Get the free Mobile Remote Deposit Application - bmhpfcubborgb

Show details

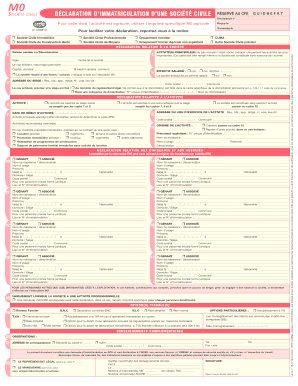

Mobile Remote Deposit Application Contact Information: Credit Union Account # Name Street Address City State Zip Code Home Phone Work Phone Cell Phone Email Address Daily Deposit Limit Request: $500

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mobile remote deposit application

Edit your mobile remote deposit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mobile remote deposit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mobile remote deposit application online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mobile remote deposit application. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mobile remote deposit application

How to fill out a mobile remote deposit application:

01

Access the mobile banking app: Download the mobile banking app from your bank's website or app store. If you don't have a mobile banking account, you may need to enroll before proceeding.

02

Sign in or create an account: Open the app and sign in using your online banking credentials. If you don't have an account, follow the prompts to create one.

03

Locate the mobile remote deposit option: Once you have logged in, navigate to the menu or settings section of the app. Look for the option that mentions mobile remote deposit. It is usually under the "Deposit" or "Mobile Check Deposit" tab.

04

Provide personal information: Fill out the required fields with your personal information, such as your name, address, phone number, and email. This information helps the bank verify your identity and contact you if needed.

05

Set up deposit account: Select the account where you want the deposited funds to be credited. This is usually your checking account, but it can vary depending on your bank.

06

Accept terms and conditions: Read through the terms and conditions related to mobile remote deposit. These usually highlight important information about fees, deposit limits, and the bank's policies regarding returned checks. If you agree, click on the accept button to proceed.

07

Take a picture of the check: Follow the prompts to take clear and legible photos of the front and back of the check using your mobile device's camera. Make sure the check is properly endorsed with your signature and any required additional endorsement, such as "For mobile deposit only."

08

Enter check details: After taking the photos, enter the check amount and any other required details as prompted by the app. This ensures that the correct amount is deposited into your account.

09

Review and submit: Double-check all the information you have provided before submitting the deposit. Review the check images, the amount entered, and the account where you want the funds deposited. If everything looks correct, submit the deposit for processing.

Who needs a mobile remote deposit application?

01

Individuals who receive checks regularly: A mobile remote deposit application is useful for individuals who often receive checks as payment or reimbursement. It allows them to deposit these checks quickly and conveniently without visiting a physical bank branch.

02

Business owners: Business owners, especially those who operate small businesses or are self-employed, can benefit from a mobile remote deposit application. They can easily deposit customer payments or business checks directly into their business accounts, saving time and avoiding potential delays.

03

People who prefer banking on the go: If you prefer managing your finances on your mobile device and want to avoid visiting the bank for simple tasks like depositing checks, a mobile remote deposit application is perfect for you. It provides the flexibility and convenience of banking anytime and anywhere.

04

Those who value time-saving solutions: Mobile remote deposit eliminates the need to physically go to the bank or find an ATM to deposit checks. Instead, you can simply take a photo of the check and submit it through the app. This saves you valuable time and effort.

05

Individuals concerned about check security: With a mobile remote deposit application, checks are securely transmitted and deposited digitally, reducing the risk of losing or misplacing physical checks. This can provide peace of mind for individuals concerned about check security.

In conclusion, anyone who receives checks regularly, values convenience, prefers mobile banking, wants to save time, or prioritizes check security can benefit from a mobile remote deposit application.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my mobile remote deposit application directly from Gmail?

mobile remote deposit application and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an eSignature for the mobile remote deposit application in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your mobile remote deposit application and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete mobile remote deposit application on an Android device?

Complete your mobile remote deposit application and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is mobile remote deposit application?

Mobile remote deposit application is a service that allows users to deposit checks into their bank accounts using their mobile devices.

Who is required to file mobile remote deposit application?

Users who wish to utilize the mobile remote deposit service offered by their bank are required to file a mobile remote deposit application.

How to fill out mobile remote deposit application?

To fill out a mobile remote deposit application, users need to provide their personal information, account details, and agree to the terms and conditions of the service.

What is the purpose of mobile remote deposit application?

The purpose of a mobile remote deposit application is to provide users with a convenient way to deposit checks without having to visit a bank branch.

What information must be reported on mobile remote deposit application?

The mobile remote deposit application typically requires users to report their full name, address, phone number, account number, and the check amount being deposited.

Fill out your mobile remote deposit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mobile Remote Deposit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.