Get the free Business Tax Record Book

Show details

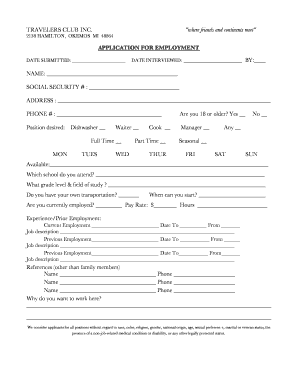

This document is designed to assist in organizing and accumulating information necessary for completing income tax returns accurately, while facilitating recordkeeping for deductions and credits according

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business tax record book

Edit your business tax record book form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business tax record book form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business tax record book online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business tax record book. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business tax record book

How to fill out Business Tax Record Book

01

Gather all necessary financial documents, including invoices, receipts, and transaction records.

02

Start by entering the date of each transaction in the appropriate section of the record book.

03

Record the details of each transaction, including the type of income or expense.

04

Enter the corresponding amounts for each transaction, separating income from expenses.

05

Include any relevant tax identification numbers, if required.

06

Review the entries for accuracy and ensure they match your financial documents.

07

Keep the record book updated regularly to avoid any backlog.

08

At the end of the fiscal year, summarize total income and expenses for tax reporting.

Who needs Business Tax Record Book?

01

Small business owners who report income and expenses for tax purposes.

02

Freelancers who need to track their business-related income and expenses.

03

Any self-employed individuals who must substantiate their income for tax returns.

04

Entrepreneurs who need to maintain clear financial records for future business planning.

05

Organizations and non-profits that report taxable activities.

Fill

form

: Try Risk Free

People Also Ask about

What is a book of record?

Creating a Book of Record (BOR) is an important part of any business. It serves as a record of all of the important documents, activities, and decisions that your company has made.

What is a company record book?

A Company Record Book is also called a “Corporate Record Book”. Simply, it is a book that houses your important company documents. In the old days, companies kept a three-ring binder with this important information. Today, it's common to house this information electronically.

What is a book for recording business records?

Business transactions are ordinarily summarized in books called journals and ledgers. You can buy them at your local stationery or office supply store. A journal is a book where you record each business transaction shown on your supporting documents.

What's the best way to store tax records?

If you prefer to keep hard copies of your tax records, the best way to store them is in a locked, fireproof safe with your other important documents. This ensures they are well-organized and ready for tax preparation.

What is a book used to record business transactions?

A journal is a book where you record each business transaction shown on your supporting documents. You may have to keep separate journals for transactions that occur frequently. A ledger is a book that contains the totals from all of your journals. It is organized into different accounts.

What is a record book in business?

A business record is a wri en evidence summarising a transac on carried out by a person in his business at a given me or over a given period. Business records are normally kept in books in an organised form. Business records can also be maintained in electronic format. Purpose of keeping Business Records.

What is the difference between book and tax?

Book Accounting: Accounting used on a company's audited financial statements. Balance Sheets (assets, liabilities and equity) and income statements should be reported using U.S. GAAP. Tax Accounting: Income and deductions reported on tax return in accordance with the rules in the I.R.C. and attending regulations.

What is a book of record for a business?

A Company Record Book is also called a “Corporate Record Book”. Simply, it is a book that houses your important company documents. In the old days, companies kept a three-ring binder with this important information. Today, it's common to house this information electronically.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business Tax Record Book?

A Business Tax Record Book is a document used by businesses to systematically record all financial transactions, income, and expenses for the purpose of tax reporting and compliance.

Who is required to file Business Tax Record Book?

Typically, all businesses that are required to file taxes, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, must maintain and file a Business Tax Record Book.

How to fill out Business Tax Record Book?

To fill out a Business Tax Record Book, businesses should enter each financial transaction in chronological order, categorizing income and expenses, and ensuring that all required documentation and receipts are kept for verification.

What is the purpose of Business Tax Record Book?

The purpose of a Business Tax Record Book is to provide an accurate and organized record of financial activity, which aids in tax filing, financial analysis, and compliance with tax laws.

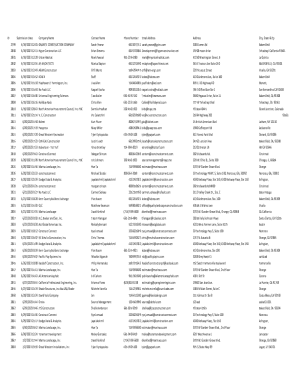

What information must be reported on Business Tax Record Book?

The information that must be reported includes dates of transactions, details of income and expenses, amounts, and categories of transactions, along with supporting documentation such as invoices and receipts.

Fill out your business tax record book online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Tax Record Book is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.