This form is for a seller to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. Upon

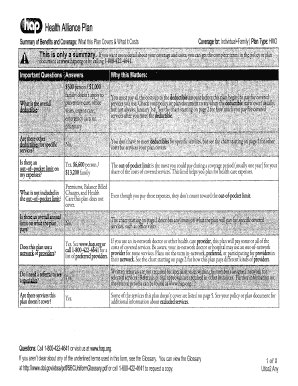

Get the free NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)

Show details

This document is an affidavit for sellers to declare they are not foreign persons under Section 1445 of the Internal Revenue Code and provide necessary details for tax identification purposes related

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-foreign affidavit under internal

Edit your non-foreign affidavit under internal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-foreign affidavit under internal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-foreign affidavit under internal

How to fill out NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)

01

Obtain a NON-FOREIGN AFFIDAVIT form, which can usually be found through the IRS or relevant tax authorities.

02

Fill in the seller's name and tax identification number (such as Social Security Number or Employer Identification Number).

03

Provide the address of the property being sold.

04

Include a declaration stating that the seller is not a foreign person under the Internal Revenue Code.

05

Sign and date the affidavit in the appropriate section.

06

Have the affidavit notarized by a qualified notary public.

07

Submit the completed affidavit to the buyer or their representative for record-keeping during the property sale.

Who needs NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

01

Individuals or entities who are selling real property in the United States and wish to certify that they are not foreign persons as defined under U.S. tax law.

02

Buyers of residential or commercial real estate who are responsible for withholding taxes if the seller is a foreign person.

03

Real estate agents or attorneys facilitating a property sale and ensuring compliance with tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is a qualified substitute for FIRPTA?

A qualified substitute may be (i) an attorney, title company, or escrow company (but not the Seller's agent) responsible for closing the transaction, or (ii) the Buyer's agent.

How to get around FIRPTA?

A foreign seller can escape FIRPTA if: ⇒ The buyer signs an affidavit, confirming that he or she will use that property as their main residence for the minimum period of 2 years after the sale. A foreign seller can reduce the FIRPTA withheld amount if they apply for a Withholding Certificate (Form 8288-B).

What is required for a FIRPTA affidavit?

Required Information The FIRPTA affidavit requires specific information to verify the seller's status. Key details include: Seller Identification: Full name, address, and taxpayer identification number. Property Description: Legal description of the real estate property being sold.

What is the 50% rule for FIRPTA?

Answer 6: In order for a USRPI to be considered a “residence” of the transferee/buyer for the reduced or eliminated withholding, one or more transferees/buyers have to have definite plans to reside at the USRPI for at least 50 percent of the number of days that the property is used by any person during each of the

What is an example of a FIRPTA statement?

By this Affidavit, the undersigned hereby gives sworn representation that it, as seller(s) of a United States real property interest, is not a foreign person as defined in the Internal Revenue Code Section 1445, thus permitting the transferee of the property to waive the ten (10%) percent withholding requirement in

Does the buyer have to pay FIRPTA?

Although the tax charged comes from the sales price, the responsibility to withhold is on the buyer. If the buyer fails to comply with the FIRPTA withholding requirements, then they may be held liable for the tax owed—in addition to penalties and interest.

How can I avoid paying FIRPTA?

If the seller is a U.S. person – FIRPTA only applies to foreign sellers. If the seller can provide legal documentation showing that they are a U.S. citizen or U.S. tax resident, then the sale is not subject to FIRPTA withholding.

What is a section 1445 affidavit?

CERTIFICATE OF NON FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a transferee (buyer) of a U.S. real property interest must withhold tax if the transferor (seller) is a foreign person.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

The NON-FOREIGN AFFIDAVIT under Internal Revenue Code Section 1445(b)(2) is a legal document that certifies that the seller of a U.S. real property interest is not a foreign person, thereby exempting the buyer from the requirement to withhold tax at the time of sale.

Who is required to file NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

The seller of the U.S. real property interest is required to file the NON-FOREIGN AFFIDAVIT to certify their status as a non-foreign person.

How to fill out NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

To fill out the affidavit, provide the seller's name, address, taxpayer identification number (TIN), and a statement asserting that the seller is not a foreign person as defined under the Internal Revenue Code.

What is the purpose of NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

The purpose of the NON-FOREIGN AFFIDAVIT is to ensure compliance with tax laws by allowing the buyer to confirm the seller's non-foreign status, which removes the withholding tax obligation on the buyer.

What information must be reported on NON-FOREIGN AFFIDAVIT UNDER INTERNAL REVENUE CODE SECTION 1445(b)(2)?

The affidavit must include the seller's name, address, taxpayer identification number (TIN), a declaration that the seller is not a foreign person, and any applicable signatures.

Fill out your non-foreign affidavit under internal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Foreign Affidavit Under Internal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.