VA FR300P 2003 free printable template

Show details

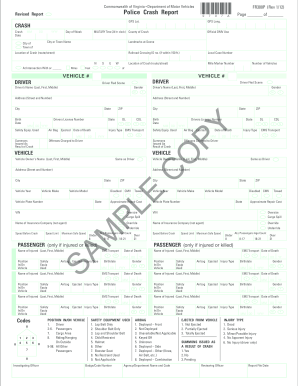

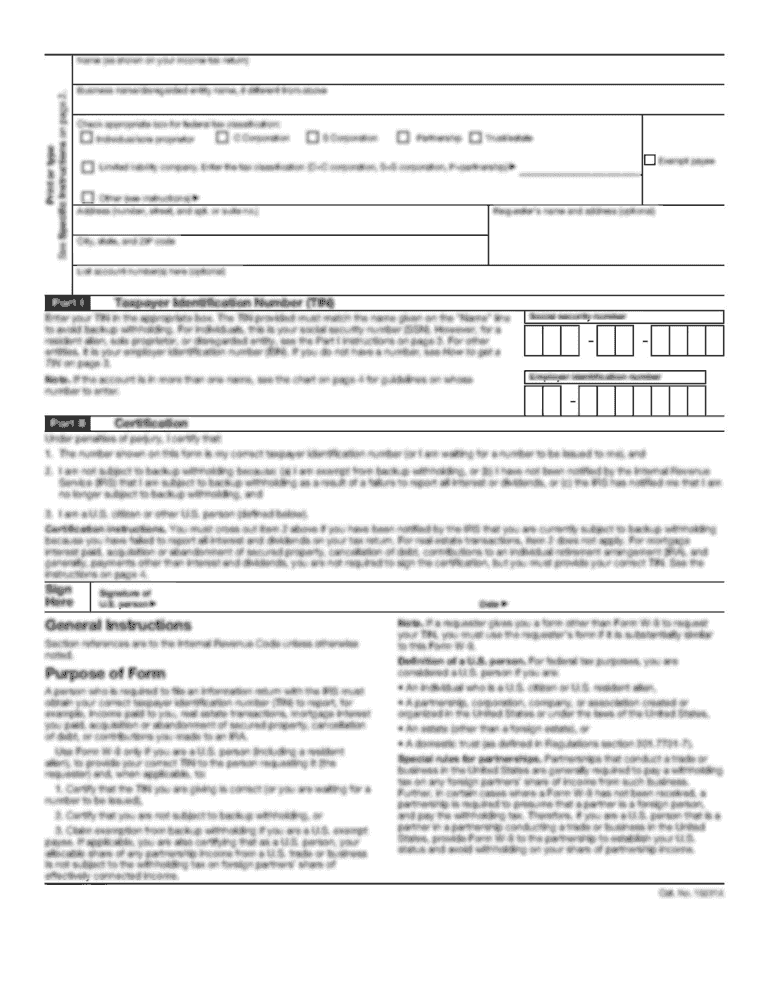

Clock County of crash FR300P Rev 9/03 Official DMV use Landmark at scene City of Town of Location of crash route/street GPS Lat. Commonwealth of Virginia Department of Motor Vehicles Police Crash Report If a question does not apply enter an X. If an answer is unknown enter a U or appropriate number. Other explain in crash description* FR300T Rev 9/03 Traffic control 1. No traffic control 2. Officer or flagger 3. Traffic signal 4. Stop sign 5. Slow or warning sign 6. Traffic lanes marked 7....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA FR300P

Edit your VA FR300P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA FR300P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA FR300P online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA FR300P. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA FR300P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA FR300P

How to fill out VA FR300P

01

Obtain the VA FR300P form from the official VA website or your local VA office.

02

Read the instructions carefully before beginning to fill out the form.

03

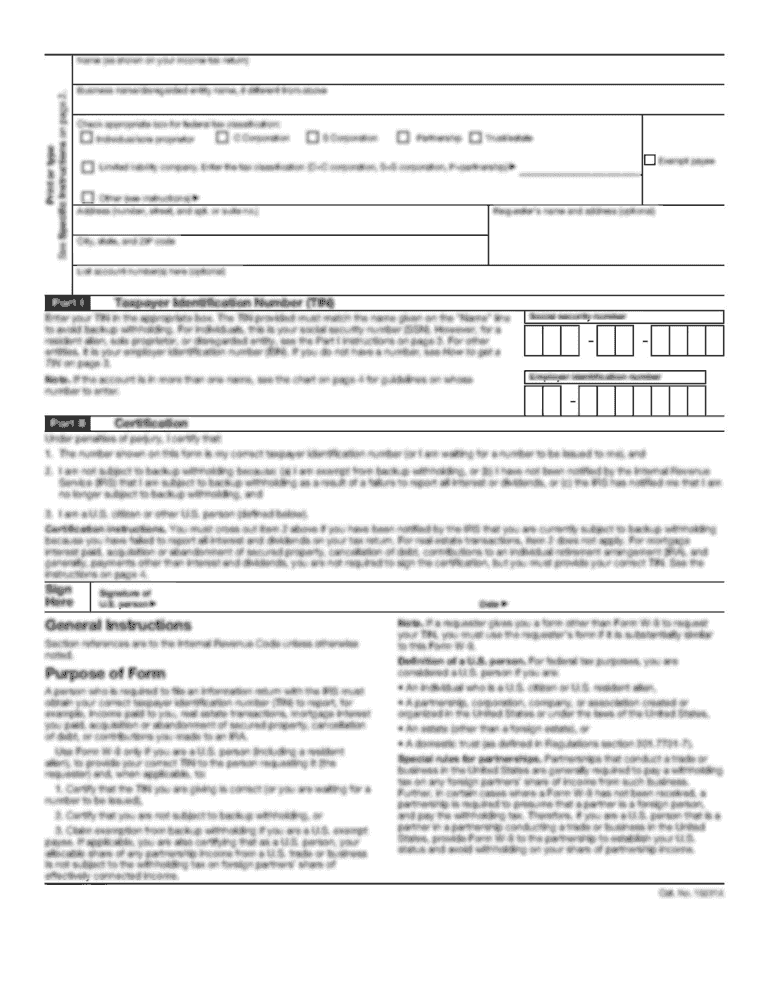

Fill in your personal information, including your name, Social Security number, and contact details.

04

Provide details about the service-related disability or condition.

05

Include information regarding any prior claims or benefits received.

06

Attach any required supporting documents, such as medical records or previous claim outcomes.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form before submission.

09

Submit the form via mail or online as directed by the VA.

Who needs VA FR300P?

01

Veterans who are applying for certain benefits related to service-connected disabilities or conditions.

02

Individuals seeking to update or appeal a previous claim.

03

Survivors or dependents of veterans looking for benefits related to the veteran's service.

Fill

form

: Try Risk Free

People Also Ask about

What is the standard deduction for 2023 in DC?

Standard Deduction: From $12,550 to $12,950 for single and married/registered domestic partner filers filing separately. From $18,800 to $19,400 for head of household filers. From $25,100 to $25,900 for married/registered partners filing jointly and qualifying widow(er) with dependent child(ren) filers.

What is the standard exemption for 2023?

It's also adjusted annually for inflation, so your 2022 standard deduction is larger than it was for 2021, and your 2023 amount will be higher than your 2022 amount.2023 Standard Deduction Amounts. Filing Status2023 Standard DeductionMarried Filing Jointly; Qualifying Widow(er)$27,700Head of Household$20,8001 more row • 13 Mar 2023

Do I have to file taxes if my business didn t make any money?

It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income.

What documents do I need for capital gains tax?

1099-S form to report your capital gains Federal tax law generally requires lenders or real estate agents to file a Form 1099-S, Proceeds from Real Estate Transactions, with the IRS when you sell your home, unless you meet IRS requirements for excluding capital gains tax.

What is the standard deduction change for 2023?

For single taxpayers and married individuals filing separately, the standard deduction rises to $13,850 for 2023, up $900, and for heads of households, the standard deduction will be $20,800 for tax year 2023, up $1,400 from the amount for tax year 2022.

What are the new tax brackets and deductions for 2023?

Tax brackets 2023. For the 2023 tax year, the seven tax brackets are 10%, 12%, 22%, 24%, 32%, 35% and 37%, the same as in 2022. The IRS made significant adjustments to the tax income thresholds for 2023, which means that some people may be in a lower tax bracket than they were previously.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit VA FR300P from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your VA FR300P into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete VA FR300P online?

pdfFiller has made it simple to fill out and eSign VA FR300P. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out VA FR300P on an Android device?

On an Android device, use the pdfFiller mobile app to finish your VA FR300P. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is VA FR300P?

The VA FR300P is a form used by businesses to report their Virginia sales and use tax information to the Virginia Department of Taxation.

Who is required to file VA FR300P?

Businesses in Virginia that are registered for sales and use tax and are required to report their tax liabilities must file the VA FR300P.

How to fill out VA FR300P?

To fill out the VA FR300P, businesses must provide information including their taxable sales, total sales, and any exemptions. The form should be completed accurately and submitted by the due date.

What is the purpose of VA FR300P?

The purpose of VA FR300P is to ensure that businesses report their sales and use tax obligations and remit the appropriate taxes to the state.

What information must be reported on VA FR300P?

Businesses must report information such as total gross sales, taxable sales, allowances for bad debts, and the amount of sales tax collected.

Fill out your VA FR300P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA fr300p is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.