Get the free 2009 D-41 Fiduciary Income Tax Return

Show details

This document is a tax return form for fiduciaries in the District of Columbia, meant for reporting income, deductions, and tax calculations for estates and trusts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 d-41 fiduciary income

Edit your 2009 d-41 fiduciary income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 d-41 fiduciary income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 d-41 fiduciary income online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2009 d-41 fiduciary income. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 d-41 fiduciary income

How to fill out 2009 D-41 Fiduciary Income Tax Return

01

Obtain the 2009 D-41 Fiduciary Income Tax Return form from the relevant tax authority.

02

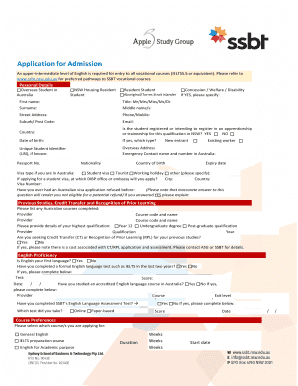

Complete the identification section with the trust or estate's name, address, and tax identification number.

03

Fill in the income section by reporting all income earned by the trust or estate, including dividends, interest, and capital gains.

04

Deduct any allowable expenses related to the administration of the trust or estate from the total income.

05

Calculate the fiduciary income tax liability using the applicable tax rates for the year.

06

Complete any additional schedules or forms that are required for specific types of income or deductions.

07

Sign and date the form, ensuring that it is filed by the tax deadline.

Who needs 2009 D-41 Fiduciary Income Tax Return?

01

Any trust or estate that generated income during the 2009 tax year and is required to report its income to the tax authority.

02

Fiduciaries managing estates or trusts on behalf of beneficiaries who need to comply with federal and state tax obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is a 1041 fiduciary tax return?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is the purpose of a 1041?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

What is the time limit for condonation of delay in income tax?

You must submit your condonation applications within five years from the end of the relevant assessment year. If you received a refund based on a court order, the five-year limit does not include the duration your case was pending in court. You have six months from the date of the court order to apply for condonation.

Who must file a 1041 tax return?

Income tax on income generated by assets of the estate of the deceased. If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes.

What is the fiduciary tax return?

And the estate really captures all of the income – the fiduciary income tax return captures all the income- that's earned during the period of estate administration, really from the moment of death until the assets are distributed to the beneficiary.

What is the form for fiduciary income tax return in California?

The fiduciary (or one of the fiduciaries) must file Form 541 for a trust if any of the following apply: Gross income for the taxable year of more than $10,000 (regardless of the amount of net income) Net income for the taxable year of more than $100. An alternative minimum tax liability.

What is a fiduciary tax?

What is Fiduciary Income Tax? If you are responsible for overseeing an estate or trust, you are the fiduciary of that estate or trust. Estates and trusts can own property and receive income, just like an individual or business. Fiduciary income tax is the tax that is paid on income received by estates and trusts.

What are fiduciary fees on 1041?

Fiduciary fees are the amounts executors, administrators, or trustees charge for their services. If you've figured out that the amount of work involved in administering a trust or estate is so much that you really need to be paid, this point is where you deduct your fee for services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 D-41 Fiduciary Income Tax Return?

The 2009 D-41 Fiduciary Income Tax Return is a tax form used by estates and trusts in the District of Columbia to report income, deductions, and tax liabilities for the tax year ending in 2009.

Who is required to file 2009 D-41 Fiduciary Income Tax Return?

Estates and trusts that have gross income equal to or exceeding a certain threshold or that have any taxable income are required to file the 2009 D-41 form.

How to fill out 2009 D-41 Fiduciary Income Tax Return?

To fill out the 2009 D-41 form, filers must provide information on the estate or trust's income, deductions, and credits, complete all applicable sections of the form, and ensure accuracy before submission.

What is the purpose of 2009 D-41 Fiduciary Income Tax Return?

The purpose of the 2009 D-41 Fiduciary Income Tax Return is to report income generated by an estate or trust and to calculate the tax owed to the District of Columbia on that income.

What information must be reported on 2009 D-41 Fiduciary Income Tax Return?

Information that must be reported includes the name and address of the estate or trust, the taxpayer identification number, income types and amounts, allowable deductions, and any credits claimed.

Fill out your 2009 d-41 fiduciary income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 D-41 Fiduciary Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.