ED IBR Plan Request 2013-2025 free printable template

Show details

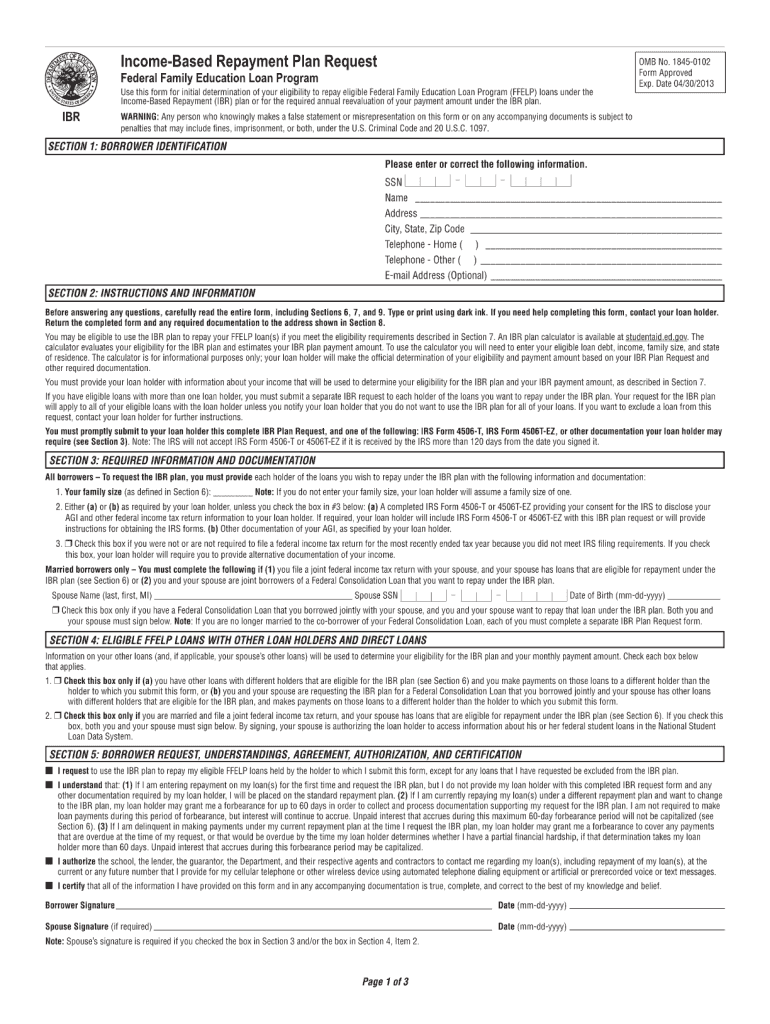

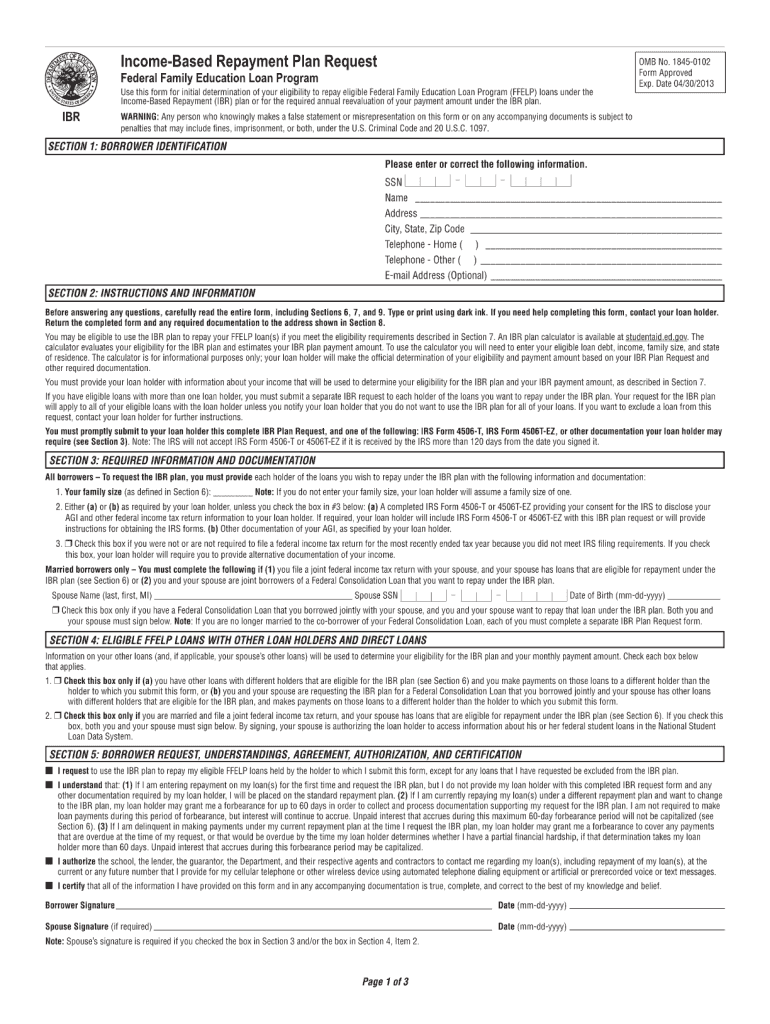

Income-Based Repayment Plan Request

Federal Family Education Loan Program IBR

Use this form for initial determination of your eligibility to repay eligible Federal Family Education Loan Program (FF

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign omb no 1845 0102 form

Edit your omb 1845 0102 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your omb no 1845 0102 fillable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing omb 1845 0102 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit omb 0102 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out omb no 1845 0102 fillable form

How to fill out ED IBR Plan Request

01

Begin by visiting the ED IBR Plan Request form on the official website.

02

Fill out your personal information in the designated sections, including name, address, and contact details.

03

Provide your income information, including sources and amounts.

04

Include details of any additional household members and their income if applicable.

05

Review the eligibility criteria to ensure you meet the requirements for the plan.

06

Attach any required documentation, such as proof of income or financial hardship.

07

Double-check all filled information for accuracy.

08

Submit the form online or print it out and send it to the appropriate address as indicated.

Who needs ED IBR Plan Request?

01

Individuals who are experiencing financial hardship and wish to apply for an Income-Based Repayment (IBR) plan for their federal student loans.

02

Borrowers who want to lower their monthly student loan payments based on their current income.

03

Those who are interested in qualifying for loan forgiveness programs that require an IBR agreement.

Fill

income driven repayment plan request omb no 1845 0102

: Try Risk Free

People Also Ask about

How long does an income based repayment plan take to process?

Depending on whether you applied electronically or submitted a paper request form and whether you've submitted all required documents, it may take your servicer a few weeks to process your request, because they will need to obtain documentation of your income and family size.

How long does it take to get approved for income-driven repayment?

These income-driven repayment (IDR) plans can make your monthly payment as little as 10 percent of your income. Despite the right to an IDR plan, borrowers still struggle to enroll. Generally, processing your IDR application should take no more than two weeks.

How long does it take to get IDR approved?

It usually takes about two weeks for your servicer to process an IDR application or recertification — however, some borrowers have experienced longer delays.

What is proof of income for IBR?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer. Signature: Your signature is your guarantee that all information is accurate.

How do I verify my income for IBR?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer. Signature: Your signature is your guarantee that all information is accurate.

Why don t my payments qualify for PSLF?

If you no longer work full-time for a qualifying employer or lost your job, your suspended payments will not count toward PSLF. But you don't lose your eligibility for PSLF entirely. If you later meet the qualifying employer and full-time status requirements, payments you make at that point will count toward PSLF.

What is proof of income for IDR?

Proof of income: You must submit your most recent tax return to show your updated income. If you don't have your tax return, you may submit alternative documentation, such as recent pay stubs or a letter from your employer. Signature: Your signature is your guarantee that all information is accurate.

What documents are needed for income-driven repayment?

Documentation will usually include a pay stub or letter from your employer listing your gross pay. Write on your documentation how often you receive the income, for example, “twice per month” or “every other week." • You must provide at least one piece of documentation for each source of taxable income.

What income qualifies for IDR?

Right now, the Education Department calculates IDR payments based on discretionary income — your household income minus 150% of the federal poverty guideline for your family size and location.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ED IBR Plan Request from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your ED IBR Plan Request into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send ED IBR Plan Request to be eSigned by others?

ED IBR Plan Request is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get ED IBR Plan Request?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ED IBR Plan Request in a matter of seconds. Open it right away and start customizing it using advanced editing features.

What is ED IBR Plan Request?

The ED IBR Plan Request is a formal submission that allows borrowers to request an Income-Based Repayment (IBR) plan for their federal student loans, taking into account their income and family size to determine the monthly payment.

Who is required to file ED IBR Plan Request?

Any borrower with federal student loans who wishes to change their repayment plan to an Income-Based Repayment option is required to file an ED IBR Plan Request.

How to fill out ED IBR Plan Request?

To fill out the ED IBR Plan Request, borrowers need to provide personal information including their name, Social Security number, income details, family size, and other loan-related information on the designated form available on the U.S. Department of Education website.

What is the purpose of ED IBR Plan Request?

The purpose of the ED IBR Plan Request is to facilitate access to income-driven repayment options for borrowers, helping them manage their student loan debt based on their financial situation.

What information must be reported on ED IBR Plan Request?

The information that must be reported on the ED IBR Plan Request includes the borrower's income (tax returns or pay stubs), family size, loan information, and any other relevant financial circumstances that affect their ability to pay.

Fill out your ED IBR Plan Request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ED IBR Plan Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.