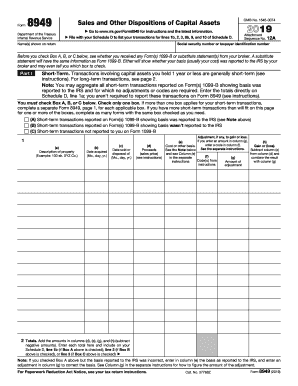

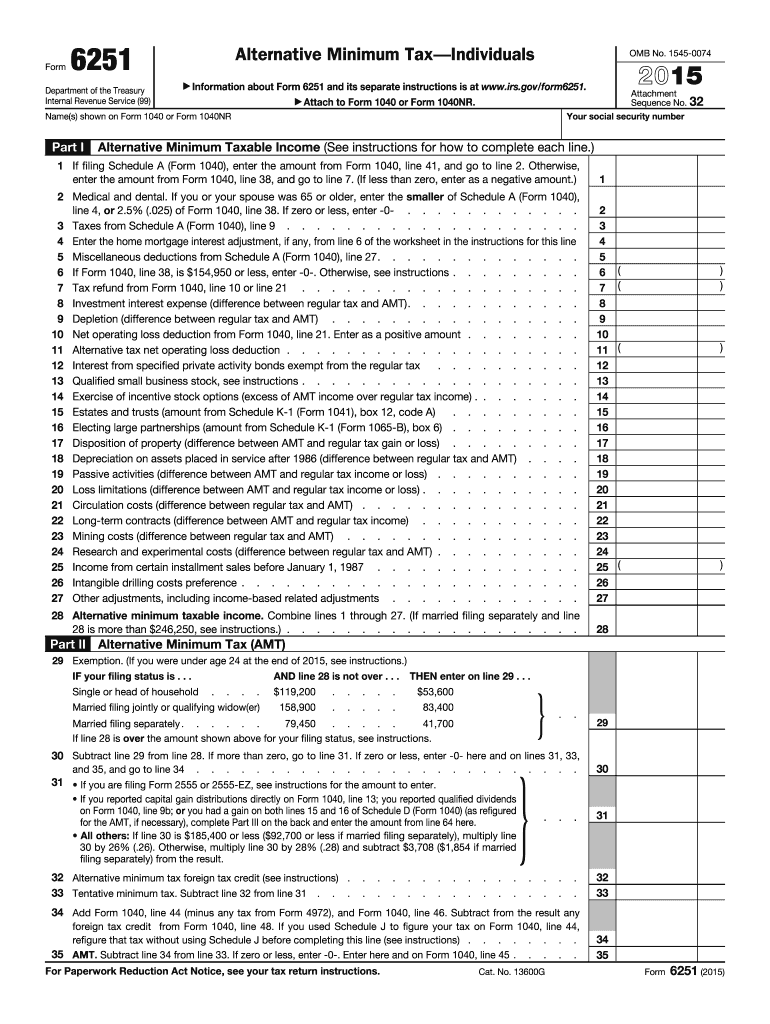

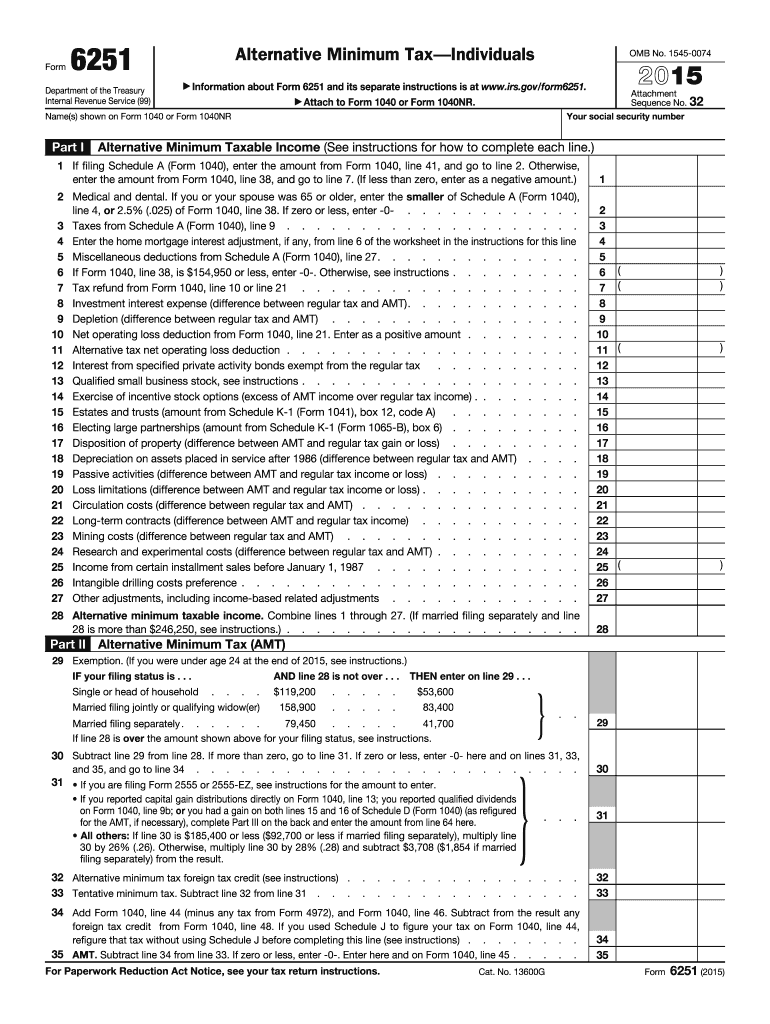

IRS 6251 2015 free printable template

Show details

Extent: v. Note. Cat. No. 13600.” Description based on: 2005; title from title screen (viewed on Aug. 18, 2006). Link http://purl.access.gpo.gov/GPO/ LPS73210.

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 6251

Edit your IRS 6251 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 6251 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 6251 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IRS 6251. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 6251 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 6251

How to fill out IRS 6251

01

Download IRS Form 6251 from the IRS website.

02

Fill in your name, Social Security number, and other personal information at the top of the form.

03

Determine your adjusted gross income (AGI) and enter it on the form.

04

Identify any tax preferences and adjustments that apply to you from the list provided in the instructions.

05

Complete each section of the form by carefully following the guidance provided for preferences and adjustments.

06

Calculate your alternative minimum taxable income (AMTI).

07

Determine your alternative minimum tax (AMT) liability using the provided tax rates.

08

Complete the bottom section of the form which may involve additional credits.

09

Double-check your calculations and ensure all entries are accurate.

10

Submit the completed form along with your federal tax return.

Who needs IRS 6251?

01

Individuals who have a high adjusted gross income.

02

Taxpayers who claim certain deductions or credits that may trigger AMT.

03

People with large amounts of income from tax-exempt interest.

04

Taxpayers benefiting from specific tax preference items.

Fill

form

: Try Risk Free

People Also Ask about

How can I avoid paying alternative minimum tax?

A good strategy for minimizing your AMT liability is to keep your adjusted gross income (AGI) as low as possible. Some options: Participate in a 401(k), 403(b), SARSEP, 457(b) plan, or SIMPLE IRA by making the maximum allowable salary deferral contributions.

How do I know if I need to file Form 6251?

3. You may need to file Form 6251 if you have specific AMT items. If you need to report any of the following items on your tax return, you must file Form 6251, Alternative Minimum Tax, even if you do not owe AMT. Home mortgage interest on a loan that you did not use to buy, build or improve your home.

Do I need to include Form 6251?

You may need to file Form 6251 if you have specific AMT items. If you need to report any of the following items on your tax return, you must file Form 6251, Alternative Minimum Tax, even if you do not owe AMT. Home mortgage interest on a loan that you did not use to buy, build or improve your home.

How much does it cost to trigger AMT?

Note. The AMT exemption begins to disappear and phase out after you reach a certain income level. But these are very high thresholds: $539,900 for single filers and $1,079,800 for married taxpayers of joint returns as of 2022.

Who needs to calculate alternative minimum tax?

The Alternative Minimum Tax (AMT) is triggered when taxpayers have more income than an exemption amount and they make use of many common itemized deductions. You must calculate your tax twice if your income is greater than the AMT exemption.

What is Form 6251 on tax return?

Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT). The AMT applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

Is Form 6251 required?

You're not required to sign Form 6251. Just be sure to include it when you file your tax return if your income was over the thresholds detailed above.

What is AMT adjustment to investment income?

Investment interest: The difference between the regular tax deduction for investment interest and the AMT deduction for investment interest is an AMT adjustment. For regular tax purposes, an individual taxpayer can deduct investment interest to the extent of his or her net investment income.

What are AMT adjustments and preferences?

The AMT starts with regular taxable income and applies its own system of “adjustments” and “preferences.” These are calculations that add more income to or remove deductions from regular taxable income to arrive at alternative minimum taxable income (AMTI).

Do I have to calculate alternative minimum tax?

Who Has To Pay the AMT? You only have to concern yourself with the AMT if your adjusted gross income (AGI) exceeds the exemption for your filing status. You would then have to calculate your alternative minimum taxable income and pay the higher tax.

How do I know if I need to file AMT?

These are some of the most likely situations: Having a high household income. If your household income is over the phase-out thresholds ($1,079,800 for married filing jointly and $539,900 for everyone else), and you have a significant amount of itemized deductions, the AMT could still affect you.

How do I know if I need to make an AMT adjustment to my investment income or expenses?

To figure out whether you owe any additional tax under the Alternative Minimum Tax system, you need to fill out Form 6251. If the tax calculated on Form 6251 is higher than that calculated on your regular tax return, you have to pay the difference as AMT in addition to the regularly calculated income tax.

Do I need to file IRS Form 6251?

Only people with taxable incomes that exceed certain income levels, and taxpayers who claimed some uncommon tax deductions, are required to complete this form and pay the AMT.

Where do I find my alternative minimum tax?

To find out if you may be subject to the AMT, refer to the Alternative Minimum Tax (AMT) line instructions in the Instructions for Form 1040 (and Form 1040-SR). If subject to the AMT, you may be required to complete and attach Form 6251, Alternative Minimum Tax – Individuals.

Who should use Form 6251?

Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT). The AMT is a separate tax that is imposed in addition to your regular tax. It applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

Which of the following might trigger alternative minimum tax?

Some of the income that might trigger the alternative minimum tax include the following: Fair market value of incentive stock options that were exercised but not sold. Interest earned from private activity bonds. Foreign tax credits.

Who needs to fill Form 6251?

More In Forms and Instructions Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT). The AMT applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my IRS 6251 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign IRS 6251 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I make changes in IRS 6251?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your IRS 6251 and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I fill out IRS 6251 on an Android device?

Use the pdfFiller Android app to finish your IRS 6251 and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

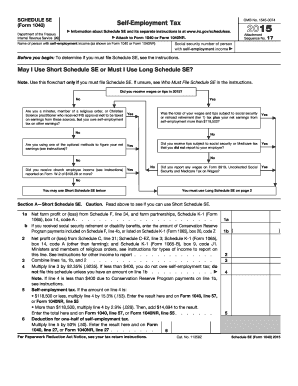

What is IRS 6251?

IRS Form 6251 is used to calculate the alternative minimum tax (AMT) for individuals. It ensures that high-income individuals pay a minimum amount of tax by eliminating certain deductions and credits.

Who is required to file IRS 6251?

Taxpayers who have an alternative minimum tax liability, which can be triggered by having a higher income, certain deductions, or specific tax credits, are required to file IRS Form 6251.

How to fill out IRS 6251?

To fill out IRS Form 6251, start by entering your income, then adjust for any applicable deductions and tax credits. Follow the form's instructions to calculate the AMT and compare it to your regular tax to determine if you owe AMT.

What is the purpose of IRS 6251?

The purpose of IRS Form 6251 is to assess alternative minimum tax, ensuring that taxpayers with higher incomes pay at least the minimum amount of tax despite deductions and credits they may claim.

What information must be reported on IRS 6251?

Information reported on IRS Form 6251 includes your total income, adjustments to income, allowed deductions, and tax credits. You also report any AMT adjustments based on specific items that may influence your tax calculation.

Fill out your IRS 6251 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 6251 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.