Get the free Financial Statements and Independent Auditors' Reports - ecusd7

Show details

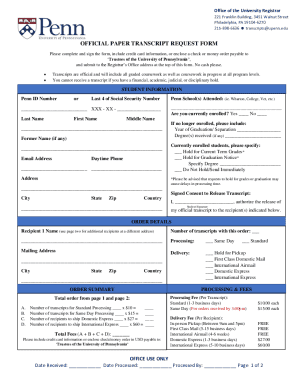

This document outlines the financial statements and independent auditor's reports for the Edwardsville Community Unit School District No.7 as of June 30, 2012, including supplementary information

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements and independent

Edit your financial statements and independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements and independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit financial statements and independent online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit financial statements and independent. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements and independent

How to fill out Financial Statements and Independent Auditors' Reports

01

Gather all relevant financial data including income, expenses, assets, and liabilities.

02

Choose the appropriate financial statement format (e.g., balance sheet, income statement, cash flow statement).

03

Fill out the income statement by listing revenues and expenses to determine net income.

04

Create the balance sheet by organizing assets, liabilities, and equity into appropriate categories.

05

Compile the cash flow statement by categorizing cash inflows and outflows from operating, investing, and financing activities.

06

Review for accuracy and ensure all calculations are correct.

07

Prepare the Independent Auditors' Report by summarizing the audit process and expressing an opinion on the financial statements.

08

Include any necessary disclosures and notes to clarify any aspects of the financial statements.

09

Finalize the reports and have them signed off by appropriate parties.

Who needs Financial Statements and Independent Auditors' Reports?

01

Businesses for internal management and strategic planning.

02

Investors to assess potential returns and risks.

03

Lenders for determining creditworthiness and loan eligibility.

04

Regulatory bodies for compliance with laws and regulations.

05

Potential buyers during mergers or acquisitions.

06

Stakeholders for transparency and accountability.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 C's of audit report writing?

As a guide for what details to include in the audit report, use the five “C's” of recording observations: criteria, condition, cause, consequence, and corrective action plans (or recommendations).

What is an independent auditor's report?

An independent Auditor's Report is an official opinion issued by an external or internal auditor as to the quality and accuracy of the financial statements prepared by a company.

What are the 4 C's of audit report writing?

We've always believed that boards should ensure that their organizations maximize the full potential of internal audit. This issue of Board Perspectives discusses the four C's directors should consider when evaluating the sufficiency of any risk-based audit plan: culture, competitiveness, compliance and cybersecurity.

What are the 5 principles of audit?

The fundamental principles are: integrity, objectivity, professional competence and due care, confidentiality, and professional behaviour.

What are the 5 C's of an audit report?

The 5 C's framework can help ensure that internal audit reports are comprehensive, clear, concise, consistent, and constructive.

What are the 5c of report writing?

For reports to help your team in any situation, they have to be clear, concise, complete, consistent, and courteous.

What are the 4 types of audit report?

There are four types of audit opinions: unqualified, qualified, adverse, and disclaimer of opinion. Each type reflects a different level of assurance and has distinct implications for the audited entity.

What is an audit report in English?

An audit report is a formal, independent assessment in which an auditor shares their opinion on an organization's financial performance, internal controls or regulatory compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Financial Statements and Independent Auditors' Reports?

Financial statements are formal records of the financial activities and position of a business, person, or entity. They include balance sheets, income statements, and cash flow statements. Independent auditors' reports are documents prepared by external auditors that express an opinion on the fairness of the financial statements and whether they comply with accepted accounting principles.

Who is required to file Financial Statements and Independent Auditors' Reports?

Typically, publicly traded companies, large private companies, and certain nonprofit organizations are required to file financial statements and independent auditors' reports. This requirement can vary based on jurisdiction and regulatory bodies.

How to fill out Financial Statements and Independent Auditors' Reports?

To fill out financial statements, entities must gather accurate financial data regarding their revenues, expenses, assets, and liabilities. This data should then be organized according to standard accounting principles. For the auditors' report, the auditor assesses the financial statements, performs necessary audits, and then drafts a report summarizing their findings and opinions.

What is the purpose of Financial Statements and Independent Auditors' Reports?

The purpose of financial statements is to provide stakeholders with information about the financial performance and position of an entity. Independent auditors' reports serve to enhance the credibility of the financial statements through an independent evaluation, thereby increasing users' confidence in the accuracy and fair representation of the information presented.

What information must be reported on Financial Statements and Independent Auditors' Reports?

Financial statements typically report key information such as revenues, expenses, profits, assets, liabilities, and equity. Independent auditors' reports provide insights into the methods used for auditing, the findings, and the auditor's opinion on whether the financial statements present a true and fair view of the financial position in accordance with relevant accounting frameworks.

Fill out your financial statements and independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements And Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.