Get the free Insurance claims to repair your home may be unlike anything youve ever dealt with

Show details

Dear Client:

Insurance claims to repair your home may be unlike anything you've ever dealt with. They feel a little like

an insurance claim and a little like remodeling. The process is somewhat confusing,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance claims to repair

Edit your insurance claims to repair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance claims to repair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

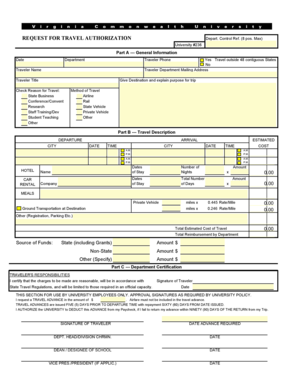

Editing insurance claims to repair online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit insurance claims to repair. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance claims to repair

How to fill out insurance claims to repair:

01

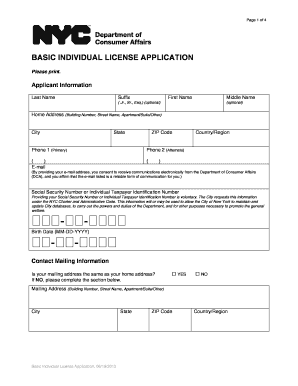

Gather all necessary information: Before starting the claims process, ensure you have all relevant details such as policy number, date and time of the incident, and a detailed description of the damage.

02

Contact your insurance company: Reach out to your insurance company as soon as possible to inform them about the damage and initiate the claims process. They will provide you with specific instructions and necessary forms.

03

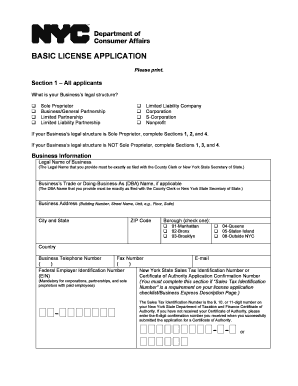

Fill out the claim form: Obtain the appropriate claim form from your insurance company. Carefully fill out all required fields, providing accurate information about the incident, damage, and any third parties involved.

04

Attach supporting documentation: Collect any supporting documents that can substantiate your claim, such as photographs of the damage, police reports (if applicable), receipts for repairs or replacements, and any other relevant evidence.

05

Provide detailed descriptions: Be as detailed and thorough as possible when describing the damage. Include information about the cause of the damage, the extent of it, and any other important factors that can support your claim.

06

Be honest and accurate: It is crucial to provide truthful and accurate information on the claim form. Any false or misleading information can result in a denial of your claim and potential legal consequences.

Who needs insurance claims to repair:

01

Homeowners: Homeowners who experience damage to their property, whether due to natural disasters, accidents, or vandalism, may need to file insurance claims to cover the costs of repair.

02

Vehicle owners: In the event of an accident, collision, burglary, or damage caused by external factors like storms, vehicle owners may require insurance claims to repair their cars, motorcycles, or other forms of transportation.

03

Business owners: Business establishments can also face damages that require repairs, such as structural damage, fire or water damage, or theft. Insurance claims can provide financial assistance to repair or replace affected properties.

04

Renters: While renters may not own the property they reside in, they may still need to file insurance claims for damages to personal belongings caused by factors outside of their control, such as fires, floods, or break-ins.

05

Individuals with specialized insurance: People with specialized insurance policies like boat or jewelry insurance might need to file claims for repairs in case of damage or loss to their valuable assets.

06

Contractors or tradespeople: Professionals in the construction and trades industry may need to file insurance claims to repair or replace tools, equipment, or materials that have been damaged or stolen while on the job.

Note: It is important to remember that insurance policies vary, and the specific requirements for filing claims may differ between companies and policy types. Consult your insurance provider and policy documents for accurate and personalized guidance.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is insurance claims to repair?

Insurance claims to repair are requests submitted by policyholders to their insurance company for coverage of damages to their property that require repairs.

Who is required to file insurance claims to repair?

Policyholders who have experienced damages to their property that are covered under their insurance policy are required to file insurance claims to repair.

How to fill out insurance claims to repair?

To fill out insurance claims to repair, policyholders must contact their insurance company, provide details about the damages, complete the necessary forms, and submit any required documentation.

What is the purpose of insurance claims to repair?

The purpose of insurance claims to repair is to ensure that policyholders receive financial assistance from their insurance company to cover the costs of repairing damages to their property.

What information must be reported on insurance claims to repair?

Policyholders must report details about the damages, the cause of the damages, the estimated cost of repairs, and any relevant documentation such as photos or receipts.

How can I edit insurance claims to repair from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like insurance claims to repair, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I edit insurance claims to repair in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing insurance claims to repair and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete insurance claims to repair on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your insurance claims to repair from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Fill out your insurance claims to repair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Claims To Repair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.