Get the free Deduct-a-Buck Authorization & Information Form - mcul

Show details

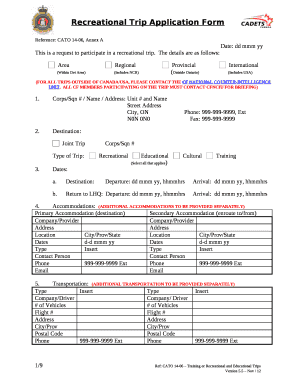

This form is designed for members of the Credit Union to authorize deductions for contributions to the Deduct-a-Buck program, including various options for the deduction schedule and contact information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deduct-a-buck authorization information form

Edit your deduct-a-buck authorization information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deduct-a-buck authorization information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deduct-a-buck authorization information form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit deduct-a-buck authorization information form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deduct-a-buck authorization information form

How to fill out Deduct-a-Buck Authorization & Information Form

01

Begin by downloading the Deduct-a-Buck Authorization & Information Form from the official website.

02

Fill in your personal details at the top of the form, including your full name, address, and contact information.

03

Provide the specific amount you wish to deduct from your account, following any guidelines specified in the form.

04

If required, indicate the reason for the deduction in the designated section.

05

Review all the information filled in to ensure accuracy.

06

Sign and date the form at the bottom to authorize the deduction.

07

Submit the completed form according to the instructions provided, either by mail or electronically.

Who needs Deduct-a-Buck Authorization & Information Form?

01

Anyone interested in enrolling in the Deduct-a-Buck program.

02

Individuals who wish to set up automated deductions from their accounts.

03

Participants in programs requiring funding contributions or donations.

Fill

form

: Try Risk Free

People Also Ask about

Can I write off an entire car?

You can deduct car expenses only if you are self-employed as a contractor (freelancer or gig worker), or you are a business owner. You may be able to deduct all or part of the purchase price of your vehicle in the first year of business use, using the Section 179 deduction.

What is the IRS form for deductions?

More In Forms and Instructions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions.

What vehicles qualify for 100% bonus depreciation?

Vehicle Weight is Key: This tax benefit applies fully to 'heavy' vehicles with a Gross Vehicle Weight Rating (GVWR) over 6,000 pounds. Most heavy-duty pickup trucks, chassis cabs, and cargo vans fall into this category. Bonus Depreciation (Section 168k) vs.

How to qualify for Section 179 deduction?

To benefit from Section 179, your purchased or financed property must meet all of the following requirements: Business Usage Exceeding 50% “New to You” Acquisition. Placed in Service During the Same Tax Year. Purchased or Financed (Not From Related Parties)

What deductions can be claimed on Form 706?

Some of the deductions that can be taken on Form 706 include the below: Funeral Expenses. Unpaid Debts of the Decedent: Claims Against the Estate. Medical and Dental Expenses. Certain Taxes. Theft and Casualty Losses. Statutory Deductions Unrelated to Expenses:

Can I deduct the full price of a vehicle?

You can deduct car expenses only if you are self-employed as a contractor (freelancer or gig worker), or you are a business owner. You may be able to deduct all or part of the purchase price of your vehicle in the first year of business use, using the Section 179 deduction.

What is the maximum you can claim for car expenses?

You can claim a maximum of 5,000 work-related kilometres per car. You need to keep records that show how you work out your work-related kilometres.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deduct-a-Buck Authorization & Information Form?

The Deduct-a-Buck Authorization & Information Form is a document used to authorize the deduction of specified amounts from a person's account for particular purposes, often related to financial transactions or program participation.

Who is required to file Deduct-a-Buck Authorization & Information Form?

Individuals or entities that wish to authorize deductions for payments or contributions typically need to file the Deduct-a-Buck Authorization & Information Form.

How to fill out Deduct-a-Buck Authorization & Information Form?

To fill out the Deduct-a-Buck Authorization & Information Form, individuals should provide their personal and financial information, specify the amount to be deducted, indicate the purpose of the deduction, and sign the form to authorize it.

What is the purpose of Deduct-a-Buck Authorization & Information Form?

The purpose of the Deduct-a-Buck Authorization & Information Form is to grant permission for automatic deductions from an account, ensuring that the payer and the recipient have a clear understanding of the agreement.

What information must be reported on Deduct-a-Buck Authorization & Information Form?

The information that must be reported on the form includes the account holder's name, account number, the amount to be deducted, the frequency of deductions, the purpose of deductions, and the signature of the account holder.

Fill out your deduct-a-buck authorization information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deduct-A-Buck Authorization Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.