Get the free Financial Statements 2014 Trust Questionnaire Taurus Ref: Ensure this questionnaire ...

Show details

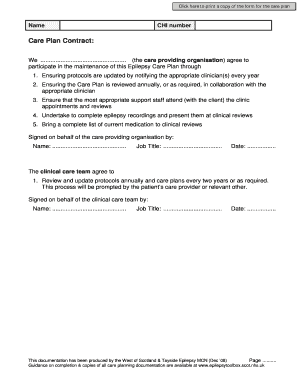

Financial Statements 2014 Trust Questionnaire Taurus Ref: Ensure this questionnaire is completed and included with your records Client Name: Balance Date: Email: Physical Address: Postal Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements 2014 trust

Edit your financial statements 2014 trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements 2014 trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements 2014 trust online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit financial statements 2014 trust. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements 2014 trust

How to fill out financial statements 2014 trust:

01

Gather all necessary documents and information: To fill out financial statements for a 2014 trust, you will need to collect relevant financial documents such as bank statements, investment statements, tax returns, and any other supporting documents related to the trust's financial activities during that year. Additionally, you will need to have a clear understanding of the trust's assets, liabilities, income, and expenses for that period.

02

Identify the required sections: Financial statements typically consist of several sections, including a balance sheet, income statement, statement of cash flows, and notes to the financial statements. Review the guidelines or instructions provided with the financial statement template to determine which sections are applicable to the 2014 trust.

03

Complete the balance sheet: The balance sheet provides a snapshot of the trust's financial position at a specific point in time. List all the trust's assets, such as cash, investments, real estate, and any other holdings, along with their corresponding values. Then, list the trust's liabilities, which may include outstanding debts or obligations. Calculate the trust's net worth by subtracting the total liabilities from the total assets.

04

Prepare the income statement: The income statement showcases the trust's revenue, expenses, and overall profitability for the reporting period. Start by listing all sources of income earned by the trust during 2014, such as interest, dividends, rental income, or capital gains. Next, outline all expenses incurred, including trustee fees, legal fees, accounting fees, or any other costs related to managing the trust. Finally, calculate the trust's net income by subtracting total expenses from total income.

05

Include the statement of cash flows: The statement of cash flows tracks the inflows and outflows of cash for the trust during the reporting period. It classifies cash movements into operating activities (such as income and expenses), investing activities (such as buying or selling assets), and financing activities (such as taking out loans or receiving capital contributions). Ensure that all cash transactions for 2014 are accurately categorized and summarized in this statement.

06

Provide supporting documentation and disclosures: The notes to the financial statements serve to explain and provide additional context for the information presented in the balance sheet, income statement, and statement of cash flows. Include any relevant details or explanations about significant accounting policies, contingent liabilities, or any other pertinent information that could impact the trust's financial position.

Who needs financial statements 2014 trust?

Trustees: Trustees of the trust need financial statements for 2014 to accurately assess the trust's financial performance, determine its net worth, and make informed decisions regarding the management and distribution of trust assets.

Beneficiaries: Beneficiaries of the 2014 trust may require financial statements for various purposes, such as understanding their entitlements, verifying trust distributions, or assessing the trust's financial stability.

Tax authorities: Tax authorities, such as the Internal Revenue Service (IRS) in the United States, may require financial statements for trusts to ensure compliance with tax laws and accurately calculate tax obligations.

Legal professionals: Attorneys and legal professionals involved in trust administration or legal proceedings related to the trust may need financial statements for the 2014 period to support their work and provide an accurate representation of the trust's financial position.

Financial institutions: Banks or other financial institutions that have a business relationship with the trust may request financial statements to assess creditworthiness, evaluate risk, or fulfill regulatory requirements.

Please note that specific requirements and individuals who need financial statements may vary depending on the jurisdiction and purpose of the trust. It is advised to consult with legal and financial professionals to determine the exact needs and obligations regarding financial statements for a 2014 trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is financial statements trust questionnaire?

The financial statements trust questionnaire is a document that gathers important information about a company's financial status and trust assets.

Who is required to file financial statements trust questionnaire?

Companies or organizations that hold trust assets are required to file the financial statements trust questionnaire.

How to fill out financial statements trust questionnaire?

To fill out the financial statements trust questionnaire, companies need to provide accurate and detailed information about their financial activities and trust assets.

What is the purpose of financial statements trust questionnaire?

The purpose of the financial statements trust questionnaire is to ensure transparency and accountability in the management of trust assets.

What information must be reported on financial statements trust questionnaire?

Companies must report detailed financial information, including assets, liabilities, income, and expenses related to trust assets.

How can I send financial statements 2014 trust to be eSigned by others?

When you're ready to share your financial statements 2014 trust, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Where do I find financial statements 2014 trust?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific financial statements 2014 trust and other forms. Find the template you need and change it using powerful tools.

How do I edit financial statements 2014 trust on an Android device?

You can edit, sign, and distribute financial statements 2014 trust on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your financial statements 2014 trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements 2014 Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.