Get the free Two-Part Basic Agent Flood Insurance Webinar - floods

Show details

This document provides information regarding a two-part basic agent flood insurance webinar sponsored by the National Flood Insurance Program, detailing session schedules, registration information,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign two-part basic agent flood

Edit your two-part basic agent flood form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your two-part basic agent flood form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit two-part basic agent flood online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit two-part basic agent flood. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out two-part basic agent flood

How to fill out Two-Part Basic Agent Flood Insurance Webinar

01

Visit the registration website for the Two-Part Basic Agent Flood Insurance Webinar.

02

Fill out the required personal information fields, such as name, email address, and phone number.

03

Select your preferred session dates and times from the available options.

04

Complete any additional questions regarding your experience and background in flood insurance.

05

Review your entries for accuracy and completeness.

06

Submit the registration form.

07

Look out for a confirmation email with further details and instructions.

Who needs Two-Part Basic Agent Flood Insurance Webinar?

01

Real estate agents looking to enhance their knowledge of flood insurance.

02

Insurance agents who want to understand the basics of flood insurance.

03

Any professional involved in property transactions in flood-prone areas.

04

Homeowners seeking to learn more about their flood insurance options.

Fill

form

: Try Risk Free

People Also Ask about

Who would participate in a right your own flood insurance program?

The Write Your Own (WYO) Program, established in 1983, is a partnership between FEMA and private property and casualty insurers. It allows participating companies to issue and service Standard Flood Insurance Policies (SFIPs) under their own names.

What is the best flood insurance company?

Best flood insurance companies Best NFIP flood insurance: Amica. Best for Florida residents: Kin. Best for low rates: Aon Edge. Best for pools and basements: Neptune. Best for contents coverage: Beyond Floods. Best for customization: Wright Flood. Best for high-value homes: Chubb.

What is the minimum flood insurance requirement?

NFIP guidelines state you must have at least equal to the lesser of the outstanding principal balance of the loan, the Replacement Cost Value of the home (RCV) or the maximum NFIP limit of $250,000.

What are the four components of the National Flood Insurance Program?

The NFIP is funded from (1) premiums, fees, and surcharges paid by NFIP policyholders; (2) direct annual appropriations for flood hazard mapping and risk analysis program); (3) borrowing from the Treasury when the balance of the National Flood Insurance Fund is insufficient to pay the NFIP's obligations (e.g.,

What must the minimum flood insurance coverage equal?

The amount of coverage must at least equal the total project cost or the maximum coverage limit of the National Flood Insurance Program, whichever is less. If the community is not participating, or if its participation has been suspended, federal assistance may not be used for projects in the Special Flood Hazard Area.

What is a standard flood insurance policy?

A Standard Flood Insurance Policy is a single-peril (flood) policy that pays for direct physical damage to your insured property up to the replacement cost or Actual Cash Value (ACV) (See “How Flood Damages Are Valued”) of the actual damages or the policy limit of liability, whichever is less.

What is the minimum deductible for flood insurance?

NFIP flood insurance deductibles For these types of buildings, the NFIP has minimum deductibles based on building coverage: $1,000 minimum for $100,000 or less in coverage and $1,250 for more than $100,000 of coverage. As this table shows, discount rates can depend on your deductible.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Two-Part Basic Agent Flood Insurance Webinar?

The Two-Part Basic Agent Flood Insurance Webinar is an instructional seminar designed to educate insurance agents about the key principles and requirements of flood insurance underwriting and policy management.

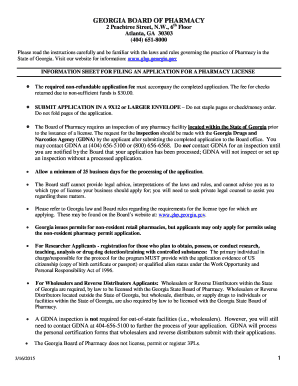

Who is required to file Two-Part Basic Agent Flood Insurance Webinar?

Insurance agents who are seeking to become certified or maintain their certification for writing flood insurance policies are required to attend and file the Two-Part Basic Agent Flood Insurance Webinar.

How to fill out Two-Part Basic Agent Flood Insurance Webinar?

To fill out the Two-Part Basic Agent Flood Insurance Webinar, participants should complete the registration form provided at the beginning of the webinar and ensure that they answer all session-related questions and provide necessary documentation as instructed.

What is the purpose of Two-Part Basic Agent Flood Insurance Webinar?

The purpose of the Two-Part Basic Agent Flood Insurance Webinar is to provide agents with a comprehensive understanding of flood insurance policies, including coverage options, pricing, and compliance with federal regulations.

What information must be reported on Two-Part Basic Agent Flood Insurance Webinar?

Participants must report their attendance, any assessments taken during the webinar, and additional feedback or inquiries related to the material covered in the sessions.

Fill out your two-part basic agent flood online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Two-Part Basic Agent Flood is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.