Get the free 2000 D.C. Personal Property Tax Return - app cfo dc

Show details

Instructions and procedures for filing the D.C. personal property tax return for the tax year beginning July 1, 1999, and ending June 30, 2000.

We are not affiliated with any brand or entity on this form

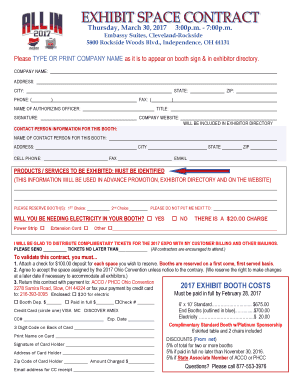

Get, Create, Make and Sign 2000 dc personal property

Edit your 2000 dc personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2000 dc personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2000 dc personal property online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2000 dc personal property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2000 dc personal property

How to fill out 2000 D.C. Personal Property Tax Return

01

Gather all necessary documents related to personal property.

02

Obtain the 2000 D.C. Personal Property Tax Return form from the D.C. government website or local tax office.

03

Fill out your business name, address, and federal employer identification number (EIN) at the top of the form.

04

List all personal property including furniture, equipment, and any other taxable items you own.

05

Provide the estimated value of each item as of January 1, 2000.

06

Ensure you complete any additional schedules or sections required for specific types of property.

07

Review and double-check all information filled out for accuracy.

08

Sign and date the form at the bottom.

09

Submit the form to the Office of Tax and Revenue by the due date, ensuring you keep a copy for your records.

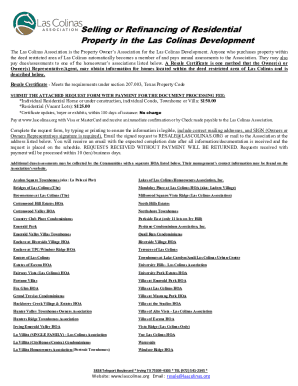

Who needs 2000 D.C. Personal Property Tax Return?

01

Individuals and businesses in D.C. who own tangible personal property valued over a certain threshold.

02

Entities operating in D.C. that possess equipment, furniture, or other personal property.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file a DC personal property tax return?

Who is required to file and pay Personal Property Tax? Generally, every individual, corporation, partnership, executor, administrator, guardian, receiver, trustee, or other taxpayer that owns or holds personal property for a trade or business must file a personal property tax return unless they are exempt from filing.

Does DC have personal property tax on cars?

DC doesn't do an annual personal property tax on cars.

What is the personal property tax rate in DC?

(a) Each year the district shall levy a tax against every person on the tangible personal property owned or held in trust in that person's trade or business in the District. The rate of tax shall be $3.40 for each $100 of value of the taxable personal property, in excess of $225,000 in value.

Does DC have car property tax?

DC doesn't do an annual personal property tax on cars.

Is there a property tax in DC?

All real property, unless expressly exempted, is subject to the real property tax and is assessed at 100% of market value. The District of Columbia has four property classes: Class 1 – improved residential real property that is occupied and is used exclusively for nontransient residential dwelling purposes.

How often do you pay property tax in DC?

Real Property Tax Bills District of Columbia law provides that all taxable real property in the District is subject to an annual levy of tax. A property owner will receive a property tax bill twice a year. The tax should be paid timely to avoid penalties and interest.

Do you pay personal property tax in DC?

An individual or entity engaged in business with a location in the District of Columbia must file a Personal Property tax return and report the current value of the tangible personal property as of July 1st of each year.

Do you have to pay personal property tax in DC?

Individuals, corporations, partnerships, executors, administrators, guardians, receivers, and trustees that own or hold personal property in trust in the District of Columbia must file a DC personal property tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2000 D.C. Personal Property Tax Return?

The 2000 D.C. Personal Property Tax Return is a form that businesses are required to file in Washington D.C. to report personal property owned as of January 1st, including equipment, furniture, and fixtures.

Who is required to file 2000 D.C. Personal Property Tax Return?

All businesses that own personal property in the District of Columbia and have a taxable value exceeding a certain threshold are required to file the 2000 D.C. Personal Property Tax Return.

How to fill out 2000 D.C. Personal Property Tax Return?

To fill out the 2000 D.C. Personal Property Tax Return, businesses must provide details about their personal property, including descriptions, acquisition dates, cost, and any deductions applicable to the property.

What is the purpose of 2000 D.C. Personal Property Tax Return?

The purpose of the 2000 D.C. Personal Property Tax Return is to assess and collect taxes on personal property owned by businesses, ensuring that all taxable personal property is reported and taxed appropriately.

What information must be reported on 2000 D.C. Personal Property Tax Return?

The information that must be reported includes the type of personal property, its location, the date it was acquired, the cost or value of the property, and any applicable exemptions or deductions.

Fill out your 2000 dc personal property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2000 Dc Personal Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.