Get the free Application for credit insurance - Euler Hermes - eulerhermes

Show details

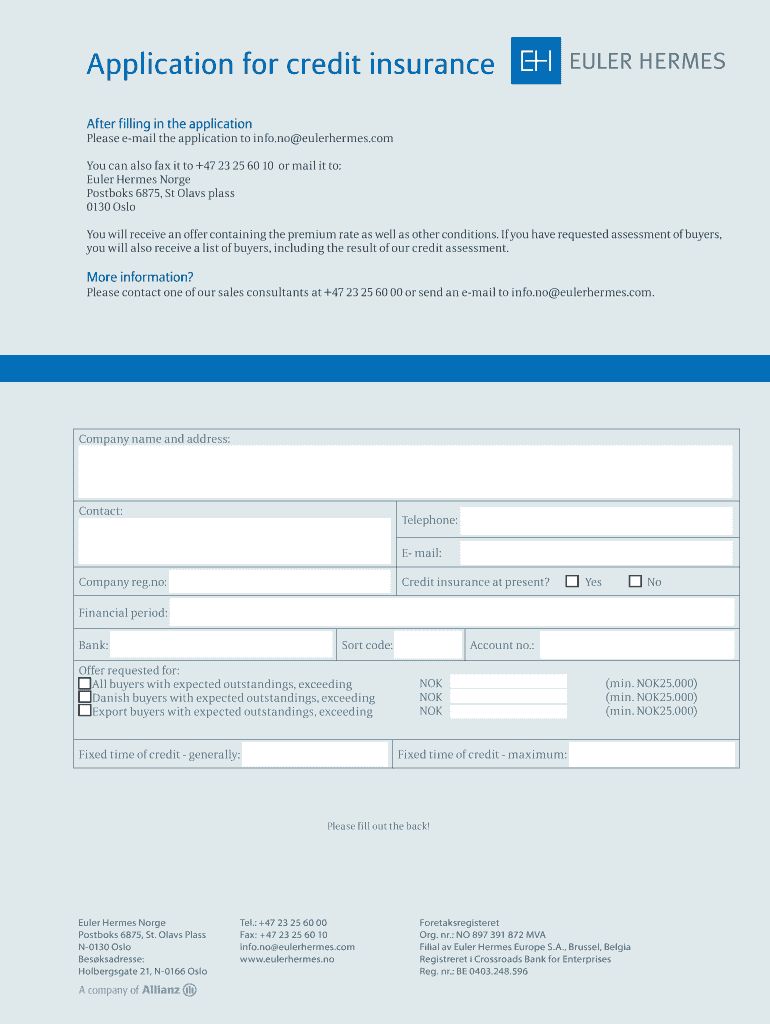

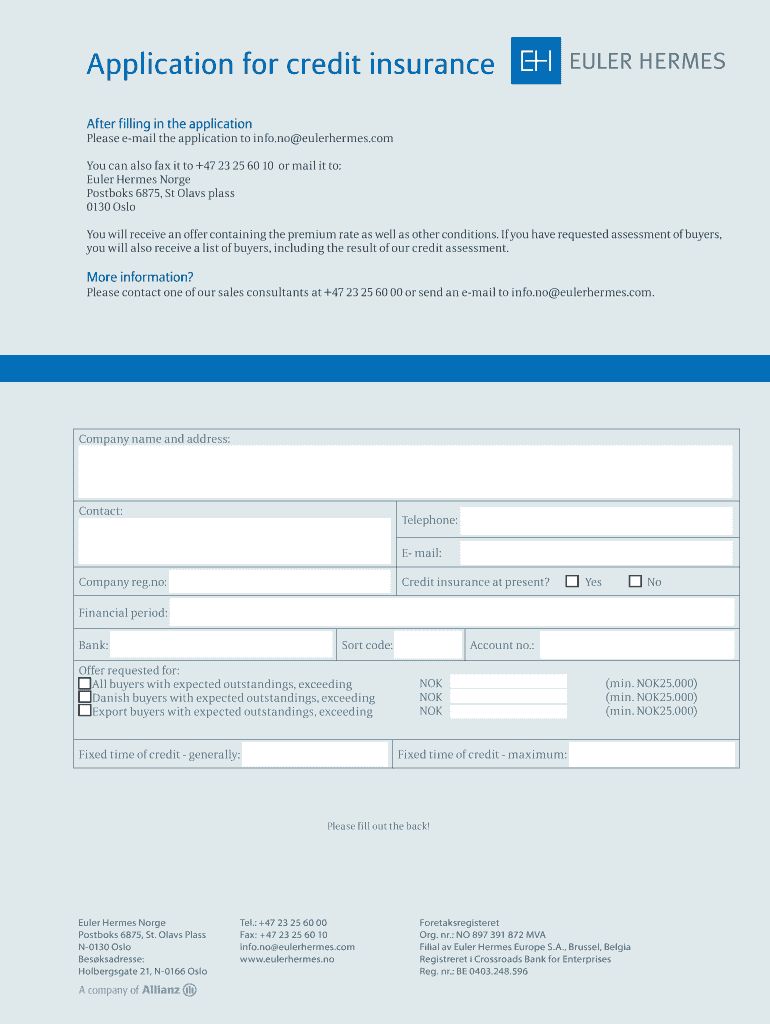

Application for credit insurance After filling in the application Please email the application to info.no eulerhermes.com You can also fax it to +47 23 25 60 10 or mail it to: Euler Hermes Norse Postdocs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for credit insurance

Edit your application for credit insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for credit insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for credit insurance online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for credit insurance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for credit insurance

How to fill out an application for credit insurance?

01

Start by gathering all the necessary information and documents: Before you begin filling out the application, make sure you have all the relevant information and documents at hand. This may include your personal details, financial statements, business information, and any other supporting documents required by the insurance provider.

02

Read and understand the application form: Carefully go through the entire application form and familiarize yourself with the questions and sections it contains. This will help you understand what information is required and how to provide it accurately.

03

Provide accurate and complete information: Ensure that you provide accurate and up-to-date information in the application form. Any inaccuracies or omissions may result in delays in processing or even rejection of your application. Double-check all the provided details to avoid any mistakes.

04

Fill in personal details: Begin by filling in your personal details, such as your full name, address, contact information, social security number, and date of birth. Be sure to provide this information accurately to avoid any potential issues.

05

Provide financial information: Fill in the financial information section, which may include details about your income, assets, liabilities, and credit history. It's important to provide this information truthfully and completely, as it will help the insurance provider assess your creditworthiness and determine the terms of your insurance policy.

06

Include business information (if applicable): If you are applying for credit insurance for a business, make sure to provide all relevant business information, such as company name, address, industry, number of employees, and annual revenue. This information helps the insurance provider evaluate the risks associated with extending credit to your business.

07

Attach supporting documents: Attach any necessary supporting documents as requested by the application form. These may include bank statements, financial statements, tax returns, credit reports, or any other documents required to verify the information you provided in the application.

08

Review and sign the application: Once you have filled in all the required sections and attached the necessary documents, review the application form thoroughly. Check for any errors or omissions and make any necessary corrections. Afterward, sign the application form as per the provided instructions.

Who needs an application for credit insurance?

01

Businesses: Business owners, especially those involved in offering credit terms to customers, often require credit insurance to protect their accounts receivable from potential non-payment or default by their customers. This insurance provides coverage for losses incurred due to customer insolvency, bankruptcy, or other credit-related risks.

02

Lenders and financial institutions: Lenders and financial institutions that provide financing or loans to individuals or businesses may require credit insurance as a condition for lending. It helps mitigate the risk of non-payment by borrowers and provides assurance that their investments are protected against credit-related losses.

03

Exporters: Exporters who engage in international trade are often exposed to higher credit risks due to factors such as foreign exchange fluctuations, political instability, or unfamiliarity with buyers. Credit insurance can help mitigate these risks and provide exporters with confidence and financial protection when trading internationally.

04

Importers: Importers who purchase goods or services on credit terms from overseas suppliers can benefit from credit insurance to protect themselves against the risk of non-delivery, non-performance, or insolvency of their suppliers. It provides importers with peace of mind and financial security in their procurement transactions.

05

Individuals: While less common, individuals who extend credit to others in the form of personal loans or financing may also consider credit insurance to safeguard themselves from potential default or non-payment. This insurance can provide coverage for personal loans, credit card debts, or other credit-related obligations.

In summary, filling out an application for credit insurance involves gathering relevant information, accurately providing personal and financial details, attaching necessary documents, reviewing the form for accuracy, and signing it. The application for credit insurance is needed by businesses, lenders, exporters, importers, and even individuals to protect themselves from credit-related risks and ensure financial security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my application for credit insurance in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your application for credit insurance and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send application for credit insurance to be eSigned by others?

application for credit insurance is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How can I get application for credit insurance?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the application for credit insurance. Open it immediately and start altering it with sophisticated capabilities.

What is application for credit insurance?

An application for credit insurance is a form used by individuals or businesses to apply for insurance coverage to protect against potential losses due to credit-related issues.

Who is required to file application for credit insurance?

Any individual or business seeking credit insurance coverage is required to file an application for credit insurance.

How to fill out application for credit insurance?

To fill out an application for credit insurance, individuals or businesses must provide information about their credit history, financial standing, and the amount of coverage needed.

What is the purpose of application for credit insurance?

The purpose of an application for credit insurance is to assess the risk of offering insurance coverage to an individual or business and determine the appropriate premium to charge.

What information must be reported on application for credit insurance?

Information such as credit history, financial statements, and requested coverage amount must be reported on an application for credit insurance.

Fill out your application for credit insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Credit Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.