Get the free Vollmacht zur fiskalvertretung - Porath Customs Agents

Show details

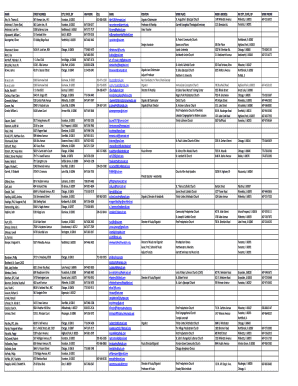

Formula drunken VILLACH OUR FISKALVERTRETUNG 1. Hermit derailed WIR her Firm North GmbH, Am Windhukkai 5, DE 20457 Hamburg, Must Dent NR. DE 812124132, die Villach our Fiskalvertretung each 22a ff

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vollmacht zur fiskalvertretung

Edit your vollmacht zur fiskalvertretung form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vollmacht zur fiskalvertretung form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing vollmacht zur fiskalvertretung online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vollmacht zur fiskalvertretung. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vollmacht zur fiskalvertretung

How to fill out the Vollmacht zur Fiskalvertretung:

01

First, start by providing your personal information. Write your full name, address, and contact details at the top of the form. Make sure to include any relevant reference numbers or tax identification numbers, if applicable.

02

Next, specify the duration of the power of attorney. Indicate whether it is a one-time authorization or if it covers a specific period. Also, mention any limitations or conditions you would like to set.

03

Clearly state the name and address of the authorized representative, also known as the fiscal representative. Include their contact details and any relevant identification or tax numbers.

04

Specify the tax obligations covered by the power of attorney. This may include VAT (Value Added Tax), customs duties, or other specific taxes. Be as specific as possible to avoid any confusion later on.

05

State the purpose of the authorization. Explain why you are granting the fiscal representative the authority to act on your behalf. This could be for tax reporting, communication with tax authorities, or any other related tasks.

06

Clearly outline the scope of the representative's powers. Specify the actions they are authorized to perform on your behalf, such as filing tax returns, making payments, or accessing your tax records. Include any limitations or exclusions as necessary.

07

Consider attaching any supporting documents. Depending on the nature of your business or tax situation, you might need to provide additional documentation to support your authorization. This could include copies of your identification documents, business licenses, or other relevant paperwork.

08

Review the completed form carefully. Make sure all the information is accurate and up-to-date. Double-check that you have provided all the necessary details requested on the form.

Who needs Vollmacht zur Fiskalvertretung:

01

Businesses operating in a foreign country: Companies conducting business in a foreign country may require a fiscal representative to handle their tax obligations in that jurisdiction.

02

Non-resident individuals: If you are a non-resident individual generating income in a foreign country, you may need a fiscal representative to assist you in fulfilling your tax obligations.

03

Companies without a local presence: If your company does not have a physical presence, such as an office or branch, in the country where you are liable to pay taxes, you may need to appoint a fiscal representative to act on your behalf.

Remember, it is always recommended to consult with a tax advisor or legal professional to ensure that you understand the specific requirements and implications of appointing a fiscal representative.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is vollmacht zur fiskalvertretung?

Vollmacht zur Fiskalvertretung is a power of attorney for fiscal representation, allowing a third party to act on behalf of a business in tax matters.

Who is required to file vollmacht zur fiskalvertretung?

Businesses operating in Germany and using a fiscal representative are required to file Vollmacht zur Fiskalvertretung.

How to fill out vollmacht zur fiskalvertretung?

Vollmacht zur Fiskalvertretung can be filled out by providing the necessary information about the business and the fiscal representative, along with signatures from both parties.

What is the purpose of vollmacht zur fiskalvertretung?

The purpose of Vollmacht zur Fiskalvertretung is to authorize a fiscal representative to act on behalf of a business in tax-related matters.

What information must be reported on vollmacht zur fiskalvertretung?

Information such as business details, fiscal representative details, and signatures of both parties must be reported on Vollmacht zur Fiskalvertretung.

How can I modify vollmacht zur fiskalvertretung without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your vollmacht zur fiskalvertretung into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute vollmacht zur fiskalvertretung online?

pdfFiller makes it easy to finish and sign vollmacht zur fiskalvertretung online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I fill out the vollmacht zur fiskalvertretung form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign vollmacht zur fiskalvertretung and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your vollmacht zur fiskalvertretung online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vollmacht Zur Fiskalvertretung is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.