Get the free Verification of Application for Federal Unsubsidized Loans Only - gtcc

Show details

This document is used to verify the application for federal unsubsidized loans and to clarify the student's intent regarding parental financial support information for financial aid purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verification of application for

Edit your verification of application for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verification of application for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing verification of application for online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit verification of application for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

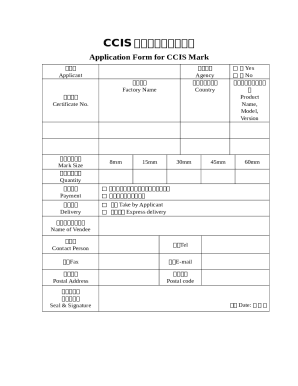

How to fill out verification of application for

How to fill out Verification of Application for Federal Unsubsidized Loans Only

01

Obtain the Verification of Application for Federal Unsubsidized Loans Only form from your school's financial aid office or website.

02

Fill out the personal information section, including your name, student ID, and contact information.

03

Provide financial information as requested, including income details for yourself and your parents if applicable.

04

Review any additional documentation needed, such as tax returns or W-2 forms, and gather them.

05

Complete the certification section by signing and dating the form to confirm that the information provided is accurate.

06

Submit the completed form and any required documents to your school’s financial aid office by the specified deadline.

Who needs Verification of Application for Federal Unsubsidized Loans Only?

01

Students applying for Federal Unsubsidized Loans who are required to verify their financial information before receiving aid.

02

Individuals who have discrepancies in their financial aid applications that need clarification for receiving loans.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't do FAFSA verification?

Some people are selected for verification at random; and some schools verify all students' FAFSA forms. All you need to do is provide the documentation your school asks for — and be sure to do so by the school's deadline, or you won't be able to get federal student aid.

What happens if you fail to meet the deadline for FAFSA verification?

If you miss the deadline to submit your information, it will delay the disbursement of your financial aid. In some cases, you might even lose your aid. Respond as quickly as you can! Make sure you submit the documents in the way the college asks for them (such as by mail, a secure portal or even email).

What is student loan verification?

Verification is the process of checking the accuracy of the information students provide when they apply for financial aid through the Free Ap- plication for Federal Student Aid (FAFSA), administered by the U.S. Department of Education.

What is better, a subsidized or unsubsidized loan?

Drawbacks of Unsubsidized Student Loans You're responsible for paying the interest on that loan from day one. Unsubsidized loans are not the worst loans you can borrow in terms of pure cost and the interest rate that you'll receive. However, the interest accumulates even before you enter repayment.

What is a federal unsubsidized loan?

Some of the documentation you may need to provide in the verification process for you and your parents (if applicable) are: Tax transcripts or tax returns showing income information filed with the IRS. W-2 forms or other documents showing money earned from work.

How many people get selected for FAFSA verification?

About 17% of FAFSA forms were selected for verification during the first three quarters of the 2021-2022 cycle, ing to a 2021 NCAN/National Association of Student Financial Aid Administrators report. The U.S. Department of Education set goals to decrease overall verification rates in recent years.

Why is my school asking for FAFSA verification?

Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you're selected for verification, your school will request additional documentation that supports the information you reported. Don't assume you're being accused of doing anything wrong.

Do you pay back unsubsidized loans?

unsubsidized loans add interest over the years that YOU have to pay for in the long run. subsidized loans add interest that the government pays for and you dont have to owe the interest back. basically, subsidized is much better.

What happens if you don't do FAFSA verification?

What happens if I don't complete FAFSA verification process? Your college can withhold your financial aid until you've completed the verification process. To avoid any delays in your financial aid, submit the information requested by your college as soon as you can.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Verification of Application for Federal Unsubsidized Loans Only?

Verification of Application for Federal Unsubsidized Loans Only is a process required by the U.S. Department of Education to confirm the accuracy of the information provided by a student when applying for federal unsubsidized loans. This process helps to ensure that the student is eligible for the loans they are requesting.

Who is required to file Verification of Application for Federal Unsubsidized Loans Only?

Students who are applying for federal unsubsidized loans and are selected for verification by their school or the U.S. Department of Education are required to file Verification of Application for Federal Unsubsidized Loans Only.

How to fill out Verification of Application for Federal Unsubsidized Loans Only?

To fill out Verification of Application for Federal Unsubsidized Loans Only, students should gather their financial documents, complete the necessary forms provided by their school, and ensure that all information is accurate and submitted by the school's deadline.

What is the purpose of Verification of Application for Federal Unsubsidized Loans Only?

The purpose of Verification of Application for Federal Unsubsidized Loans Only is to ensure the integrity of the financial aid process by confirming the accuracy of financial information submitted by students, thereby preventing fraud and ensuring that funds are allocated correctly.

What information must be reported on Verification of Application for Federal Unsubsidized Loans Only?

The information that must be reported on Verification of Application for Federal Unsubsidized Loans Only includes the student's income, family size, household resources, and any other financial information that accurately reflects the student's financial situation.

Fill out your verification of application for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verification Of Application For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.