UK SA103S 2015 free printable template

Show details

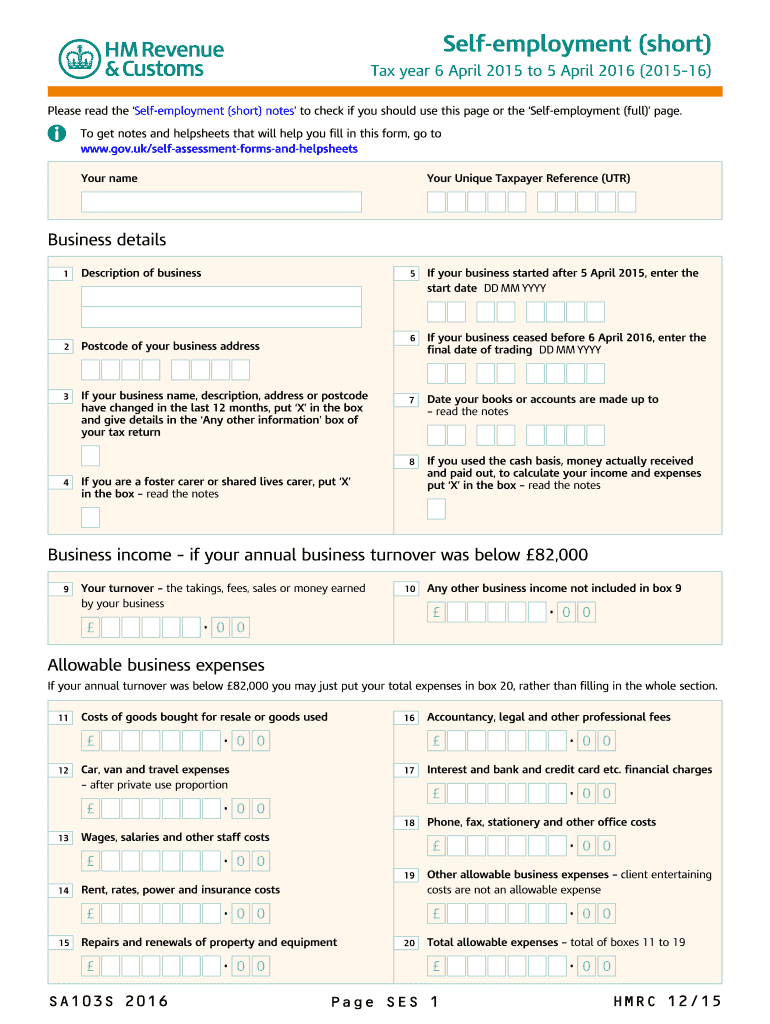

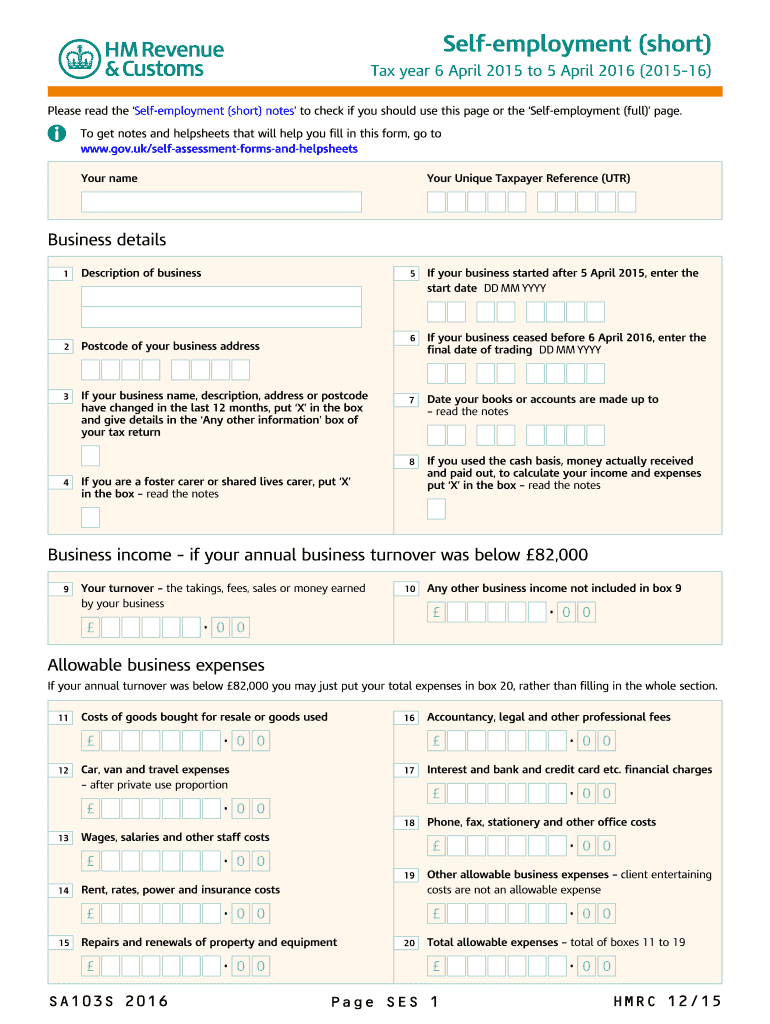

Self-employment (short) Tax year 6 April 2015 to 5 April 2016 (201516) Please read the Self employment (short) notes to check if you should use this page or the Self employment (full) page. To get

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign sa103s

Edit your sa103s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sa103s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sa103s online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sa103s. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK SA103S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out sa103s

How to fill out UK SA103S

01

Gather all relevant information regarding your self-employment income and expenses.

02

Download the UK SA103S form from the HM Revenue and Customs (HMRC) website.

03

Fill out the personal details section, including your name, address, and National Insurance number.

04

Enter your income from self-employment in the appropriate section.

05

Calculate and enter allowable expenses to deduct from your income.

06

Complete any relevant supplementary sections, such as those for multiple businesses.

07

Review the form for accuracy and ensure all calculations are correct.

08

Submit the form either online via HMRC's self-assessment service or by post.

Who needs UK SA103S?

01

Self-employed individuals in the UK whose annual income exceeds the tax-free allowance and need to report their profits for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

What does self Assessment mean for income?

Self-assessment means that you are responsible for making your own assessment of tax due. You pay Preliminary Tax (an estimate of tax due for your current trading year) on or before 31 October each year and make a tax return for the previous year not later than 31 October.

What is the self-employment tax deduction?

Yes, you can deduct self-employment tax as a business expense. It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

What is self assessment for self-employed?

Self Assessment is a system HM Revenue and Customs ( HMRC ) uses to collect Income Tax. Tax is usually deducted automatically from wages and pensions. People and businesses with other income (including COVID-19 grants and support payments) must report it in a tax return.

What is SA103?

The SA103 forms are supplementary tax return forms filling out details about your self-employment on your Self Assessment.

What is the self-employment tax rate for 2023?

If you're self-employed, you pay the combined employee and employer amount. This amount is a 12.4% Social Security tax on up to $160,200 of your net earnings and a 2.9% Medicare tax on your entire net earnings.

What is the difference between self Assessment and self-employed?

Self Assessment is the tax return process for self-employed people. Whereas HMRC collects income tax from employees directly through the PAYE system, the self-employed need to work out their income and expenses and then pay their bill each January.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my sa103s in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your sa103s and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify sa103s without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your sa103s into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Can I create an electronic signature for signing my sa103s in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your sa103s and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is UK SA103S?

UK SA103S is a self-assessment supplementary form for individuals who have income from self-employment and need to report their trading income to HM Revenue and Customs (HMRC).

Who is required to file UK SA103S?

Individuals who are self-employed and have income from their business activities are required to file UK SA103S as part of their self-assessment tax return.

How to fill out UK SA103S?

To fill out UK SA103S, gather your self-employment income and expenses, complete sections that detail your trading income, allowable expenses, and any other relevant financial information, then submit it along with your tax return to HMRC.

What is the purpose of UK SA103S?

The purpose of UK SA103S is to provide HMRC with detailed information about a taxpayer's self-employment income and expenses, ensuring accurate assessment of their tax obligations.

What information must be reported on UK SA103S?

UK SA103S requires reporting of the total sales or turnover, cost of goods sold, allowable business expenses, and profit or loss calculation for the self-employment activities.

Fill out your sa103s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

sa103s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.