IN Governmental 457(b) Application for Catch-Up Form 30 2009-2025 free printable template

Show details

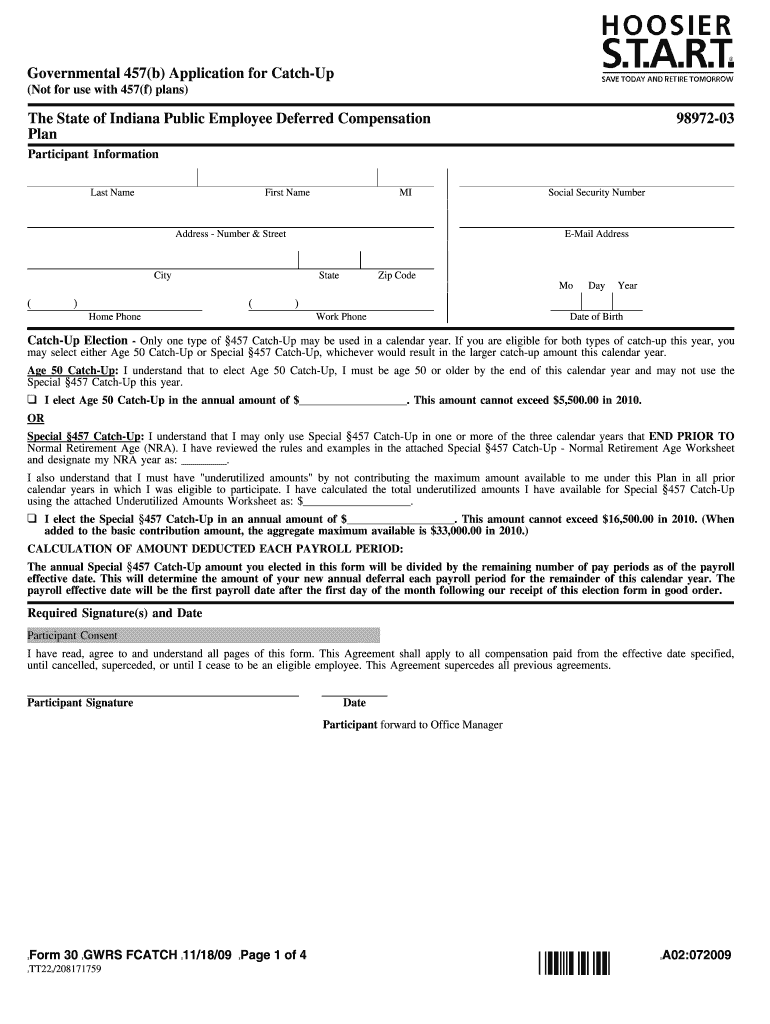

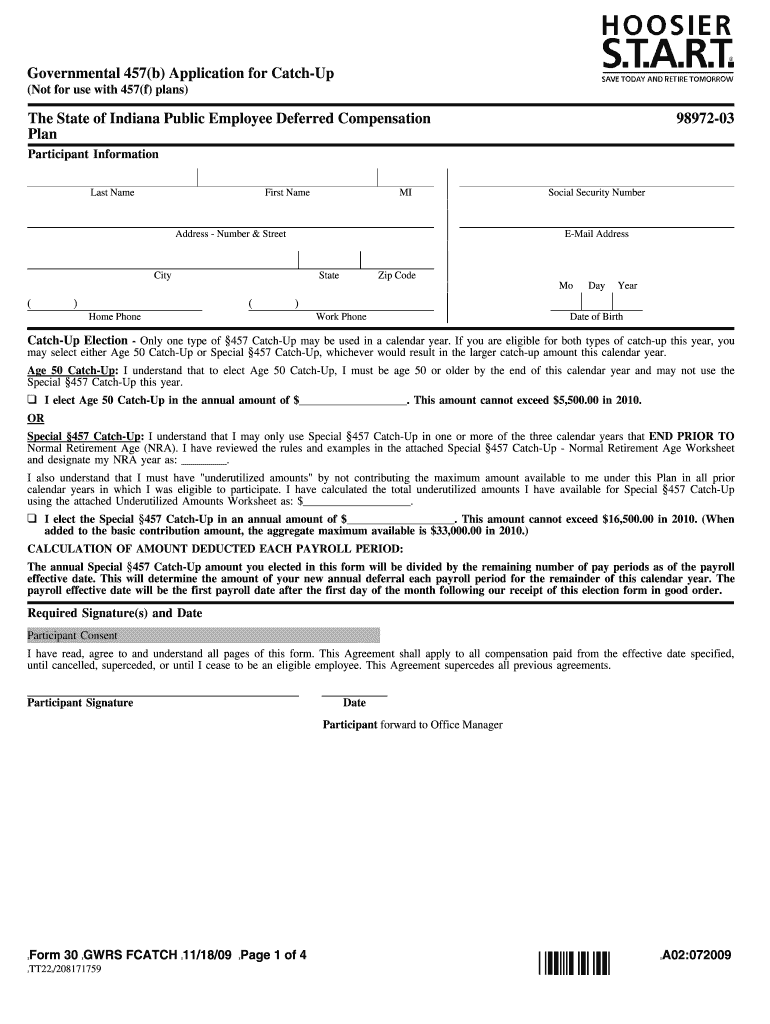

Governmental 457(b) Application for Catch-Up The State of Indiana Public Employee Deferred Compensation Plan (Not for use with 457(f) plans) Participant Information 98972-03 Catch-Up Election Only

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IN Governmental 457b Application for Catch-Up Form 30

Edit your IN Governmental 457b Application for Catch-Up Form 30 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IN Governmental 457b Application for Catch-Up Form 30 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IN Governmental 457b Application for Catch-Up Form 30 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IN Governmental 457b Application for Catch-Up Form 30. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out IN Governmental 457b Application for Catch-Up Form 30

How to fill out IN Governmental 457(b) Application for Catch-Up Form 30

01

Obtain the IN Governmental 457(b) Application for Catch-Up Form 30 from the official website or your HR department.

02

Read the instructions carefully to ensure you understand the eligibility criteria and requirements.

03

Fill in your personal information, including your name, address, and employee ID, in the designated sections.

04

Indicate your desire to take advantage of the catch-up provisions under the 457(b) plan in the appropriate section.

05

Calculate the amount you wish to contribute, ensuring it falls within the catch-up limits specified by the IRS.

06

Sign and date the form to certify the information provided is accurate.

07

Submit the completed form to your HR or benefits office for processing.

Who needs IN Governmental 457(b) Application for Catch-Up Form 30?

01

Participants in the IN Governmental 457(b) retirement plan who are nearing retirement age and wish to increase their contributions beyond the standard limits.

02

Employees who have previously deferred contributions and are looking to catch up on their retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid tax on my 457 withdrawal?

Earnings accumulate on a tax-deferred basis, and distributions are tax-free if made five years after the initial contribution to the plan and the employee is over 59½.

Can I withdraw from 457b after leaving job?

You are eligible to withdraw funds from your 457(b) plan when you separate service from your employer (for any reason) or for an approved unforeseeable emergency. After separation from service, you may also rollover your account into an IRA or an existing qualified retirement plan.

What do you do with a 457 after leaving a job?

The 457 plan is a retirement savings plan and you generally cannot withdraw money while you are still employed. When you leave employment, you may withdraw funds; leave them in place; transfer them to a 457, 403(b) or 401(k) of a new employer; or roll them into an Individual Retirement Account (IRA).

When can you collect 457b?

You can withdraw funds from your 457(b) plan penalty-free at any age once you leave your employer or retire. You won't owe an early withdrawal penalty even if you are not yet 59 ½, but you will pay federal and state income taxes on the withdrawal.

What happens to my 457 B when I retire?

Participants are eligible to withdraw funds from their 457(b) plan when separating from service (for any reason) or for an approved unforeseeable emergency. After separation from service, a participant may rollover their account into a traditional IRA or an existing qualified retirement plan.

What is the age limit for 457 catch up contributions?

Special 457(b) catch-up The Age 50+ Catch-up provision automatically allows people to contribute more to their 457(b) account starting in the year they will turn 50.

What is the 457 b catch up for 2023?

To take advantage of the Age 50+ catch up, you could contribute up to $1,154 per biweekly paycheck ($30,000 for the year). If you are eligible and wish to use the full Special 457(b) Catch-up provision, you could contribute up to $1,731 per biweekly paycheck ($45,000 for 2023).

What is the special pre retirement catch up provision 457?

The “Pre-Retirement” catch-up provision allows you to make additional contributions to your 457 plan in order to make up for years in which you did not contribute the maximum permissible amount. You may catch up for any year(s) that you were employed by your current employer going back to January 1, 1979.

Does a 457b allow catch up contributions?

Special 457(b) catch-up contributions, if permitted by the plan, allow a participant for 3 years prior to the normal retirement age (as specified in the plan) to contribute the lesser of: the elective deferral limit ($22,500 in 2023; $20,500 in 2022; $19,500 in 2020 and in 2021).

Does 457 B have tax-exempt catch up?

If you are a participant in a 457(b) plan sponsored by a tax-exempt, non-governmental employer, you are not eligible for the Age 50+ Catch-Up election. You may only elect the Special Catch-Up during the three consecutive years prior to — but not including — the year you reach your Plan's normal retirement age.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in IN Governmental 457b Application for Catch-Up Form 30?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your IN Governmental 457b Application for Catch-Up Form 30 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I create an eSignature for the IN Governmental 457b Application for Catch-Up Form 30 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your IN Governmental 457b Application for Catch-Up Form 30 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I fill out IN Governmental 457b Application for Catch-Up Form 30 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your IN Governmental 457b Application for Catch-Up Form 30. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IN Governmental 457(b) Application for Catch-Up Form 30?

The IN Governmental 457(b) Application for Catch-Up Form 30 is a form used by eligible employees of governmental employers in Indiana to apply for catch-up contributions to their 457(b) retirement plans, allowing them to defer additional compensation beyond standard contribution limits.

Who is required to file IN Governmental 457(b) Application for Catch-Up Form 30?

Individuals who are nearing retirement age and have not contributed the maximum allowed to their 457(b) plan in prior years are required to file the IN Governmental 457(b) Application for Catch-Up Form 30 to take advantage of the catch-up contribution provisions.

How to fill out IN Governmental 457(b) Application for Catch-Up Form 30?

To fill out the form, individuals need to provide personal information such as their name, address, and employee ID. They must specify the amount they wish to contribute, indicate their eligibility for catch-up contributions, and provide any required documentation or signatures.

What is the purpose of IN Governmental 457(b) Application for Catch-Up Form 30?

The purpose of the form is to enable eligible participants in a governmental 457(b) retirement plan to request additional contributions to their retirement savings, beyond the standard annual limits, in order to enhance their retirement savings as they approach retirement.

What information must be reported on IN Governmental 457(b) Application for Catch-Up Form 30?

The form must report personal identification details, the amount of catch-up contributions being requested, years of service, prior contribution limits, and any other relevant data required to demonstrate eligibility for the catch-up provision.

Fill out your IN Governmental 457b Application for Catch-Up Form 30 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IN Governmental 457b Application For Catch-Up Form 30 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.