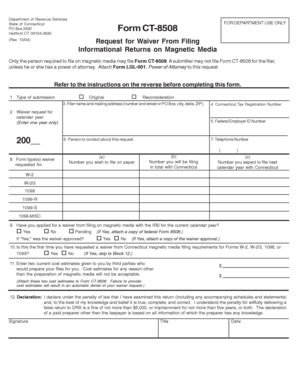

Get the free MODEL INSURANCE FRAUD BUREAU ACT - insurancefraud

Show details

This document outlines a model legislation aimed at establishing a framework for insurance fraud bureaus, detailing their purpose, definitions of insurance fraud, duties, powers, funding mechanisms,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign model insurance fraud bureau

Edit your model insurance fraud bureau form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your model insurance fraud bureau form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit model insurance fraud bureau online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit model insurance fraud bureau. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out model insurance fraud bureau

How to fill out MODEL INSURANCE FRAUD BUREAU ACT

01

Gather necessary information: Collect all relevant documents and data related to the insurance claim.

02

Identify the reporting agency: Determine which insurance fraud bureau the submission needs to be directed to.

03

Fill out the required forms: Complete all forms accurately with the required information, ensuring clarity and precision.

04

Provide supporting evidence: Attach any documents or evidence that support the claim of fraud, such as photographs, witness statements, or policy details.

05

Review the submission: Double-check all information for accuracy and completeness before submission.

06

Submit the report: Send the completed forms and supporting documentation to the appropriate insurance fraud bureau either via mail or electronically as required.

07

Keep a record: Retain copies of all submitted documents and correspondence for future reference.

Who needs MODEL INSURANCE FRAUD BUREAU ACT?

01

Insurance companies and their agents who suspect fraud.

02

Policyholders who have fallen victim to fraud and need to report it.

03

Regulatory authorities involved in monitoring and investigating insurance fraud.

04

Legal professionals working on insurance fraud cases.

Fill

form

: Try Risk Free

People Also Ask about

What is the process of insurance fraud investigation?

The steps of an insurance fraud investigation typically involve initial detection and identification of potential fraud indicators, followed by thorough interviews, gathering of evidence, including activity checks, social media scrutiny, and scrutiny of documentation, ensuring adherence to legal and procedural

What is the primary role of the insurance fraud bureau?

What we do. We use a wide range of data and intelligence to achieve two primary objectives: Help insurers identify fraud and avoid the financial consequences. Support police, regulators and other law enforcement agencies in finding fraudsters and bringing them to justice.

What three elements must be present to be considered insurance fraud?

Typical Elements for Insurance Fraud The accused knowingly made a false or misleading statement, and it was done with intent to deceive; The false statement was made in connection with an application, claim, or payment; and. The false statement had an impact on the outcome of the application or claim.

What is the role of the insurance fraud Bureau?

What we do. We use a wide range of data and intelligence to achieve two primary objectives: Help insurers identify fraud and avoid the financial consequences. Support police, regulators and other law enforcement agencies in finding fraudsters and bringing them to justice.

Who investigates insurance fraud?

The FBI investigates these crimes in partnership with: Federal, state, and local agencies. Healthcare Fraud Prevention Partnership. Insurance groups such as the National Health Care Anti-Fraud Association, the National Insurance Crime Bureau, and insurance investigative units.

What does the IFB do?

Raising awareness, protecting the public and reporting to Cheatline. One of the IFB's priorities is to raise public awareness of insurance fraud, encouraging reports to its Cheatline service and helping the public to identify the signs of potential fraud.

What are the techniques used in insurance fraud detection?

Artificial intelligence is one of the key tools used in insurance fraud detection. It is based on the use of algorithms that can identify patterns specific to fraudulent activity. AI helps humans review large amounts of data more efficiently, allowing them to identify potential fraudsters before they cause any damage.

What is the role of investigation in insurance fraud?

Insurance companies often conduct claims investigations to evaluate the legitimacy of a claim. The investigation process helps the claims adjuster make an educated decision about how to proceed with a claim. Insurance claims investigations are used to combat the prevalence of false or inflated claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MODEL INSURANCE FRAUD BUREAU ACT?

The Model Insurance Fraud Bureau Act is a legislative framework designed to address and combat insurance fraud by establishing guidelines for the reporting and investigation of fraudulent activities within the insurance industry.

Who is required to file MODEL INSURANCE FRAUD BUREAU ACT?

Insurance companies, agents, and other entities engaged in the insurance business are required to file under the Model Insurance Fraud Bureau Act.

How to fill out MODEL INSURANCE FRAUD BUREAU ACT?

To fill out the Model Insurance Fraud Bureau Act, entities must provide detailed information about suspected fraudulent activities, including the nature of the fraud, involved parties, and supporting evidence as required by the specific provisions of the act.

What is the purpose of MODEL INSURANCE FRAUD BUREAU ACT?

The purpose of the Model Insurance Fraud Bureau Act is to enhance the detection, prevention, and prosecution of insurance fraud, thereby protecting consumers and ensuring the integrity of the insurance system.

What information must be reported on MODEL INSURANCE FRAUD BUREAU ACT?

The information that must be reported includes details about the fraudulent act, affected insurance policies, involved individuals or entities, dates of incidents, and any relevant documentation or evidence that supports the suspicion of fraud.

Fill out your model insurance fraud bureau online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Model Insurance Fraud Bureau is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.