Get the free FINANCIAL DOCUMENTS: What To Keep And What To Discard

Show details

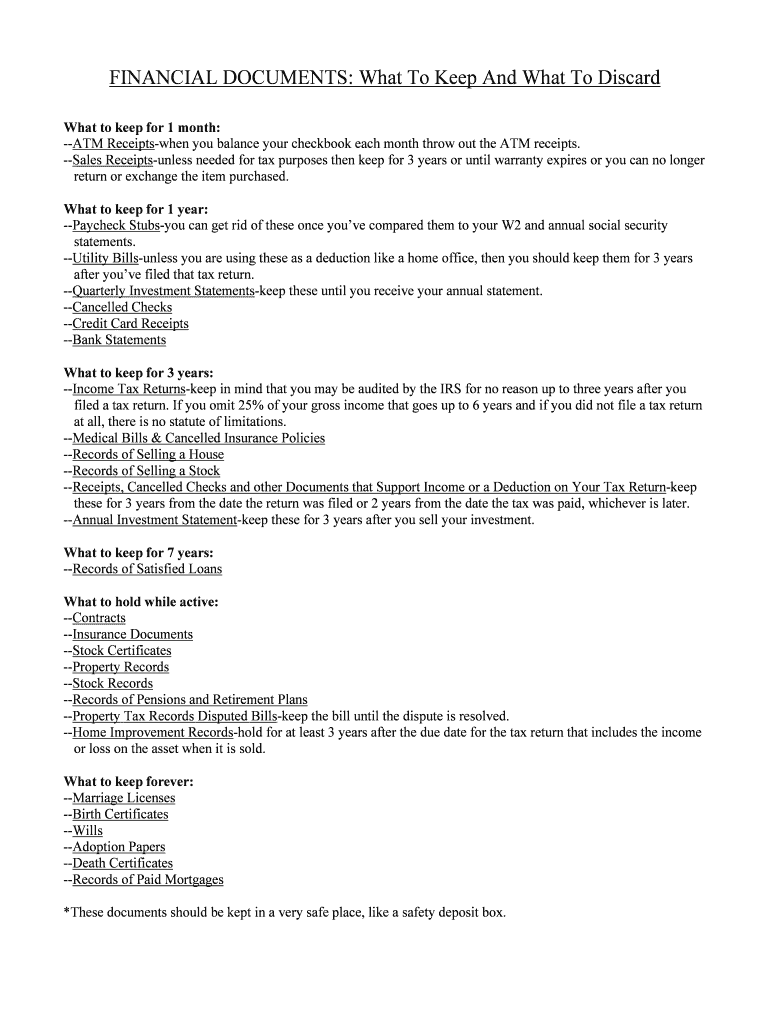

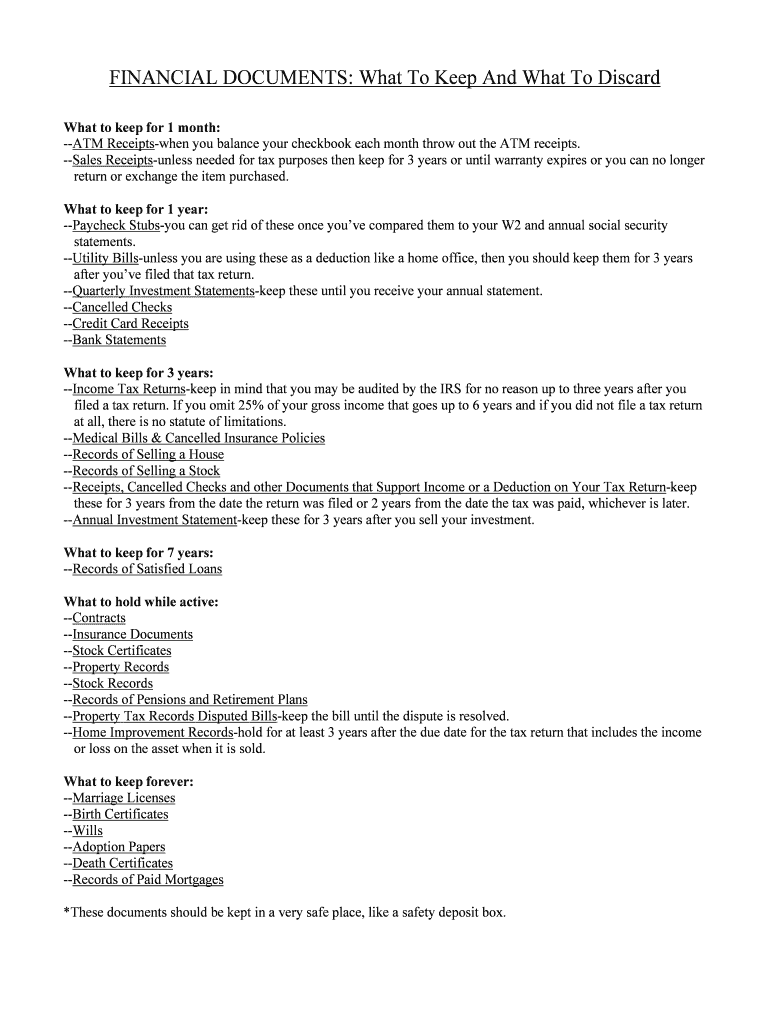

FINANCIAL DOCUMENTS: What To Keep And What To Discard

What to keep for 1 month:

ATM Receipts when you balance your checkbook each month throw out the ATM receipts.

Sales Receipt sunless needed for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial documents what to

Edit your financial documents what to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial documents what to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial documents what to online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial documents what to. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial documents what to

Point by Point: How to Fill Out Financial Documents & Who Needs Them

Understand the purpose:

01

Financial documents serve as a record of financial transactions, income, expenses, and assets.

02

They provide valuable information for various purposes like financial analysis, tax reporting, loan applications, or investment decisions.

Identify the necessary financial documents:

01

Common financial documents include income statements, balance sheets, cash flow statements, tax returns, bank statements, and expense reports.

02

Specific documents required may vary depending on the purpose and the entity requesting them.

Gather the required information:

01

Collect accurate and detailed information about your financial transactions, income sources, expenses, assets, and liabilities.

02

Ensure you have supporting documents like receipts, invoices, bank statements, and investment statements for verification.

Decide on the appropriate format:

01

Determine whether you need to submit physical copies of the documents or if digital formats are acceptable.

02

If submitting digitally, choose a compatible file format such as PDF or Excel, and ensure the files are properly named and organized.

Fill out the financial documents:

01

Begin by identifying the specific sections or fields within each document that require your input.

02

Enter the relevant information carefully, ensuring accuracy and consistency throughout.

03

Follow any specific instructions provided, such as providing explanations or supporting documentation for certain entries.

Review and verify the information:

01

Double-check all the entries made in the financial documents for accuracy and completeness.

02

Verify calculations, reconcile balances, and ensure that all relevant information has been included.

03

Mistakes or omissions may lead to inaccurate financial reporting, penalties, or delays in processing.

Seek professional assistance if needed:

01

If you are unsure about any aspect of filling out the financial documents or if they involve complex financial matters, consider consulting a financial advisor or an accountant.

02

They can provide guidance, review your financial documents, and ensure compliance with relevant regulations and standards.

Who needs financial documents and why:

01

Individuals: Financial documents are essential for individuals when applying for loans, mortgages, or credit cards. They also help in preparing tax returns, tracking personal finances, and making informed financial decisions.

02

Businesses: Financial documents are crucial for businesses in managing cash flow, preparing financial statements, attracting investors, and meeting regulatory requirements. They enable monitoring of income, expenses, and profitability, aiding in strategic planning and decision-making.

03

Investors: Financial documents provide investors with valuable insights into the financial health and performance of companies. They help assess risks, evaluate investment opportunities, and determine a company's ability to generate returns.

04

Government agencies: Financial documents are required by government agencies for taxation, auditing, and regulatory compliance purposes. They facilitate monitoring and ensuring transparency in financial activities, both for individuals and businesses.

Remember, it's important to periodically update and maintain your financial documents to reflect any changes in your financial situation or business operations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial documents what to in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your financial documents what to and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send financial documents what to for eSignature?

financial documents what to is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in financial documents what to without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your financial documents what to, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is financial documents what to?

Financial documents are records that outline the financial activities of a business or individual, such as balance sheets, income statements, and cash flow statements.

Who is required to file financial documents what to?

Businesses, individuals, and organizations are required to file financial documents in order to report their financial activities to relevant authorities.

How to fill out financial documents what to?

Financial documents can be filled out manually or using accounting software, following the specific guidelines and requirements set by regulatory bodies.

What is the purpose of financial documents what to?

Financial documents provide an accurate and transparent overview of an entity's financial health and performance, helping stakeholders make informed decisions.

What information must be reported on financial documents what to?

Financial documents typically include information on revenues, expenses, assets, liabilities, and equity of the entity.

Fill out your financial documents what to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Documents What To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.