Get the free Expense Report - nga

Show details

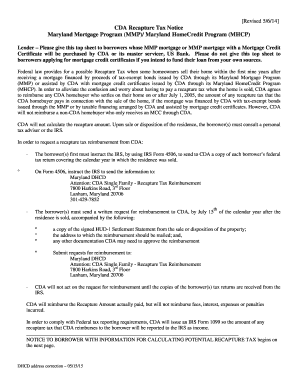

This document outlines the reimbursement procedures, lodging, transportation, meals, and non-reimbursable expenses related to the meeting titled 'Balancing Agriculture Interests with Youth Tobacco

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign expense report - nga

Edit your expense report - nga form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your expense report - nga form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing expense report - nga online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit expense report - nga. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out expense report - nga

How to fill out Expense Report

01

Gather all receipts and relevant expense documentation.

02

Open the Expense Report form provided by your organization.

03

Fill in your personal information, including name, department, and date.

04

List each expense in the designated fields, including the date, description, and amount.

05

Attach scanned copies or images of receipts as required.

06

Review the completed report for accuracy and ensure all expenses are accounted for.

07

Submit the Expense Report to your supervisor or designated approver.

Who needs Expense Report?

01

Employees who incur business-related expenses during work activities.

02

Freelancers or contractors working on behalf of an organization.

03

Finance department personnel who need to track and manage reimbursements.

04

Management staff who require oversight of employee expenses.

Fill

form

: Try Risk Free

People Also Ask about

How do you write an expense report?

6 Steps To Create An Expense Report Choose a Template (or Software) To make an expense report, you should use either a template or expense-tracking software. Edit the Columns. Add Itemized Expenses. Add up the Total. Attach Receipts, If Necessary. Print or Send the Report.

How do I make a simple expense report?

In short, the steps to create an expense sheet are: Choose a template or expense-tracking software. Edit the columns and categories (such as rent or mileage) as needed. Add itemized expenses with costs. Add up the total. Attach or save your corresponding receipts. Print or email the report.

Is an expense report an invoice?

An invoice is a request for payment from an external vendor or contractor. An expense report, on the other hand, is submitted by an employee to get reimbursed for business costs they've already paid out-of-pocket.

What is the basic expense report?

An expense report template should include key details to ensure accurate reimbursement and reporting. These typically include the date, description, and category of each expense; a subtotal; any advances received; and the total reimbursement amount.

What is an expense report?

An expense report is a form that tracks your business's spending. In small businesses, expense reports are used when employees pay out-of-pocket for business expenses. Taxes are a large reason why small businesses need to use expense reports. Expense reports are crucial for helping track work-related expenditures.

How to fill out an expense report?

How to Fill Out an Expense Report: A Step-by-Step Guide Step 1: Gather All Your Receipts and Records. Step 2: Choose the Correct Expense Report Form or Template. Step 3: Fill in Your Personal and Report Information. Step 4: Itemize Each Expense Line by Line. Step 5: Calculate Totals and Apply Any Cash Advances.

What is an example of an expense report?

Some examples include meal expenses, travel expenses, car rentals, lodging, office supplies, or even mileage when an employee uses their vehicle for business travel. Since these expenses are incurred on behalf of the organization, employees can request expense reimbursements from the business.

What is a T&E report?

T&E stands for "travel and entertainment" and is a category of business expenses that an employee incurs while conducting business, either locally or away from their tax home.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Expense Report?

An Expense Report is a document used by employees to itemize and report business-related expenses incurred during the course of their work.

Who is required to file Expense Report?

Typically, employees who incur expenses while performing their job duties are required to file an Expense Report for reimbursement.

How to fill out Expense Report?

To fill out an Expense Report, gather all receipts, itemize expenses with dates, categories, amounts, and provide any necessary explanations. Submit the completed report along with receipts to the designated approver.

What is the purpose of Expense Report?

The purpose of an Expense Report is to document and seek reimbursement for business expenditures, ensuring that employees are compensated for costs incurred during work.

What information must be reported on Expense Report?

An Expense Report must include information such as the date of the expense, type/category of expense, amount spent, purpose of the expense, and any supporting documentation like receipts.

Fill out your expense report - nga online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Expense Report - Nga is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.