Get the free Tax practitioner seminar - Long Island University - liu

Show details

Registration at the door depending upon available space. Refund Policy For more information regarding administration policies such as complaints or refunds please contact our office at (718) 7804062.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax practitioner seminar

Edit your tax practitioner seminar form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax practitioner seminar form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax practitioner seminar online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax practitioner seminar. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax practitioner seminar

How to fill out a tax practitioner seminar:

01

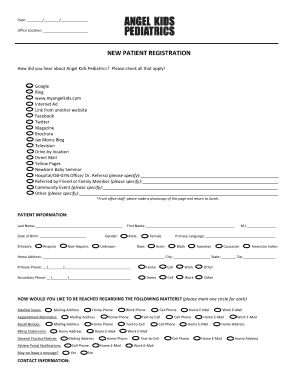

Research the requirements: Before attending the tax practitioner seminar, it is essential to understand the qualifications and prerequisites necessary to participate. Research the specific requirements set by the seminar organizers or relevant tax authorities to ensure eligibility.

02

Complete the registration process: Once you have confirmed your eligibility, proceed with the registration process. Fill out the necessary forms or online registration, providing accurate personal information and any requested documentation, such as identification or proof of professional qualifications.

03

Pay the registration fee: Some tax practitioner seminars may have a registration fee associated with attendance. Check the seminar's website or registration materials for information on payment methods and deadlines. Ensure that the fee is paid promptly to secure your spot in the seminar.

04

Prepare in advance: Before the seminar, familiarize yourself with the topics and agenda. Review any materials or prerequisites provided by the organizers to have a basic understanding of the subject matter. This preparation will maximize the benefit you gain from attending the seminar.

05

Attend the seminar: On the day(s) of the seminar, arrive on time and be prepared to actively participate. Bring any necessary materials such as notebooks, pens, or laptops to take notes. Engage in discussions, ask questions, and network with other participants and presenters to enhance your learning experience.

Who needs a tax practitioner seminar:

01

Tax professionals: Tax practitioner seminars are particularly valuable for tax professionals, such as accountants, tax advisors, enrolled agents, or lawyers, who want to expand their knowledge and stay updated with the latest tax laws, regulations, and practices. These seminars provide excellent opportunities to learn about changes in tax codes, new strategies, and best practices in the field.

02

Small business owners: Small business owners or self-employed individuals who handle their own tax affairs can also benefit from attending tax practitioner seminars. These seminars can help them understand the nuances of tax preparation, deductions, credits, and compliance requirements, enabling them to make more informed financial decisions and maximize tax benefits.

03

Students or aspiring professionals: Students pursuing a career in taxation or individuals interested in becoming tax professionals can greatly benefit from attending tax practitioner seminars. These events offer valuable insights into the industry, introduce them to current issues and trends, and provide networking opportunities with experienced professionals.

04

Individuals seeking to enhance personal tax knowledge: Even if you are not directly involved in tax-related professions, attending a tax practitioner seminar can still be beneficial. It can help you understand the basics of taxation, navigate personal tax situations effectively, and stay informed about potential changes that may impact your financial decisions.

Overall, a tax practitioner seminar is valuable for anyone looking to expand their tax knowledge, stay updated with tax laws, or advance their career in the field. Whether you are a professional, business owner, student, or individual, attending such seminars can provide valuable insights and enhance your understanding of taxation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax practitioner seminar online?

pdfFiller has made it simple to fill out and eSign tax practitioner seminar. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I create an electronic signature for signing my tax practitioner seminar in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your tax practitioner seminar and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the tax practitioner seminar form on my smartphone?

Use the pdfFiller mobile app to complete and sign tax practitioner seminar on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is tax practitioner seminar?

A tax practitioner seminar is a training or educational event for individuals who work as tax professionals.

Who is required to file tax practitioner seminar?

Tax practitioners who are mandated by their professional organizations or regulatory bodies to participate in continuing education may be required to file a tax practitioner seminar.

How to fill out tax practitioner seminar?

Tax practitioners can typically fill out a tax practitioner seminar by attending the seminar, completing any required coursework or assessments, and submitting the necessary documentation to their professional organization or regulatory body.

What is the purpose of tax practitioner seminar?

The purpose of a tax practitioner seminar is to ensure that tax professionals stay current on tax laws, regulations, and best practices in order to provide accurate and high-quality service to their clients.

What information must be reported on tax practitioner seminar?

Information such as the name and date of the seminar, the topics covered, the number of hours attended, and any assessments or certifications obtained may need to be reported on a tax practitioner seminar.

Fill out your tax practitioner seminar online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Practitioner Seminar is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.