Get the free LOAN #:

Show details

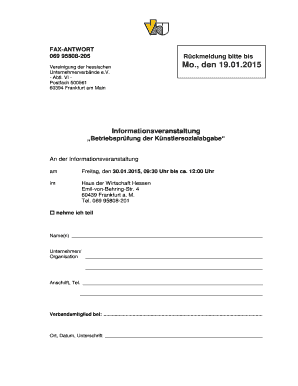

BROKER PRICE OPINION

BORROWER:

LOAN #:

Property Address:

City:

State: KY

Zip Code:

1246 Euclid Ave

Louisville

The above premises was inspected on:

5/5/2014

by:

Jerry L Thomas

The property was:

x Vacant

Occupied

Is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan

Edit your loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit loan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan

How to fill out a loan:

Gather necessary documents:

01

Identification documents such as passport or driver's license.

02

Proof of income such as pay stubs or tax returns.

03

Bank statements or financial statements to demonstrate your financial stability.

04

Information about the loan amount desired and purpose of the loan.

Research and compare lenders:

01

Explore different lenders and loan options to find the best terms and interest rates.

02

Consider factors such as reputation, customer reviews, and loan requirements.

03

Use online loan comparison tools or consult with financial advisors for guidance.

Complete the loan application:

01

Fill out the loan application form accurately and completely.

02

Provide all the required personal and financial information.

03

Double-check the application for any errors or missing details.

Submit supporting documents:

01

Attach all the necessary documents to the loan application.

02

Ensure that the documents are up-to-date and relevant.

03

Make copies of the documents for your own records.

Wait for approval:

01

Once the application is submitted, the lender will review your information.

02

This process may take a few days to a few weeks, depending on the lender and the loan type.

03

Be prepared to provide additional information or documents if requested by the lender.

Review the loan terms:

01

If your loan application is approved, carefully review the loan terms and conditions.

02

Understand the interest rate, repayment schedule, and any associated fees.

03

Clarify any doubts or questions with the lender before proceeding.

Sign the loan agreement:

01

Once you are satisfied with the loan terms, sign the loan agreement.

02

Ensure that you understand all the clauses and obligations mentioned in the agreement.

03

Keep a copy of the signed agreement for future reference.

Receive loan funds:

01

After the loan agreement is signed, the lender will disburse the loan funds.

02

It may take a few days for the funds to be transferred to your bank account.

03

Use the loan funds responsibly and according to the stated purpose.

Who needs a loan:

01

Individuals seeking to finance a large purchase, such as a car or a house, may need a loan to cover the cost.

02

Start-up businesses or entrepreneurs may need loans to fund their business operations or to invest in growth opportunities.

03

People facing unexpected expenses, such as medical bills or home repairs, may require a loan to cover these financial burdens.

04

Individuals looking to consolidate high-interest debts into a single, more manageable loan may find a loan beneficial.

05

Students pursuing higher education often rely on loans to pay for tuition fees, textbooks, and living expenses.

06

Individuals planning major life events, like weddings or vacations, may opt for a loan to finance these endeavors.

07

Those aiming to improve their credit scores may consider taking out a loan and making timely repayments to establish a positive borrowing history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan?

Loan is a financial arrangement in which a lender gives money or property to a borrower, and the borrower agrees to return the property or repay the money, usually along with interest, at a future date.

Who is required to file loan?

Individuals or organizations who wish to borrow money from a lender are required to file a loan application in order to be considered for the loan.

How to fill out loan?

To fill out a loan application, you typically need to provide information about your identity, income, employment, and financial history. You may also need to provide details about the purpose of the loan and how you plan to repay it.

What is the purpose of loan?

The purpose of a loan is to provide individuals or organizations with access to funds that they can use for various purposes, such as purchasing a home, starting a business, or financing education.

What information must be reported on loan?

The information that must be reported on a loan application typically includes personal information, employment details, income, financial assets and liabilities, and details about the intended use of the loan funds.

How do I modify my loan in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your loan and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send loan to be eSigned by others?

When you're ready to share your loan, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I fill out loan using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign loan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.