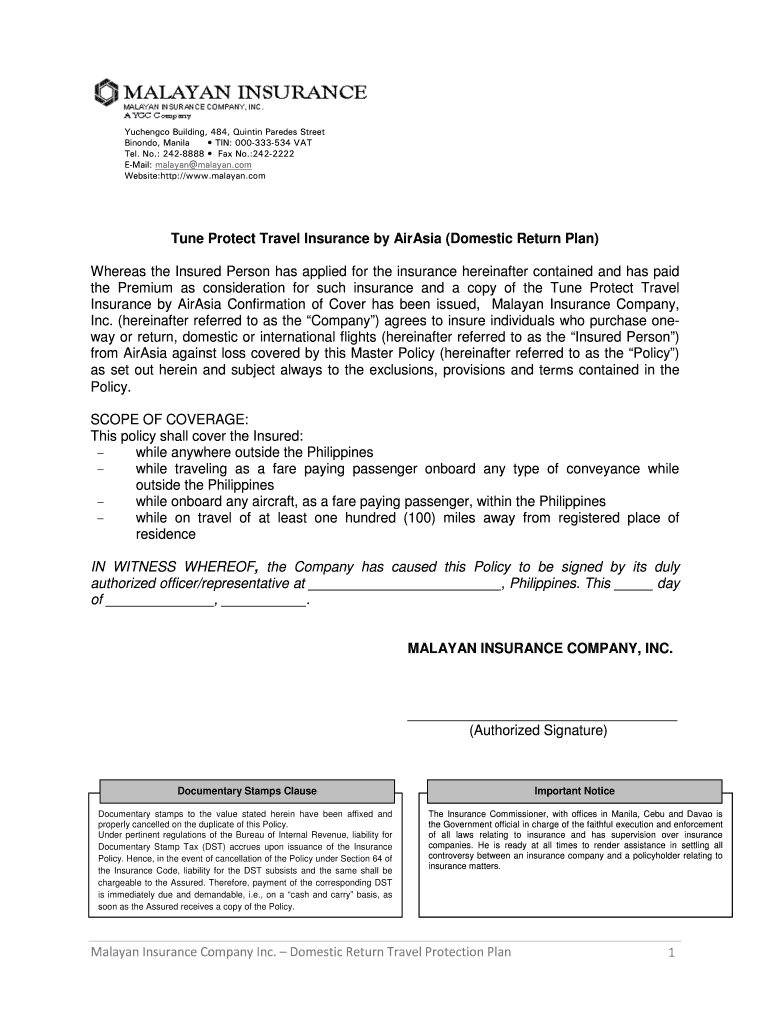

Yuchengco Building, 484, Quentin Parades Street Beyond, Manila TIN: 000333534 VAT Tel. No.: 2428888 Fax No.:2422222 Email: malayan.com Website:http://www.malayan.com Tune Protect Travel Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign domestic return plan

Edit your domestic return plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your domestic return plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing domestic return plan online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit domestic return plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

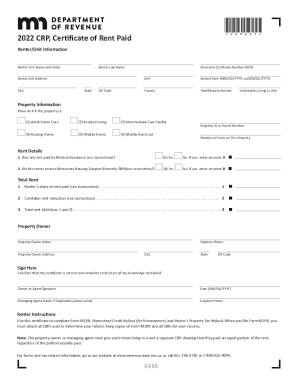

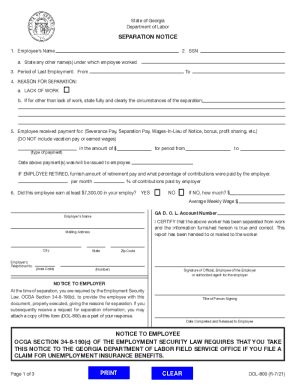

How to fill out domestic return plan

How to fill out a domestic return plan:

01

Begin by gathering all necessary information and documents required for the return plan. This may include proof of purchase, item details, and any specific return instructions provided by the seller.

02

Clearly identify the reason for the return. If the product is damaged, defective, or not as described, make sure to accurately describe the issue to facilitate the return process.

03

Fill out the required fields in the domestic return plan form, ensuring that all information provided is accurate and complete. This may include personal details such as name, contact information, and order number.

04

Follow any specific return instructions, such as packaging the item securely or printing a return label. Make sure to adhere to any deadlines or timeframes specified by the seller.

05

Keep a copy of the completed domestic return plan for your records, including any tracking numbers or return labels provided. This will serve as proof of your return request and help track the progress of the return.

Who needs a domestic return plan:

01

Customers who have purchased products from a seller and wish to return them within the specified return period.

02

Individuals who have received damaged, defective, or incorrectly described items and require a formal process to initiate their return and seek a refund or replacement.

03

Customers who want to ensure a smooth and organized return process, as the domestic return plan helps streamline the communication and documentation required for returning a product.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my domestic return plan directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your domestic return plan and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit domestic return plan in Chrome?

domestic return plan can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I edit domestic return plan on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign domestic return plan. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is domestic return plan?

The domestic return plan is a tax document that outlines the income, deductions, credits, and tax liability of a taxpayer who is a resident in the country.

Who is required to file domestic return plan?

Any individual or entity that meets the income thresholds set by the tax authorities is required to file a domestic return plan.

How to fill out domestic return plan?

The domestic return plan can be filled out either manually or electronically, by providing accurate information about the taxpayer's income, deductions, credits, and tax liability.

What is the purpose of domestic return plan?

The purpose of the domestic return plan is to report income and calculate the tax liability of a taxpayer, ensuring compliance with tax laws.

What information must be reported on domestic return plan?

Information such as income sources, deductions, credits, and tax payments must be reported on the domestic return plan.

Fill out your domestic return plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Domestic Return Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

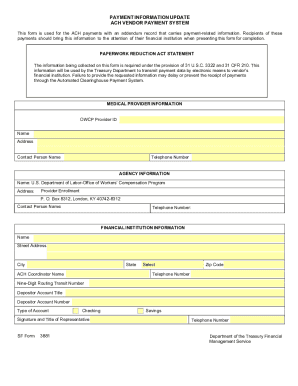

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.