Get the free Automated Recurring Billing ARB guide - bNevusb - nevus

Show details

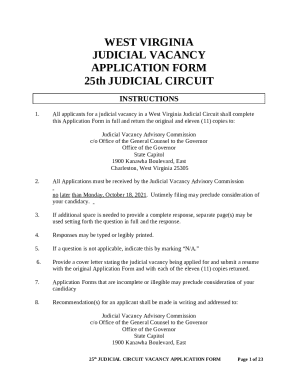

Merchant Web Services API Automated Recurring Billing (ARB) XML Guide Authorize. Net Developer Support http://developer.authorize.net Authorize. Net LLC 042007 Very.1.0 Authorize. Net LLC (Authorize.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign automated recurring billing arb

Edit your automated recurring billing arb form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your automated recurring billing arb form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit automated recurring billing arb online

Follow the steps down below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit automated recurring billing arb. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out automated recurring billing arb

How to fill out automated recurring billing arb:

01

Gather all necessary information: Before filling out the automated recurring billing (ARB) form, make sure you have all the required information on hand. This includes details such as the customer's name, address, payment method, billing amount, and frequency of billing.

02

Access the ARB form: Log in to your merchant account or payment system provider's website and navigate to the automated recurring billing section. Locate the ARB form or option to set up recurring billing.

03

Enter customer details: Begin by entering the customer's name and contact information. Ensure that you have accurate and up-to-date information to facilitate smooth automated recurring billing.

04

Choose payment method: Select the payment method the customer wishes to use for their recurring payments. This can include credit/debit cards, ACH payment, or any other supported payment method.

05

Set recurring billing frequency: Specify the frequency at which you want to bill the customer. This could be weekly, monthly, quarterly, annually, or any other interval that suits your business model.

06

Enter billing amount: Indicate the amount that needs to be billed to the customer on each recurring cycle. Be sure to double-check this value to avoid any errors in charging the customer.

07

Provide billing details: If there are any additional billing details required, such as product descriptions or service descriptions, ensure that you fill them out accurately. These details may vary depending on your business type.

08

Review and confirm: Before finalizing the ARB setup, carefully review all the information you have entered. Make sure there are no errors or discrepancies in the customer's details or the billing information. Once you are satisfied, confirm the setup.

Who needs automated recurring billing arb?

01

Subscription-based businesses: Companies that offer products or services on a subscription basis can benefit greatly from automated recurring billing. This helps facilitate timely and hassle-free payments from their customers on a recurring basis.

02

Membership organizations: Associations, gyms, clubs, and other membership-based organizations often require recurring billing to collect membership fees from their members. Automated recurring billing makes this process seamless and efficient.

03

Service providers: Businesses that provide ongoing services, such as web hosting, software as a service (SaaS), or maintenance contracts, can utilize automated recurring billing to ensure timely payments for their services.

04

E-commerce businesses: Online stores that have a subscription or recurring product model can utilize automated recurring billing to bill customers for regular product deliveries or membership access.

In summary, individuals and businesses that require regular, predictable payments can benefit from automated recurring billing (ARB). It streamlines the billing process, reduces administrative burden, and improves cash flow management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find automated recurring billing arb?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the automated recurring billing arb in seconds. Open it immediately and begin modifying it with powerful editing options.

How can I edit automated recurring billing arb on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing automated recurring billing arb, you need to install and log in to the app.

How do I edit automated recurring billing arb on an Android device?

The pdfFiller app for Android allows you to edit PDF files like automated recurring billing arb. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is automated recurring billing arb?

Automated Recurring Billing (ARB) is a feature of Authorize.Net that enables merchants to automatically charge a customer's credit card for goods or services at regular intervals.

Who is required to file automated recurring billing arb?

Merchants who want to set up recurring billing for their customers are required to file Automated Recurring Billing (ARB).

How to fill out automated recurring billing arb?

To fill out automated recurring billing arb, merchants need to set up an account with Authorize.Net, enter the customer's payment information, create a billing plan, and schedule the recurring payments.

What is the purpose of automated recurring billing arb?

The purpose of automated recurring billing arb is to streamline the payment process for merchants and provide convenience for customers who want to set up automatic payments for goods or services.

What information must be reported on automated recurring billing arb?

The information that must be reported on automated recurring billing arb includes customer payment details, billing frequency, amount to be charged, and the duration of the billing plan.

Fill out your automated recurring billing arb online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Automated Recurring Billing Arb is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.