Get the free Insurance Application Lifestyle cover

Show details

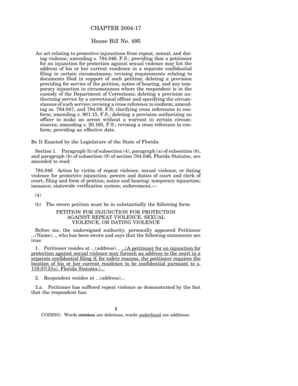

Super Insurance Application Lifestyle cover Use this form to increase your Death only or Death and Total and Permanent Disablement (TED) cover due to a specific life event. The Funds' lifestyle event

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance application lifestyle cover

Edit your insurance application lifestyle cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance application lifestyle cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance application lifestyle cover online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit insurance application lifestyle cover. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance application lifestyle cover

How to fill out insurance application lifestyle cover?

01

Gather all necessary personal information: To fill out an insurance application for lifestyle cover, you will need to provide your personal information such as your full name, date of birth, contact details, and address. Make sure to have this information readily available.

02

Understand the coverage options: Before filling out the application, it's crucial to have a clear understanding of the different coverage options that the insurance company offers. Read through the policy documents, terms, and conditions to ensure that you select the right coverage that suits your lifestyle needs.

03

Complete the application form accurately: Carefully read through the application form and provide accurate and detailed information. This may include your occupation, income, lifestyle habits, hobbies, and any pre-existing medical conditions. Providing truthful information is essential to avoid any issues when making a claim in the future.

04

Seek assistance if needed: If you are unsure about any section of the application form or need clarification, don't hesitate to reach out to the insurance company's customer service or contact an insurance agent. They can help you understand the process and answer any questions you may have.

05

Review and double-check your application: Before submitting the application, take the time to review every section to ensure that all the information provided is correct and complete. Errors or missing information can lead to delays or complications during the underwriting process.

06

Submit the application: Once you are certain that the application is filled out accurately, submit it to the insurance company through the preferred method mentioned in their instructions. This may include online submission, mailing, or hand-delivery.

Who needs insurance application lifestyle cover?

01

Individuals with dependents: If you have dependents, such as a spouse, children, or elderly parents, you may want to consider lifestyle cover to provide financial protection for them in case of your unforeseen death or disability.

02

Anyone with outstanding debts: If you have significant debts, such as a mortgage, personal loans, or credit card debt, lifestyle cover can help ensure that these obligations are paid off if you were to pass away or become disabled.

03

Individuals with high-risk hobbies or occupations: If you engage in high-risk activities or have a hazardous occupation, such as extreme sports, aviation, or mining, lifestyle cover can provide financial support to your loved ones if an accident were to occur.

04

Self-employed individuals: Self-employed individuals often lack the benefits provided by traditional employment, such as life insurance coverage. Having lifestyle cover can protect their income and provide financial security for their families in case of unexpected events.

05

Those seeking peace of mind: Even if you don't fall into any of the specific categories mentioned above, anyone who wants peace of mind knowing that their loved ones will be financially taken care of can benefit from lifestyle cover. It provides a safety net and financial protection for your family's future.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send insurance application lifestyle cover for eSignature?

When you're ready to share your insurance application lifestyle cover, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I sign the insurance application lifestyle cover electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your insurance application lifestyle cover in minutes.

How can I fill out insurance application lifestyle cover on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your insurance application lifestyle cover. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is insurance application lifestyle cover?

Insurance application lifestyle cover is a type of insurance policy that provides financial protection for individuals and their families in the event of death or disability.

Who is required to file insurance application lifestyle cover?

Anyone who wants to ensure financial security for their loved ones in case of unforeseen circumstances should consider filing insurance application lifestyle cover.

How to fill out insurance application lifestyle cover?

To fill out insurance application lifestyle cover, one must provide personal information, medical history, and choose a coverage amount that suits their needs.

What is the purpose of insurance application lifestyle cover?

The purpose of insurance application lifestyle cover is to provide financial peace of mind and security for individuals and their families.

What information must be reported on insurance application lifestyle cover?

Information such as personal details, medical history, lifestyle habits, and chosen coverage amount must be reported on insurance application lifestyle cover.

Fill out your insurance application lifestyle cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Application Lifestyle Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.