Get the free Health Savings Account (HSA) Rollover or Transfer Request Form - sscc

Show details

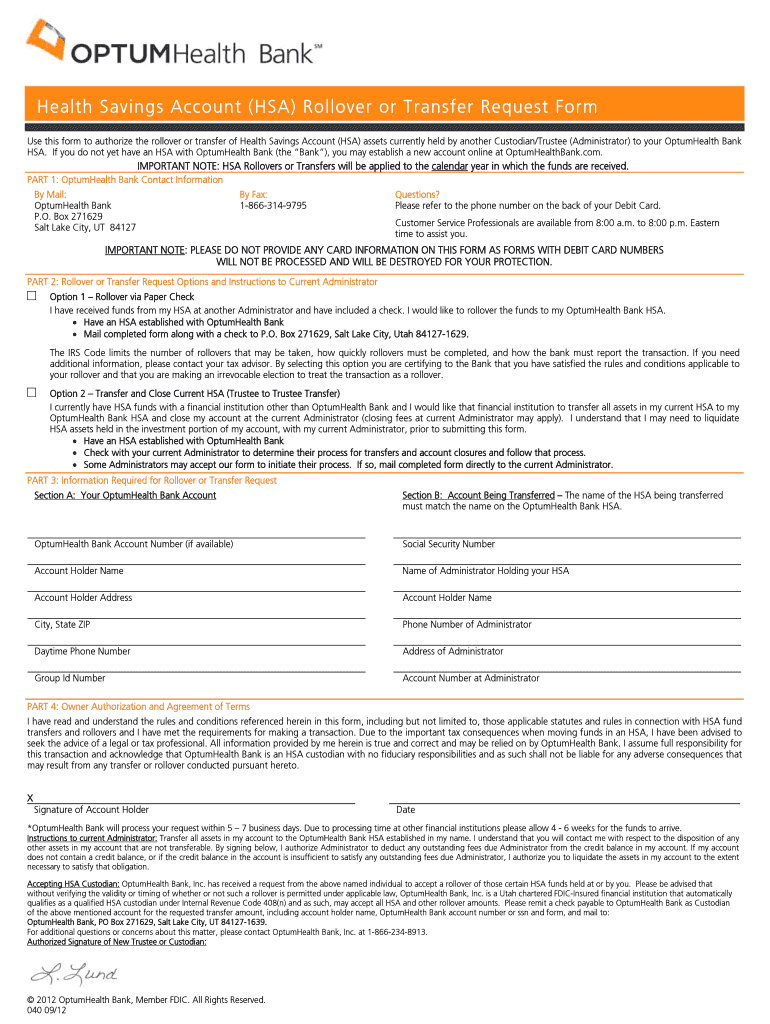

This form is used to authorize the rollover or transfer of Health Savings Account (HSA) assets from another Custodian/Trustee to OptumHealth Bank HSA.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health savings account hsa

Edit your health savings account hsa form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health savings account hsa form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health savings account hsa online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit health savings account hsa. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health savings account hsa

How to fill out Health Savings Account (HSA) Rollover or Transfer Request Form

01

Obtain the Health Savings Account (HSA) Rollover or Transfer Request Form from your HSA provider.

02

Fill in your personal information, including your name, address, and HSA account number.

03

Specify the type of transaction you are requesting (either a rollover or a transfer).

04

If transferring, include the information for the current HSA provider, including their name and contact details.

05

If rolling over funds, provide details on the account you are moving the funds from.

06

Sign and date the form to authorize the transaction.

07

Submit the completed form to your HSA provider by mail, fax, or online submission as instructed.

Who needs Health Savings Account (HSA) Rollover or Transfer Request Form?

01

Individuals who want to transfer their HSA funds from one account to another.

02

People who have received a distribution from their HSA and want to roll it over into another HSA.

03

Those changing employers and moving their HSA to a new provider.

Fill

form

: Try Risk Free

People Also Ask about

Is HSA a rollover or transfer?

Once you've had an HSA-eligible health plan and opened an HSA, the money in it is yours to keep and do with as you please (within plan and IRS rules), including transferring it to a new HSA at a different provider through what's called an HSA rollover.

How do I get my HSA form?

There are two sets of tax forms: Your annual tax Form 1099 will be mailed to the address on file by January 31 each year. Your annual tax Form 5498 will be mailed to the address on file by May 31 each year.

How to transfer funds out of HSA bank?

Online Transfer – On HSA Bank's Member Website, you can transfer funds from your HSA to an external bank account, such as a personal checking or savings account. There is a daily transfer limit of $2,500 to safeguard against fraudulent activity.

Is HSA or FSA rollover?

HSA: You have a big advantage here. With an HSA, your money rolls over every year. And it's always yours, even if you switch jobs. FSA: Use it within the year, or you might lose it.

Does health equity HSA roll over?

Roll over funds Unlike Flexible Spending Accounts (FSA), you own your HSA. That means your entire balance rolls over every year — even if you change health plans, retire, or leave your employer.

How to request HSA rollover?

The easiest and most secure way to start an HSA rollover is by contacting your current HSA provider. This might be a bank, mutual fund company or another financial institution. If your HSA was set up through your employer, the benefits department can direct you to the right contact.

Does HSA roll over to a new employer?

Key takeaways. Your HSA is yours even if you leave the employer sponsoring your plan. When changing jobs, you can consolidate your old HSA into a new HSA offered by your next employer, keep your old HSA, or roll over to a new HSA under a different financial services firm.

Is a HSA a transfer or rollover?

It differs from transfers in that your HSA provider sends your current HSA funds to you and not directly to your new HSA provider. That means the IRS views a rollover as a distribution from your account and you must deposit the money received in a new HSA within 60 days to avoid paying a 20% penalty and income taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Health Savings Account (HSA) Rollover or Transfer Request Form?

The Health Savings Account (HSA) Rollover or Transfer Request Form is a document used to initiate the transfer of funds from one HSA to another or to withdraw funds from an HSA account in a tax-free manner.

Who is required to file Health Savings Account (HSA) Rollover or Transfer Request Form?

Individuals who wish to move their funds from one HSA to another or those who are transferring funds from an HSA to another qualified account are required to file this form.

How to fill out Health Savings Account (HSA) Rollover or Transfer Request Form?

To fill out the form, provide personal details, account information for both the originating and receiving HSAs, and specify the amount to be rolled over or transferred. Follow the provided instructions carefully.

What is the purpose of Health Savings Account (HSA) Rollover or Transfer Request Form?

The purpose of the form is to facilitate the tax-free transfer of HSA funds to ensure that the account holder can maintain or consolidate their HSA assets without triggering tax penalties.

What information must be reported on Health Savings Account (HSA) Rollover or Transfer Request Form?

The form must include the account holder's personal information, details of the current HSA, details of the new HSA, and the amount being rolled over or transferred.

Fill out your health savings account hsa online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Savings Account Hsa is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.