Get the free 38 STUDIOS, LLC SCHEDULE G ATTACHMENT

Show details

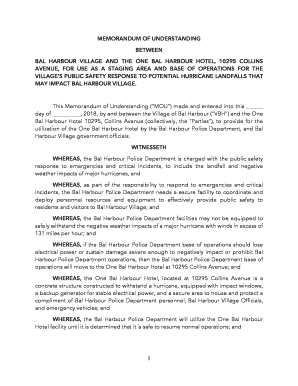

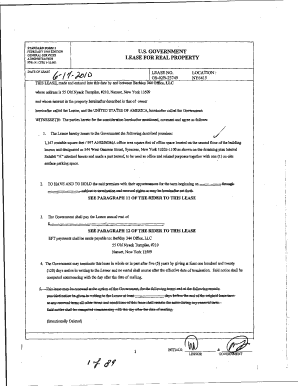

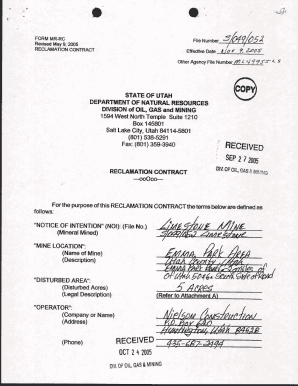

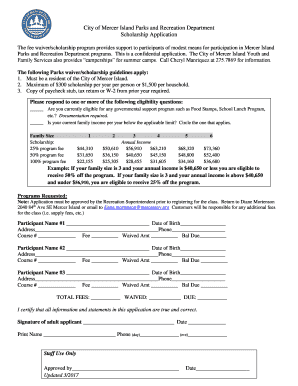

This document contains a detailed listing of various agreements and contracts associated with 38 Studios, LLC, including details about co-debtors and creditors.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 38 studios llc schedule

Edit your 38 studios llc schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 38 studios llc schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 38 studios llc schedule online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 38 studios llc schedule. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 38 studios llc schedule

How to fill out 38 STUDIOS, LLC SCHEDULE G ATTACHMENT

01

Obtain the 38 Studios, LLC Schedule G Attachment form from the appropriate source.

02

Review the instructions provided with the form for specific guidance.

03

Begin by entering the name of the LLC and the tax identification number at the top of the form.

04

Fill out each section of the form according to the information requested, such as income, expenses, and distributions.

05

Ensure all figures are accurate and correspond to your financial records.

06

Double-check that you've signed and dated the form at the bottom.

07

Submit the completed form as required by your jurisdiction or designated authority.

Who needs 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

01

Businesses that are structured as LLCs and need to report their financial information.

02

Tax professionals assisting clients who are LLC members.

03

Anyone involved in the management or financial reporting of 38 Studios, LLC.

Fill

form

: Try Risk Free

People Also Ask about

What is a 540NR?

Change in Residency: Form 540NR is designed for either part-year residents or non-residents of California for the tax year. If you were a full-year resident in a previous year but changed your residency status during the tax year, you would use Form 540NR.

Do nonresident aliens have to file US tax returns?

Who must file. You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

Do I need to file a nonresident California tax return?

Generally, you must file an income tax return if you're a resident, part-year resident, or nonresident and: Are required to file a federal return.

Do I need to file CA 540NR?

Nonresidents of California who received California sourced income in 2024, or moved into or out of California in 2024, file Form 540NR. California taxes all income received while you resided in California and the income you received from California sources while a nonresident.

What is the difference between 540 and 540NR?

How do I know if I should use Form 540 or Form 540NR for my California taxes? If you're a full-year resident of California, you'll use Form 540. If you're a non-resident or part-year resident who earned income in California, Form 540NR is the appropriate form.

Who must file CA 540NR?

Which Form To Use. Use Form 540NR if either you or your spouse/RDP were a nonresident or part-year resident in tax year 2024. If you and your spouse/RDP were California residents during the entire tax year 2024, use Form 540, California Resident Income Tax Return, or 540 2EZ, California Resident Income Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

38 Studios, LLC Schedule G Attachment is a financial document used by the company to report its financial activities and obligations, typically in the context of its tax filings or financial disclosures.

Who is required to file 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

Any entity or individual that has a financial stake or obligation related to 38 Studios, LLC, particularly those involved in financial reporting or tax obligations, may be required to file the Schedule G Attachment.

How to fill out 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

To fill out the Schedule G Attachment, one must collect the necessary financial data pertaining to revenues, expenses, and any relevant financial transactions, then input this data into the structured format provided in the attachment.

What is the purpose of 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

The purpose of the Schedule G Attachment is to ensure transparent reporting of financial activities, enabling stakeholders to understand the financial position and obligations of 38 Studios, LLC.

What information must be reported on 38 STUDIOS, LLC SCHEDULE G ATTACHMENT?

The information that must be reported typically includes income, expenditures, liabilities, assets, and any other financial details that are necessary for complete disclosure and compliance.

Fill out your 38 studios llc schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

38 Studios Llc Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.