Get the free Advanced Sukuk Islamic Securitization - REDmoney Training

Show details

The Sunk sector is growing fast

Keep up to speed with developments

Advanced Sunk &

Islamic Securitization

15th 17th December 2014

Dubai UAE

Sunk has emerged over the past 5 years as an increasingly

We are not affiliated with any brand or entity on this form

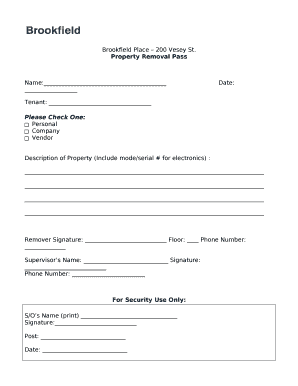

Get, Create, Make and Sign advanced sukuk islamic securitization

Edit your advanced sukuk islamic securitization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your advanced sukuk islamic securitization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit advanced sukuk islamic securitization online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit advanced sukuk islamic securitization. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out advanced sukuk islamic securitization

How to fill out advanced sukuk islamic securitization:

01

Conduct thorough research on sukuk islamic securitization: Before attempting to fill out the advanced sukuk islamic securitization, it is crucial to have a clear understanding of the concept. Research and study various sukuk structures, principles, and applicable laws to ensure a comprehensive understanding of the process.

02

Identify the purpose and structure of the securitization: Determine the specific purpose of the sukuk securitization, such as financing a project, debt restructuring, or generating investment opportunities. Based on the purpose, choose an appropriate sukuk structure, whether it be a murabaha, ijara, musharaka, or any other approved Islamic finance structure.

03

Define the assets and cash flows: Identify the assets that will be securitized and create a clear picture of the expected cash flows generated by those assets. This step requires thorough due diligence and evaluation of the assets to ensure transparency, legality, and profitability.

04

Engage legal and Shariah advisors: Seek guidance from legal and Shariah advisors who specialize in sukuk structuring and Islamic finance. These experts will provide valuable insights into the legal and regulatory requirements associated with sukuk issuance, ensuring compliance with Shariah principles and applicable international standards.

05

Draft the sukuk issuance documents: Prepare the necessary legal documents, including the prospectus, trust deed, purchase agreement, subscription agreement, and any other required documentation. These documents will outline the terms, conditions, and obligations of the sukuk issuance and will be provided to potential investors for review.

06

Perform due diligence and obtain necessary approvals: Conduct comprehensive due diligence to ensure compliance with regulatory requirements and applicable laws. Seek approvals from the relevant regulatory bodies, such as the central bank or securities commission, and collaborate with rating agencies to obtain credit ratings for the sukuk.

07

Market and distribute the sukuk: Develop a marketing strategy to attract potential investors and distribute the sukuk to the targeted market. Engage with financial institutions, investment banks, and other intermediaries to ensure optimal market penetration and maximize the chances of successful issuance.

Who needs advanced sukuk islamic securitization?

01

Governments and public entities seeking infrastructure financing: Advanced sukuk islamic securitization provides an attractive alternative for governments and public entities to raise funds for essential infrastructure projects. By securitizing assets, these entities can tap into the capital markets and attract a diverse pool of investors, easing the financial burden associated with large-scale projects.

02

Corporations and businesses requiring capital for expansion: Companies that require capital for expansion, whether domestically or internationally, can utilize advanced sukuk islamic securitization as a means of raising funds. This enables businesses to diversify their financing sources, access new markets, and align their funding strategies with their ethical and Shariah-compliant values.

03

Financial institutions seeking liquidity management tools: Advanced sukuk islamic securitization serves as an effective tool for financial institutions to manage their liquidity needs. By securitizing their assets, banks and other financial entities can raise funds without resorting to traditional borrowing methods. This allows them to optimize their liquidity positions while adhering to Islamic principles.

In summary, filling out advanced sukuk islamic securitization requires comprehensive research, expert advice, and meticulous documentation. It is utilised by governments, corporations, and financial institutions to raise funds, finance projects, and manage liquidity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the advanced sukuk islamic securitization in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your advanced sukuk islamic securitization in seconds.

How do I edit advanced sukuk islamic securitization on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign advanced sukuk islamic securitization on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out advanced sukuk islamic securitization on an Android device?

Use the pdfFiller app for Android to finish your advanced sukuk islamic securitization. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is advanced sukuk islamic securitization?

Advanced sukuk islamic securitization is a financial instrument used in Islamic finance where asset-backed securities are created through the securitization process.

Who is required to file advanced sukuk islamic securitization?

Financial institutions and companies involved in Islamic finance transactions are required to file advanced sukuk islamic securitization.

How to fill out advanced sukuk islamic securitization?

Advanced sukuk islamic securitization can be filled out by providing detailed information about the underlying assets, structure of the sukuk, and compliance with Islamic finance principles.

What is the purpose of advanced sukuk islamic securitization?

The purpose of advanced sukuk islamic securitization is to raise funds in compliance with Islamic finance principles by offering asset-backed securities to investors.

What information must be reported on advanced sukuk islamic securitization?

Information such as the underlying assets, structure of the sukuk, compliance with Islamic finance principles, and relevant financial data must be reported on advanced sukuk islamic securitization.

Fill out your advanced sukuk islamic securitization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Advanced Sukuk Islamic Securitization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.