Get the free Melding Loonheffingen Aanmelding Werkgever LH 590 - 1Z1PL FOL - herberigs

Show details

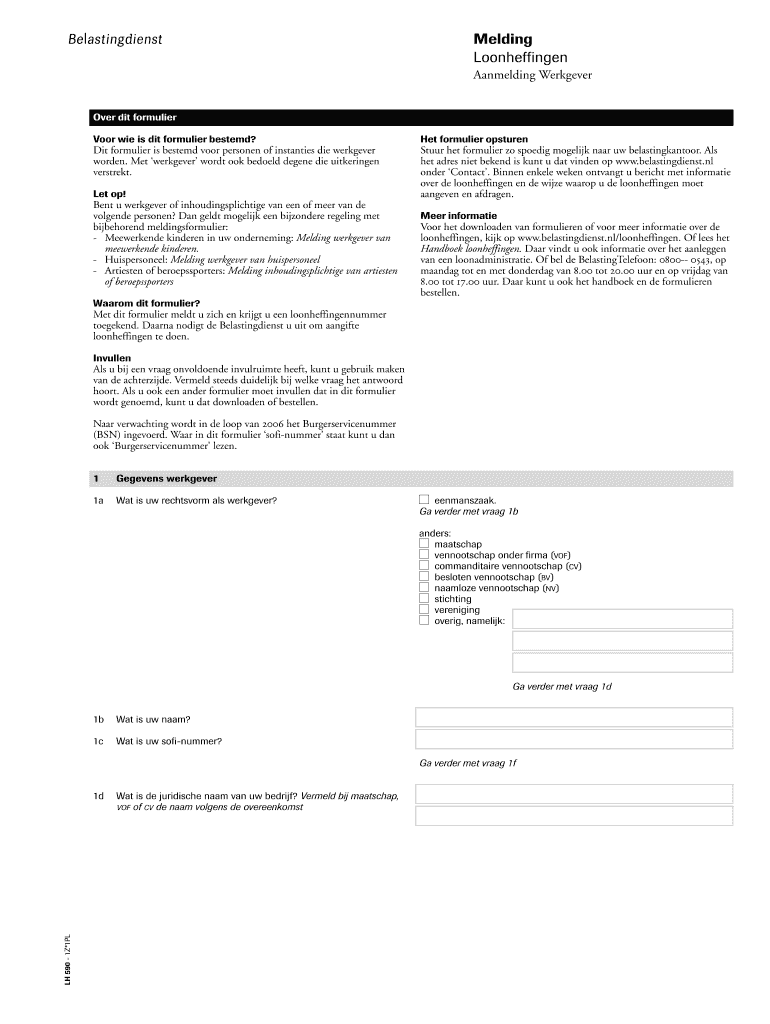

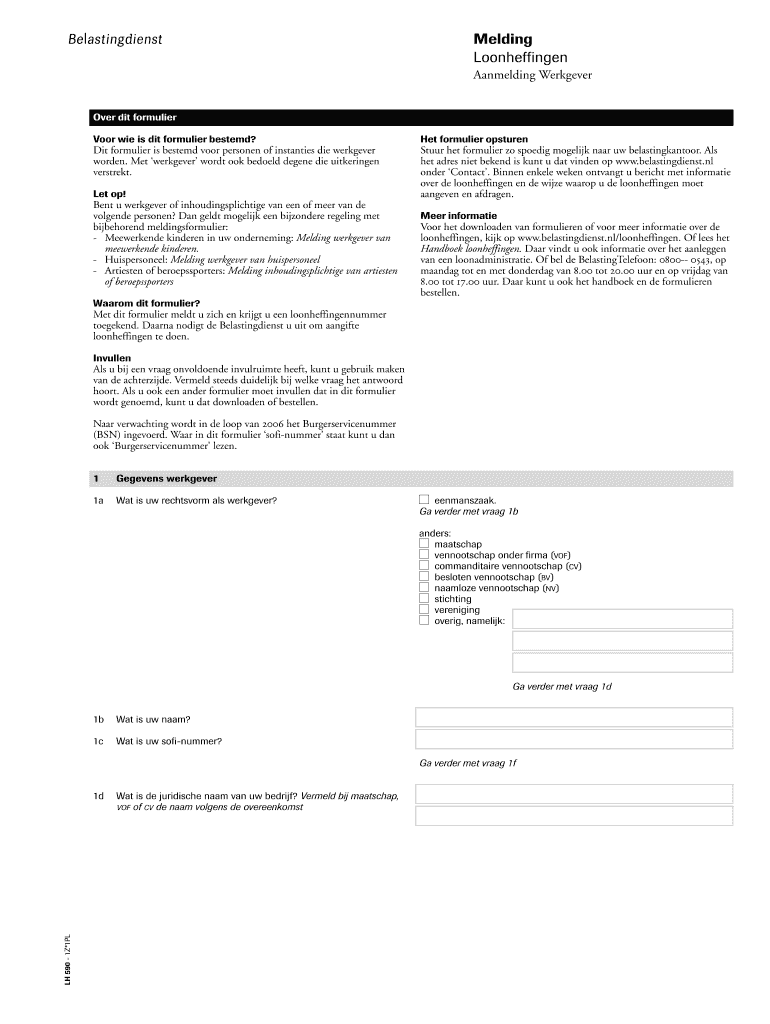

Melding Loonheffingen 12345 Amending Wherever Over it formulaic Poor we are it formulaic bested? It is formulaic is bested poor personen of instances die wherever wooden. Met wherever word took behold

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign melding loonheffingen aanmelding werkgever

Edit your melding loonheffingen aanmelding werkgever form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your melding loonheffingen aanmelding werkgever form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit melding loonheffingen aanmelding werkgever online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit melding loonheffingen aanmelding werkgever. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out melding loonheffingen aanmelding werkgever

How to fill out melding loonheffingen aanmelding werkgever:

01

Start by gathering all the necessary information. You will need the company's identification number, employee identification numbers, and the start date of employment for each employee.

02

Access the official website of the Dutch tax authorities and navigate to the section for employers.

03

Look for the option to fill out the melding loonheffingen aanmelding werkgever. It is usually found under the section for new employers or employer registrations.

04

Click on the option to start the process of filling out the form.

05

Enter your company's identification number in the provided field. Make sure to double-check it for accuracy.

06

Fill in the employee identification numbers one by one in the designated fields. If you have multiple employees, there may be an option to add more fields as needed.

07

Enter the start date of employment for each employee in the corresponding fields. Again, be careful to input the correct dates.

08

Review all the information you have entered to ensure accuracy and completeness.

09

Once you are confident that everything is correct, submit the form electronically.

10

After submission, you will receive a confirmation or reference number. Make note of this number for future reference.

Who needs melding loonheffingen aanmelding werkgever?

01

Companies or organizations that are established or registered in the Netherlands and plan to hire employees.

02

Employers who need to report employee information to the Dutch tax authorities for payroll tax purposes.

03

Individuals who are self-employed but plan to hire employees for their business.

Please note that this answer is provided for informational purposes only and it is always advisable to consult official government resources or seek professional advice for specific requirements and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit melding loonheffingen aanmelding werkgever from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like melding loonheffingen aanmelding werkgever, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I make changes in melding loonheffingen aanmelding werkgever?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your melding loonheffingen aanmelding werkgever and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I edit melding loonheffingen aanmelding werkgever straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit melding loonheffingen aanmelding werkgever.

What is melding loonheffingen aanmelding werkgever?

Melding loonheffingen aanmelding werkgever is a declaration that employers in the Netherlands must submit to the tax authorities when they start employing workers.

Who is required to file melding loonheffingen aanmelding werkgever?

All employers in the Netherlands who start employing workers are required to file melding loonheffingen aanmelding werkgever.

How to fill out melding loonheffingen aanmelding werkgever?

Employers can fill out melding loonheffingen aanmelding werkgever online through the Dutch tax authorities' website.

What is the purpose of melding loonheffingen aanmelding werkgever?

The purpose of melding loonheffingen aanmelding werkgever is to inform the tax authorities about the employment of workers and to ensure correct withholding of payroll taxes.

What information must be reported on melding loonheffingen aanmelding werkgever?

Employers must report information such as company details, employee details, employment start date, and expected wages.

Fill out your melding loonheffingen aanmelding werkgever online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Melding Loonheffingen Aanmelding Werkgever is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.