Get the free JO/S S104 - coac

Show details

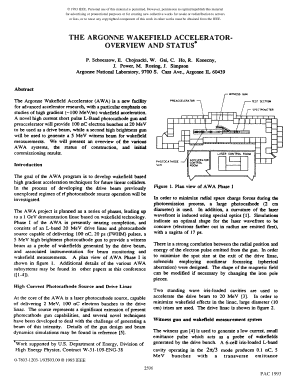

JO/S S104 01/06/2010 158199-2010-FR tats members — March de services — Avis de concourse Avis de concourse 1/5 CET Avis SUR LE site TED: http://ted.europa.eu/udl?uri TED:NOTICE:158199-2010:TEXT:FR:HTML

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign jos s104 - coac

Edit your jos s104 - coac form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your jos s104 - coac form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing jos s104 - coac online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit jos s104 - coac. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out jos s104 - coac

How to Fill Out JOS S104 - COAC:

01

Start by gathering all the necessary information: Before you start filling out JOS S104 - COAC, make sure you have all the required information at hand. This may include personal details, such as your name, contact information, and social security number, as well as specific information related to the purpose or context of the form.

02

Read the instructions carefully: It is crucial to thoroughly read and understand the instructions provided with JOS S104 - COAC. This will help you navigate through the form correctly and avoid any mistakes or confusion during the filling process.

03

Follow the specified format: JOS S104 - COAC might require you to provide information in a specific format or order. Ensure that you adhere to these guidelines to ensure accuracy and consistency.

04

Use legible handwriting or type: If you are filling out the form manually, ensure that your handwriting is clear and legible. If possible, consider typing the information to minimize the chances of misinterpretation or errors.

05

Complete all required fields: Fill in each mandatory field on JOS S104 - COAC. Pay attention to any asterisks or notes indicating essential information that must be provided. Leaving out required fields could lead to delays or rejection of the form.

06

Verify accuracy and completeness: Once you have filled out the form, review it carefully to ensure all information is accurate and complete. This step is vital to avoid potential issues or delays in processing your submission.

07

Seek assistance if needed: If you encounter difficulties or have questions while filling out JOS S104 - COAC, don't hesitate to seek help. You can consult a supervisor, HR representative, or the form's instructions for guidance.

Who needs JOS S104 - COAC?

01

Job applicants: Individuals who are applying for a position or seeking employment within an organization may need to complete JOS S104 - COAC. It may require them to provide background information, qualifications, and other relevant details.

02

Human Resources departments: HR departments often utilize JOS S104 - COAC as part of their recruitment and onboarding processes. They may require job applicants to fill out this form to gather essential information for evaluation and decision-making purposes.

03

Employers and hiring managers: Employers and hiring managers utilize JOS S104 - COAC to assess candidates for job vacancies. This form helps them collect standardized information about applicants, enabling them to make informed decisions during the recruitment process.

04

Organizational administrators: Administrators within an organization may require individuals to fill out JOS S104 - COAC for various administrative purposes, such as updating employee records, verifying qualifications, or complying with legal and regulatory requirements.

In conclusion, filling out JOS S104 - COAC involves gathering necessary information, carefully following instructions, using legible handwriting, completing all required fields, and verifying accuracy. This form is commonly used by job applicants, HR departments, employers, hiring managers, and organizational administrators.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is jos s104 - coac?

jos s104 - coac refers to a specific form used for reporting financial information by certain individuals and entities.

Who is required to file jos s104 - coac?

The individuals and entities required to file jos s104 - coac are those who meet certain criteria set by the tax authorities.

How to fill out jos s104 - coac?

To fill out jos s104 - coac, you need to gather all the required financial information and accurately report it on the form as per the provided instructions.

What is the purpose of jos s104 - coac?

The purpose of jos s104 - coac is to provide the tax authorities with detailed financial information for the purpose of tax compliance and transparency.

What information must be reported on jos s104 - coac?

The specific information that must be reported on jos s104 - coac includes details of income, expenses, assets, liabilities, and any other relevant financial information as specified by the tax authorities.

Can I sign the jos s104 - coac electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your jos s104 - coac in minutes.

How do I fill out jos s104 - coac using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign jos s104 - coac. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit jos s104 - coac on an Android device?

The pdfFiller app for Android allows you to edit PDF files like jos s104 - coac. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your jos s104 - coac online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Jos s104 - Coac is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.