Get the free Multi-Family (1 to 4 Units) - Normandy

Show details

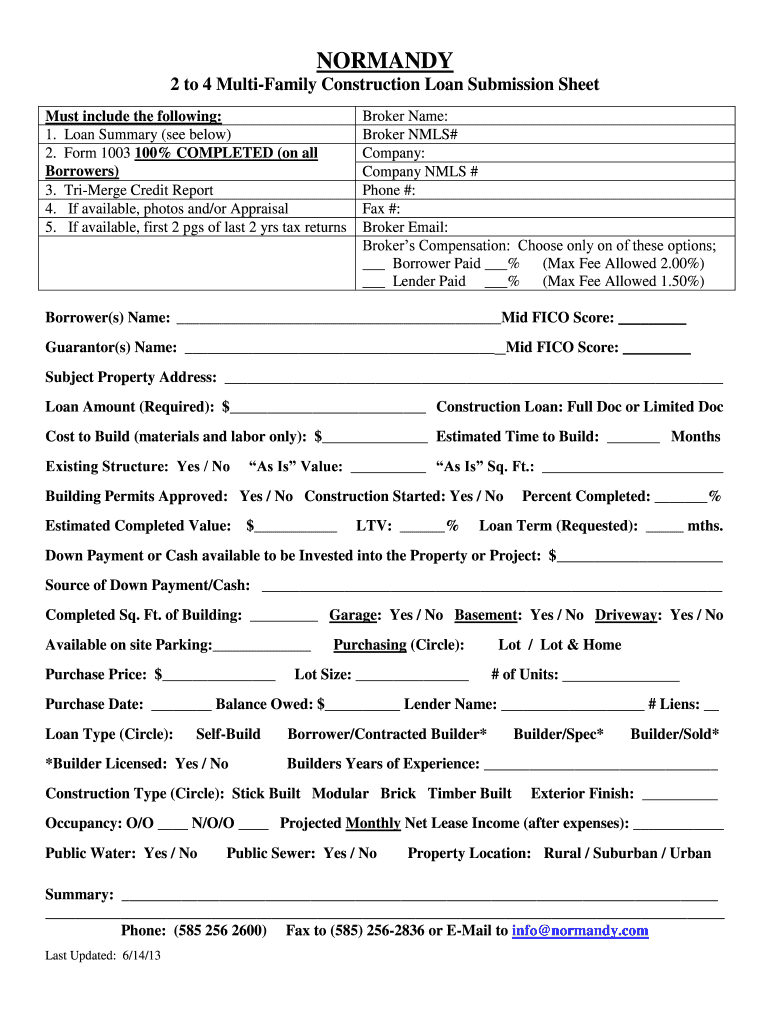

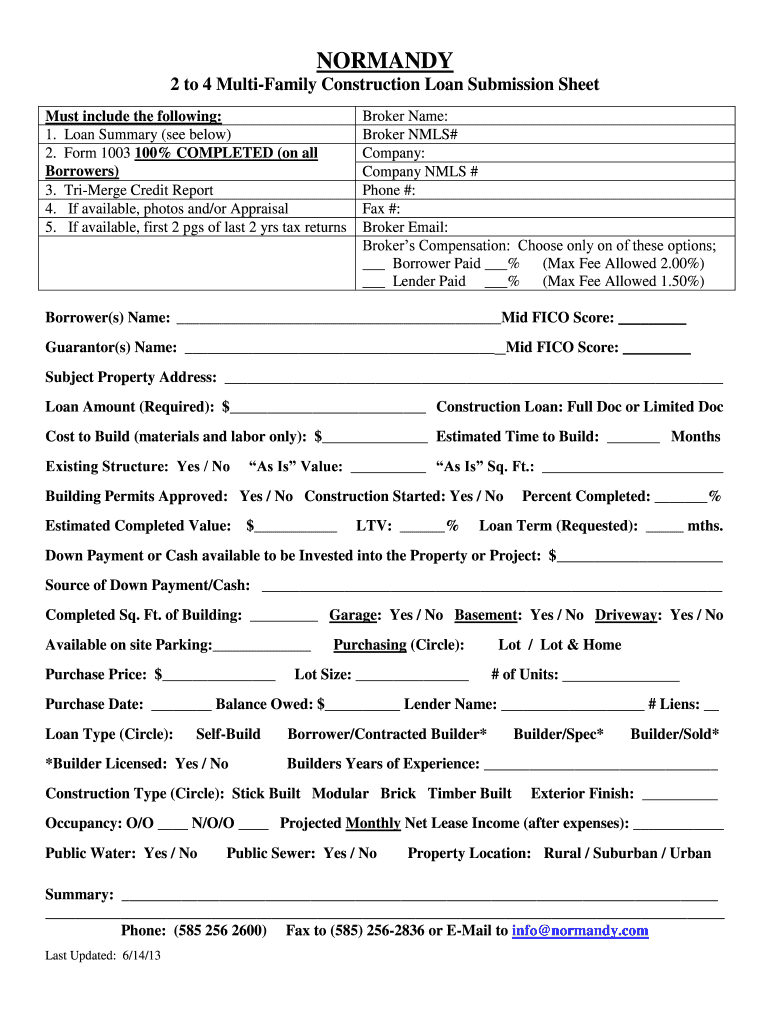

NORMANDY 2 to 4 MultiFamily Construction Loan Submission Sheet Must include the following: 1. Loan Summary (see below) 2. Form 1003 100% COMPLETED (on all Borrowers) 3. Emerge Credit Report 4. If

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign multi-family 1 to 4

Edit your multi-family 1 to 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your multi-family 1 to 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing multi-family 1 to 4 online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit multi-family 1 to 4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out multi-family 1 to 4

How to fill out multi-family 1 to 4:

01

Gather all necessary information: Start by compiling all the required details for the multi-family 1 to 4 form. This may include property address, owner information, tenant details, and any other relevant documentation.

02

Complete the property information section: Begin by providing the property address, including the street name, city, state, and zip code. Fill out the necessary information regarding the type of property, such as whether it is a single-family home or a multi-family dwelling with 1 to 4 units.

03

Enter owner information: Provide the name, contact details, and any other essential information concerning the owner or owners of the multi-family property. This may include their mailing address, phone number, and email address.

04

Provide tenant information: If applicable, fill out the section dedicated to tenant details. Include the names of the tenants residing in the multi-family property, along with their contact information and lease dates.

05

Report income and expenses: Specify the annual income generated from the property and provide a breakdown of the expenses associated with its maintenance and operation. This may include costs related to utilities, repairs, insurance, and property management fees.

06

Sign and date the form: Once you have carefully reviewed all the provided information, sign and date the multi-family 1 to 4 form to certify its accuracy.

Who needs multi-family 1 to 4:

01

Real estate investors: Those involved in real estate investment often require a multi-family 1 to 4 form as part of their property portfolio management. This enables them to keep track of their multi-family properties and assess their financial performance.

02

Property owners: Individuals who own multi-family properties consisting of 1 to 4 units may need to fill out this form to comply with legal regulations and tax requirements. It allows them to report the income and expenses associated with their rental property accurately.

03

Tax professionals: Tax professionals, including accountants or tax preparers, may require the multi-family 1 to 4 form to assist their clients in accurately reporting rental property income and expenses. This helps ensure compliance with tax laws and potentially maximize tax deductions or credits.

In summary, filling out the multi-family 1 to 4 form involves gathering all necessary information, providing property, owner, and tenant details, reporting income and expenses, and signing the form. This form is required by real estate investors, property owners, and tax professionals to manage properties efficiently and comply with relevant regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit multi-family 1 to 4 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including multi-family 1 to 4. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I get multi-family 1 to 4?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific multi-family 1 to 4 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit multi-family 1 to 4 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share multi-family 1 to 4 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is multi-family 1 to 4?

Multi-family 1 to 4 refers to residential buildings that contain 1 to 4 units, such as duplexes, triplexes, and fourplexes.

Who is required to file multi-family 1 to 4?

Owners or landlords of multi-family residential buildings with 1 to 4 units are required to file multi-family 1 to 4 forms.

How to fill out multi-family 1 to 4?

To fill out multi-family 1 to 4 forms, owners or landlords need to provide information about the property, rental income, expenses, and other relevant details.

What is the purpose of multi-family 1 to 4?

The purpose of multi-family 1 to 4 forms is to report rental income and expenses for residential buildings with 1 to 4 units for tax and regulatory purposes.

What information must be reported on multi-family 1 to 4?

Information that must be reported on multi-family 1 to 4 forms include rental income, expenses, property address, ownership details, and other relevant data.

Fill out your multi-family 1 to 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Multi-Family 1 To 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.