Get the free Mortgage Creditor Proofs of Claim and Objections: A Practical Primer for Practice Un...

Show details

Mortgage Creditor Proofs of Claim and Objections: A Practical Primer for Practice Under the Revised Rules June A. Mann Law Firm LLC David Aaron DeSoto Mann Law Firm LLC 22nd Annual DFW Consumer Bankruptcy

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage creditor proofs of

Edit your mortgage creditor proofs of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage creditor proofs of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage creditor proofs of online

Follow the steps down below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mortgage creditor proofs of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage creditor proofs of

How to fill out mortgage creditor proofs of:

01

Gather all necessary documents: Before filling out mortgage creditor proofs, make sure to collect all the required documents. This may include mortgage statements, correspondence with the creditor, proof of payments, and any other relevant information.

02

Understand the requirements: Familiarize yourself with the specific requirements for filling out the mortgage creditor proofs. Each lender may have their own guidelines, so it is essential to understand what information and documentation they are looking for.

03

Complete the necessary forms: Fill out the provided forms accurately and neatly. Double-check the information you provide to avoid any errors or discrepancies. It is crucial to provide truthful and up-to-date information to support your case effectively.

04

Include supporting documents: Along with the forms, attach any supporting documents that are required or that you believe will strengthen your case. These may include bank statements, pay stubs, tax returns, or any other relevant financial information.

05

Provide explanation if necessary: If there are any specific circumstances or events that affected your mortgage payments, make sure to provide a detailed explanation. This can help the creditor understand your situation better and may be beneficial in resolving any issues.

06

Keep copies for your records: Make copies of all the completed forms and supporting documents for your records. This will serve as a reference in case any discrepancies occur or if you need to provide additional information in the future.

Who needs mortgage creditor proofs of:

01

Homeowners facing foreclosure: If you are at risk of foreclosure and need to prove to your mortgage creditor that you have made all the necessary payments, you will likely need to submit mortgage creditor proofs.

02

Individuals refinancing their mortgage: When refinancing a mortgage, lenders often require borrowers to provide proof of their current mortgage payments. This helps them assess creditworthiness and determine the terms of the new loan.

03

Those disputing mortgage payment discrepancies: If you believe there are discrepancies or errors in your mortgage payment history, submitting mortgage creditor proofs can help support your case. These proofs can help you resolve any billing or payment issues with your creditor.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit mortgage creditor proofs of online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your mortgage creditor proofs of to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How can I edit mortgage creditor proofs of on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing mortgage creditor proofs of.

How do I complete mortgage creditor proofs of on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your mortgage creditor proofs of, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

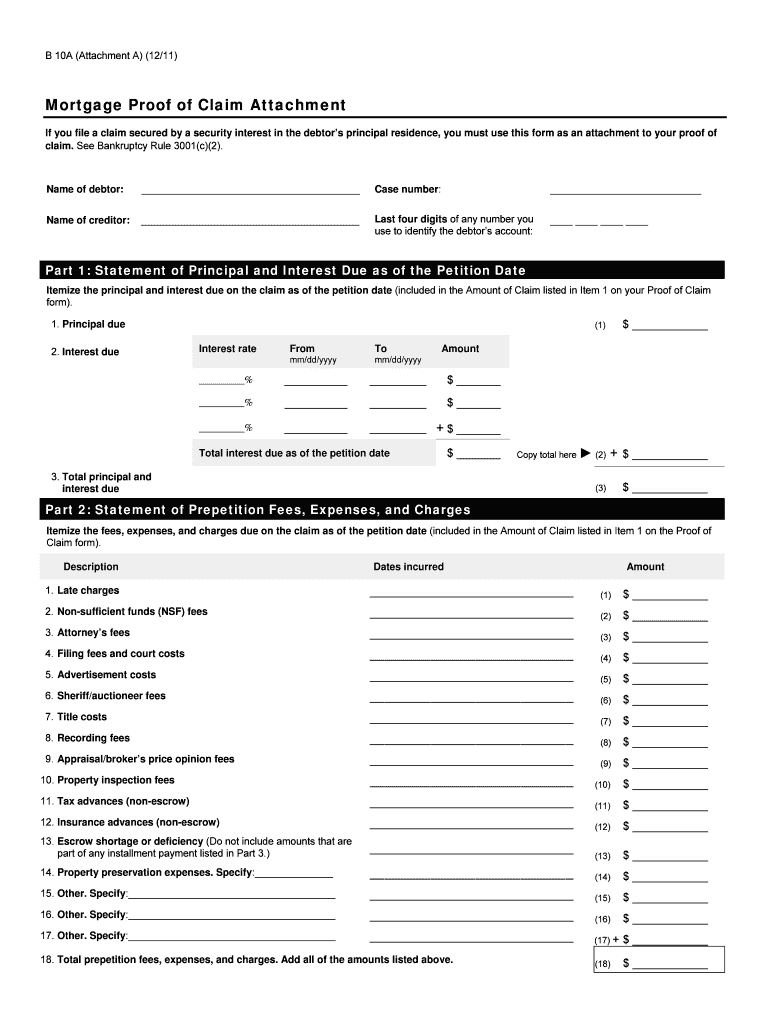

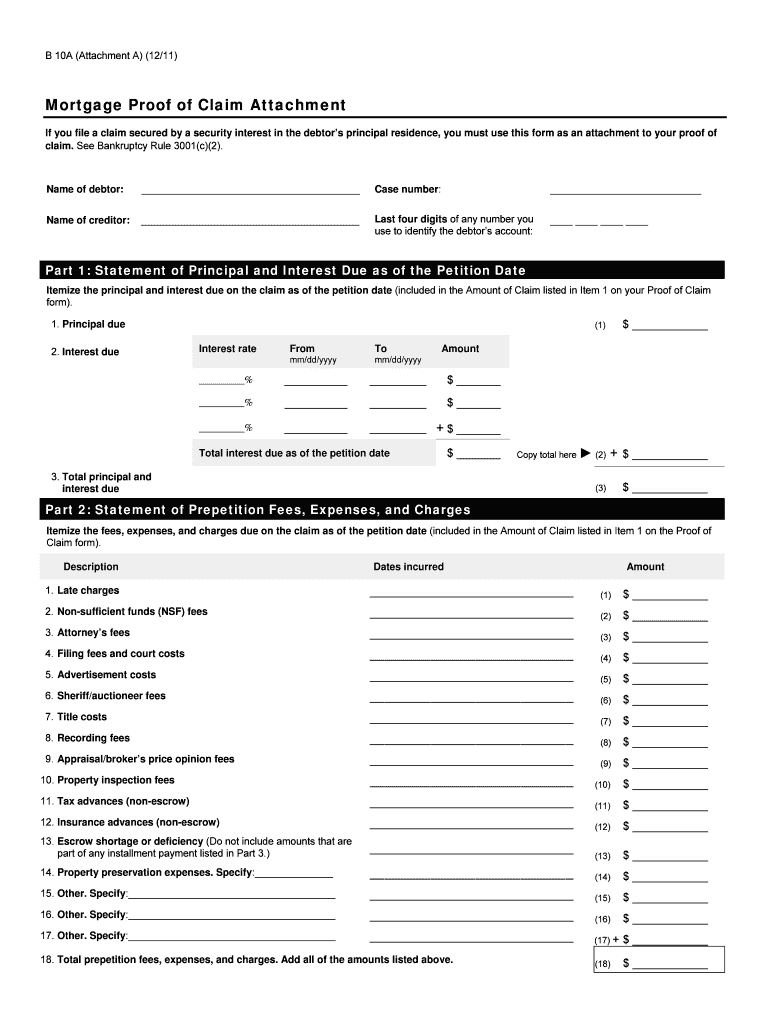

What is mortgage creditor proofs of?

Mortgage creditor proofs are documents that provide evidence of a mortgage on a property.

Who is required to file mortgage creditor proofs of?

The mortgage creditor is required to file the proofs.

How to fill out mortgage creditor proofs of?

To fill out the mortgage creditor proofs, you need to provide accurate information about the mortgage, including the loan amount, terms, and property details.

What is the purpose of mortgage creditor proofs of?

The purpose of mortgage creditor proofs is to establish the existence and details of a mortgage on a property, which is important for legal and financial purposes.

What information must be reported on mortgage creditor proofs of?

The mortgage creditor proofs should include information such as the mortgage holder's name, the property address, the loan amount, interest rate, and repayment terms.

Fill out your mortgage creditor proofs of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Creditor Proofs Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.